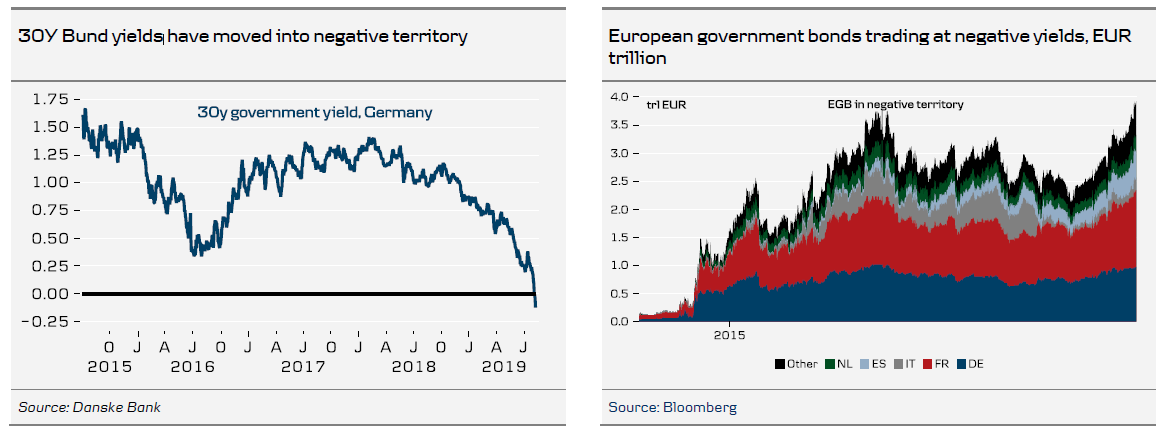

The past few weeks in the financial markets have been quite hectic, with yields dipping even deeper amid equity market sell-offs. The benchmark 10Y Bund yield is now running close to -0.6% and the German bond curve is trading in sub-zero territory across the board. Germany can now borrow funds for a 30-year term at negative rates.

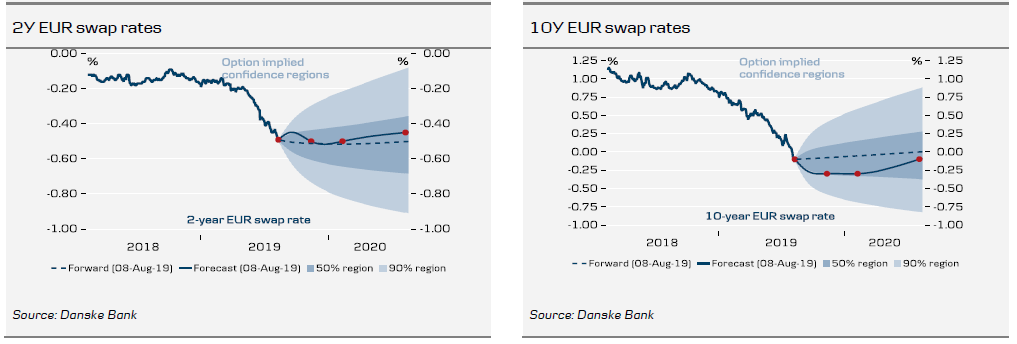

We see further room for lower yields and now expect the benchmark Bund yield to fall to -0.70% within the next three months on a combination of a weakening economic cycle, low risk appetite due to the trade war, the ECB easing policy and investors struggling to avoid negative rates. We expect the 10Y US Treasury yield to fall to 1.40% from currently 1.60%.

While we have become accustomed to low and falling (fluctuating) volatility in fixed income markets in recent years, the large uncertainty about the economy, risk appetite and monetary policy indicates we could see even bigger fluctuations for the remainder of 2019. 10Y Bund yields could be trading in a range of minus 0.8% to minus 0.2% on a 6M horizon.

