Why?

Earlier this month our Senior Market Strategist wrote an excellent article on the significance of the “Bond Bubble”, and it was prescient -- we’re currently seeing an unwind of massive bets on bond markets.

To summarize the argument: unprecedented Quantitative Easing from the US Federal Reserve and global central banks drove record capital flows to bond markets and built a massive bubble. The unwind can and likely will have far-reaching effects across financial markets.

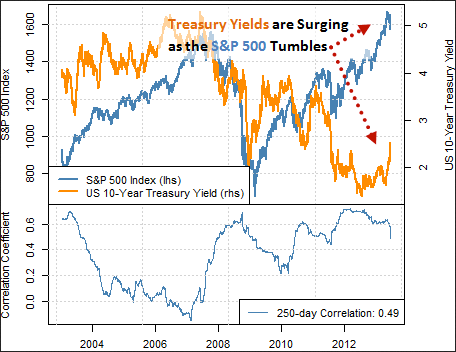

Why is this such a big deal? Let’s look at recent price action in US Government Treasury Yields and the S&P 500. Higher yields mean lower prices in bonds, and the fact that the 10-year US T-Note Yield saw its largest single-week surge in a decade is a very big deal. The S&P 500 simultaneously tumbled.

Treasury Yields are Surging as S&P 500 Tumbles -- That’s NOT SUPPOSED TO Happen.

Here’s why this isn’t supposed to be happening: the US Treasury Bond/Note/Bill is theoretically the world’s safest benchmark asset, and it’s historically done well in times of financial market turbulence. The fact that it isn’t shows that this is quite likely the Bond Bubble burst we’re long feared.

A financial market panic could follow, and it would signal an indiscriminate unwind of leveraged instruments across the board. Or in plain English: what’s gone up will come down.

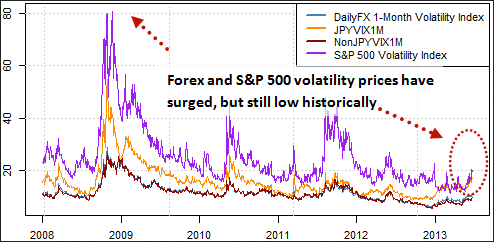

It’s helpful to take a look at financial market volatility prices as another key reason why things could get far worse before they get better.

Forex and S&P 500 Volatility Prices have Surged, but Could go Far Higher.

Why are the bond bubble and forex/S&P 500 volatility prices so critical to the US Dollar?

Put simply, volatility prices serve as an excellent proxy to investor fear. (That’s why the S&P 500 VIX is also known as the ‘Fear Index’) If they’re headed sharply higher, it could signal the start of a massive market deleveraging.

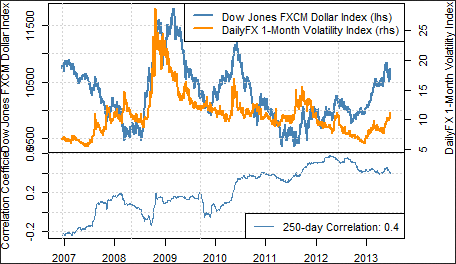

The Dow Jones FXCM Dollar Index trades near its highest since 2010 as our DailyFX 1-Month Volatility Index is only at its highest since mid-2012. Its longer-term correlation suggests that, all else remaining equal, the USDOLLAR ‘should’ be higher.

Dow Jones FXCM Dollar Index has surged as Forex Volatility Prices Rise.

Record-low interest rates in the US have made the Dollar an investor favorite to fund trades in other markets. i.e. many have borrowed in USD to buy the S&P 500 and other speculative assets. If those trades are unwound, the Dollar could surge.

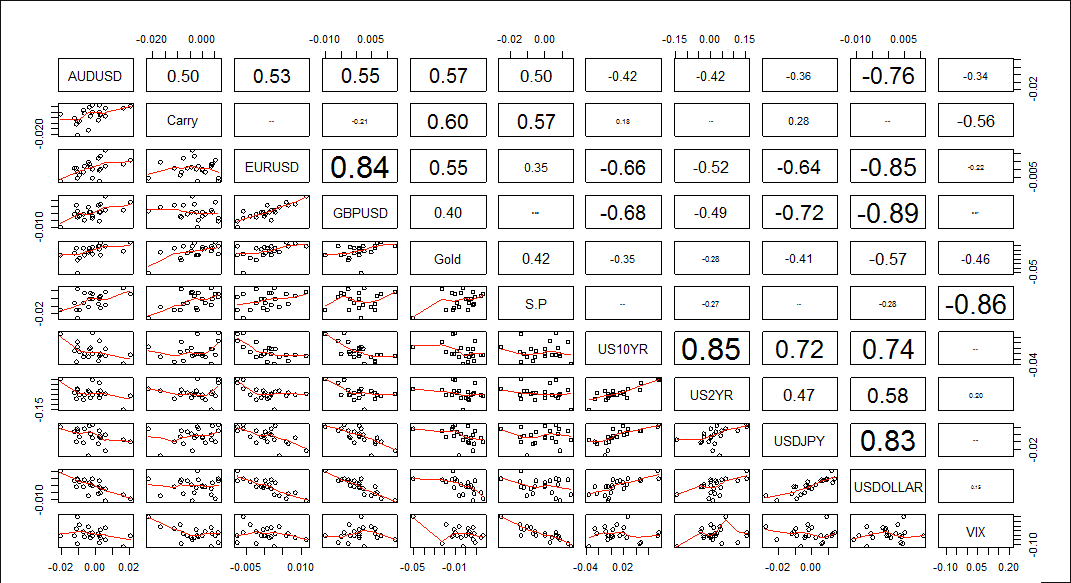

Forex Correlations Summary

View forex correlations to the S&P 500, S&P Volatility Index (VIX), Crude Oil Futures prices, US 2-Year Treasury Yields, and Spot Gold prices.

SEE GUIDE ON READING THE ABOVE CHART

by David Rodriguez, Quantitative Strategist for DailyFX.com.