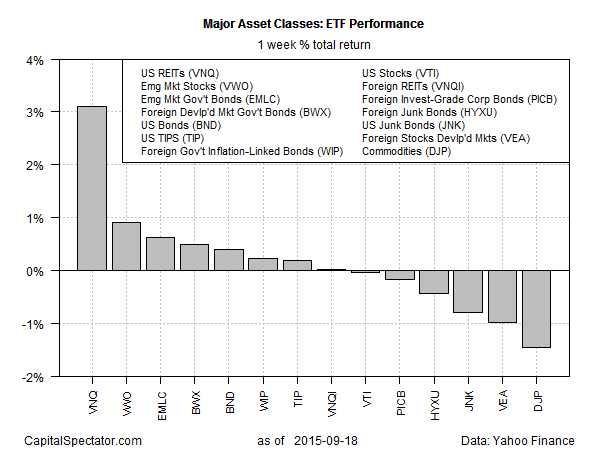

Last week’s no-hike Fed decision raises questions about the outlook for the US economy, but another delay in tightening monetary policy revived demand for interest-rate sensitive assets. US real estate investment trusts (REITs) gained more than 3% for the week through Sep. 18, based on the total return for the Vanguard REIT ETF (NYSE:VNQ). That’s the best weekly performance by far for the week just passed among our standard set of proxies for monitoring an the major asset classes.

The Fed’s preference for leaving its policy rate at the current zero-to-0.25% target lifted other rate-sensitive assets. Notably, utility stocks fared well last week. The 2.6% total return for the Utilities SPDR ETF (NYSE:XLU) was far and away the biggest gain among the major US equity sectors last week.

By contrast, the news that Yellen and company left rates unchanged weighed on the financial sector—banks in particular. The Financial Select Sector SPDR ETF (NYSE:XLF) was the second-worst performer last week for sector ETFs, courtesy of its 1.5% retreat. The bearish reaction is no doubt linked to the fact that the Fed decision ensures that there’s still no relief in sight for the big squeeze on net-interest margins—the difference between income generated by banks and financial institutions vs. the payouts to lenders. The net-interest margin for US banks has fallen like a stone in recent years, for an obvious reason—rates are at or near record lows generally. With no immediate prospect for a change on this front, the crowd dumped shares of financial stocks in the wake of the Fed’s dovish announcement.

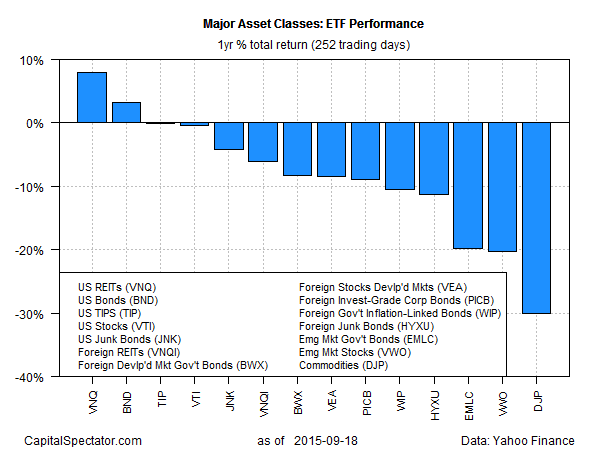

Turning to the one-year performance profile, most of the ETF proxies for the major asset classes remain under water. With the exception of REITs (+7.8%) and US investment grade bonds overall (+3.8%), red ink prevails in the trailing one-year total-return column. Broadly defined commodities remain dead last for this leg of the horse race. The iPath Bloomberg Commodity ETN (NYSE:DJP) is off a hefty 30% for the one-year (252 trading days) period through last Friday.

In theory, the news that the easy-money policy will continue is bullish news for risky assets. But at this late date, some analysts are wondering if the Fed’s reluctance to raise rates is a sign that policymakers are becoming worried about the US macro outlook. There’s still no smoking gun via a broad review of the macro numbers, as outlined in last week’s updated profile of the US economic trend. But for investors who still see darkness for the business cycle as a fait accompli, loading up on high-yielding assets has new appeal.

By contrast, if the economy turns out to be stronger than expected (or continues to muddle through with slow but sustainable growth), a rate hike in the near-term future may be in the cards after all. In that case, last week’s relief rally in yield-sensitive REITs and utility shares may be a temporary fling that will come to tears.

Deciding which outlook will prevail could be tricky in the short term. It doesn’t help that this week’s schedule for US economic reports is light. But the truth will out… eventually. Meantime, there’s renewed demand for the comparative safety and stability of higher-yielding REITs and utility shares.