Note also that the fall in yields has caused the yield curve to flatten significantly. The 2Y-10Y EUR swap curve has flattened by more than 20bp over the past month and the long end (10Y-30Y curve) by more than 10bp to around 0.45%. Yield curves typically flatten when the markets expect the economy to weaken going forward, not least, if markets are not confident that central banks will be able to put the economy back on a growth track or stoke inflation via rate cuts.

Several reasons for fall in long yields and curve flattening

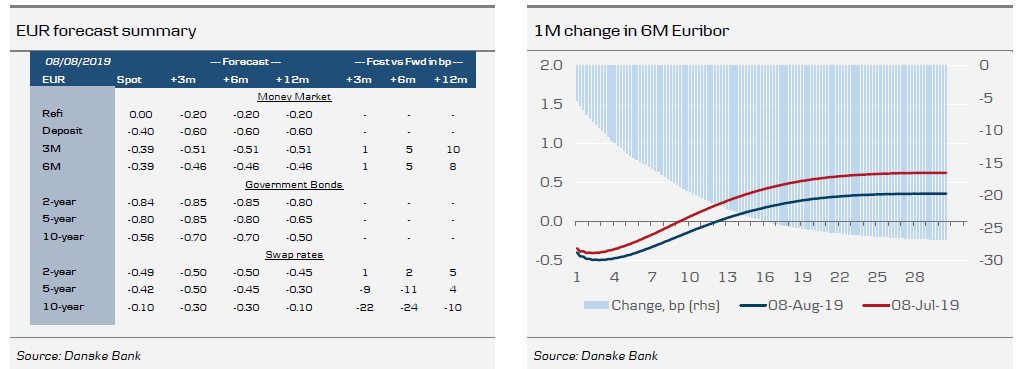

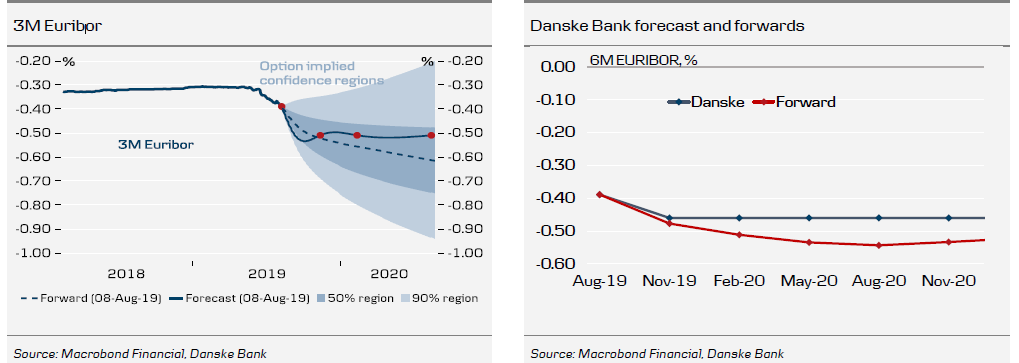

First, central banks are once again easing their monetary policies. At its July policy meeting, the ECB hinted that a stimuli package might be announced at the September meeting. We expect the ECB will: cut rates by 20bp to minus 0.60%, restart its QE programme, deliver stronger forward guidance (promising to keep rates low or lower for an extended period of time), and introduce a tiered deposit system. The latter measure would be intended to alleviate the problem banks face when having to place large amounts of surplus liquid funds at minus 0.60% while not being able to charge negative rates on retail customers’ deposit accounts. We would anticipate the ECB being more aggressive than the market expects.

