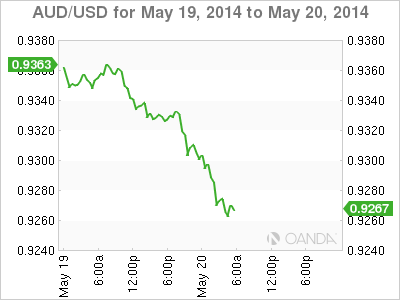

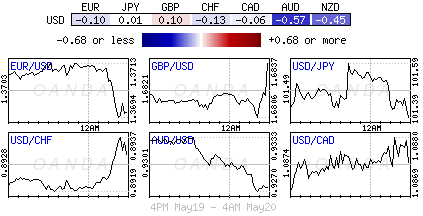

It's Tuesday and it's already difficult to get excited about a market that continues to languish within tight trading ranges. In largely quiet trading in Europe, the Aussie dollar has been the main mover, weakening well below the psychological $0.93c after the RBA said it expects "interest rates will likely remain at record low levels for some time as the economy faces a slowdown in mining investments, cuts to government spending and weaker export growth." This has allowed the fixed-income teams to scale back Aussie rate expectations. However, despite the AUD longs proving vulnerable to dovish Central Bank comments, short Aussie positions are proving to be an unattractive bet to many while 'vols' are so low (one-month 7.1%). With forex market interest dipping, the summer carry trade could prove profitable, as lethargic trading tends to drive 'vols' even lower.

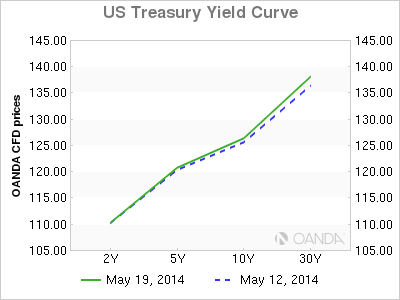

Last week's theme was the 'pain' trade – vulnerability of trades where positioning remain over weight/extreme – dominated by the "long" peripheral bond trade exit. Throughout the various asset classes, speculators have been throwing in the towel either because of profit taking (USD-short) and or short covering (stocks and bonds). In the US, the market witnessed one of the biggest short covering scrambles on US bonds. For instance, the market seems to have become too bearish on US 10's – yields were supposed to back up with tapering and the market seems to have got ahead of itself while ignoring 'lower for longer' somewhat. US 10-year's are trading above +2.5%.

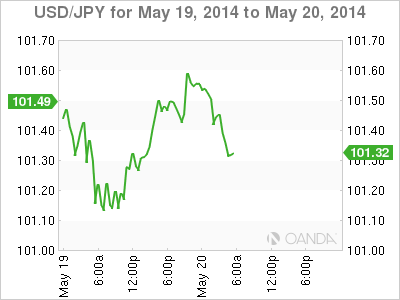

The same with euro periphery debt, investors have been too bullish and have priced in too much good news for Italian, Greek and Spanish debt in particular. Last week closed out with yields aggressively backing up. This week's short-lived nature of buying would suggest that the market is somewhat uncomfortable to put new money to work in these areas; investors prefer to trim 'long' positions. Do not underestimate the importance of yields to current forex positions. The correlation between JPY and US 10-year yield's seem to be back in play again today. With the latter slipping to a fresh day low of +2.535%, USD/JPY has been trading near its intraday low of ¥101.29 and EUR/JPY, which is also weighed down by heavy selling of EUR outright, fis alling to a fresh three-month low of 138.55.

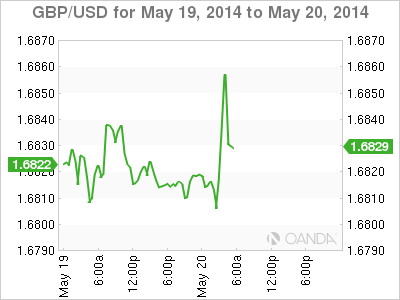

The effects of a late Easter have delivered a higher UK inflation number as expected this morning. The April number at +1.8% y/y was slightly above March's +1.6%, however, the print is unlikely to influence Governor Carney and company at the BoE on rates. The rise was mainly due to the base effects. Easter was in late April vs. March last year, and transport costs typically rise over the holiday period. Lower commodity prices and a stronger pound(£1.6830) would suggest that inflation is likely to remain subdued for some months. Expect the BoE to be watching the key variable wages over the coming months – with more jobs and higher wages could fuel inflation.

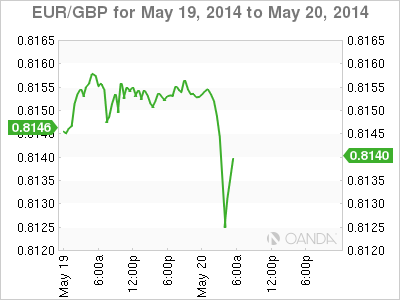

The UK headline print saw Giltsellers extend futures losses, while cash 10's moved through February's base of +2.592%, and with momentum the technicals could open up to test the top yield of +2.64% of the same month. Cable did threaten £1.6871 immediately after the print; however, subsequent profit taking on GBP longs has managed to push the currency back -50c. Many do expect the FPC to act next month by tightening lending criteria - expect June 26th to have the markets full attention. A rate hike is still being priced in for Q2 2015. The focus for the remainder of this is on "macro-prudential measures as opposed to rate hikes."

Do not be surprised to see some cautious buying ahead of tomorrows MPC minutes. Attention now turns to the minutes from the BoE's May 7-8th MPC meeting. The minutes will provide a better indication of the spectrum of views within the MPC as "to spare capacity and the size of the minority supporting earlier tightening." Original post

Original post