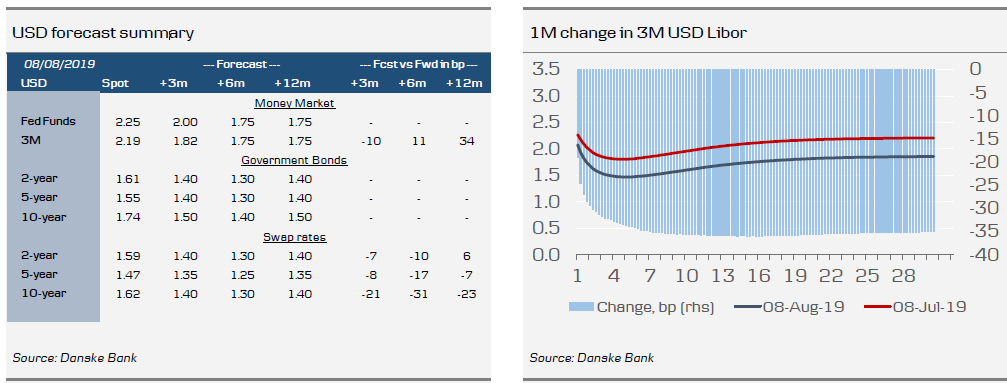

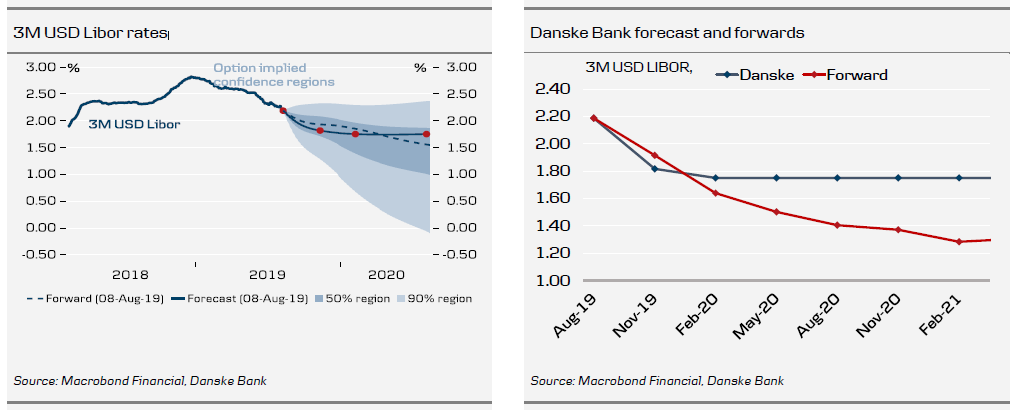

The US Federal Reserve has already announced a rate cut, and while Governor Powell was very cautious about promising a series of rate cuts, the market is currently pricing for at least three rate cuts over the next 12 months. We expect that initially the Fed will announce rate cuts in September and December. Weakened key indicators, such as lower inflation forecasts and, not least, the trade war will be decisive factors.

Second, the hunt for positive yield is set to intensify by the day. For several years, we have been talking about investors turning to longer maturities or to lower-grade credit in return for more interest. In fact, the growing proportion of European bonds with a negative coupon has accelerated this flow of funds in recent months. The main objective now, however, is not to get a higher rate of interest but rather to pursue a best-case scenario of avoiding negative interest or in the worst case to minimise the effect of negative interest. We expect the anticipated resumption of ECB asset purchases to merely reinforce this trend.

Third, risk appetite is low due to the trade war. One of the reasons the ECB and the Fed are again talking about easing policy is the concern that the US-China trade war will have economic repercussions. The latest tweets from President Trump that tariffs on Chinese goods will be raised and that China is manipulating its currency have escalated the situation and increased the pressure on global equities, forcing investors to turn to safe-haven bonds. Fears of a hard Brexit are having a similar effect.

Fourth, the global economy is under pressure and inflation forecasts are low. In particular, manufacturing companies are reporting slower order intakes and declining output. There is a real possibility that the German economy contracted in the second quarter, as industrial output fell by 5.2% y/y in June. In addition, the market is losing faith that the ECB and the Fed are able to ignite inflation. Long-term inflation forecasts from both the market and forecasters are trending downwards.

Low yields for a very long time

On 13 June, we published the research note Global Research: Euro area rates to stay very low for very long. In this report, we looked at the factors that have driven the neutral real rate of interest lower in Europe and discussed the consequences for long nominal interest rates. We concluded that current yields are not particularly low, and as we have previously argued elsewhere, the market is unlikely to speculate in rate hikes from the ECB for the next three or four years.

With low inflation expectations and a negative neutral real interest rate, current short and long yields are, in reality, not particularly low. In other words, there is no longer a gravitational or normalising force that would tend to pull yields higher over time.

This does not mean that yields cannot rise again. For example, an improving economy would point to higher yields through higher inflation expectations if risk appetite improves or if the US and China succeed in putting an end to the trade war.

However, there is no longer a trend inevitably pulling yields higher over time, and right now the economic cycle, in fact, points to lower yields rather than higher yields. Also, we are increasingly concerned that the trade war could dominate for a long time to come and that the US and China will not reach a solution – not even a truce.

Further room for lower yields

On balance, we expect 10Y Bund and Treasury yields to fall further to minus 0.70% and 1.40%, respectively, in coming months, with risks on the downside. Risk appetite is set to be the primary determinant of yield levels on a 12M horizon. Risk appetite is currently low due to the trade conflict, and while we expect it to improve slightly over the next 12 months, yields are not likely to increase significantly and we definitely do not expect a change to an upward sloping trend in yields. After all, one swallow does not make a summer. We expect to publish the next issue of Yield Outlook in September.

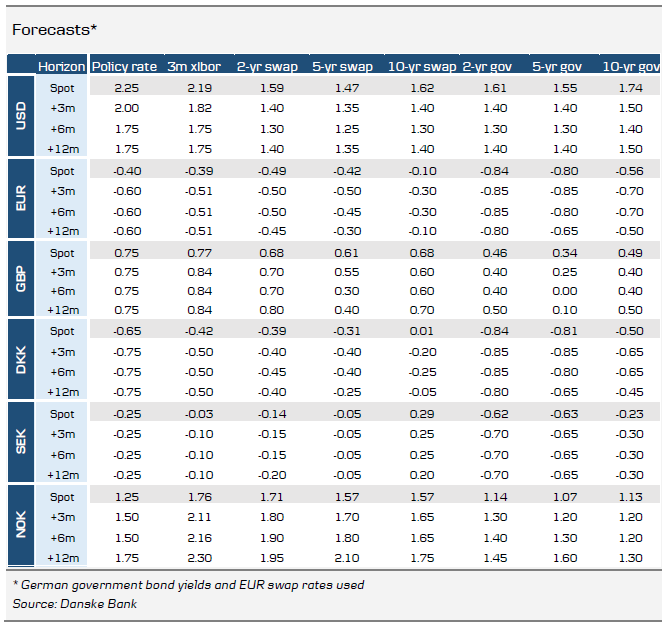

Forecasts

Eurozone forecasts

US forecasts

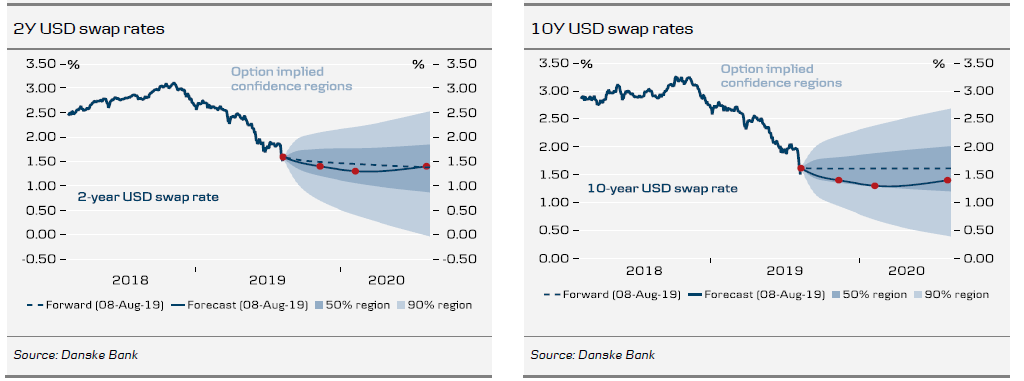

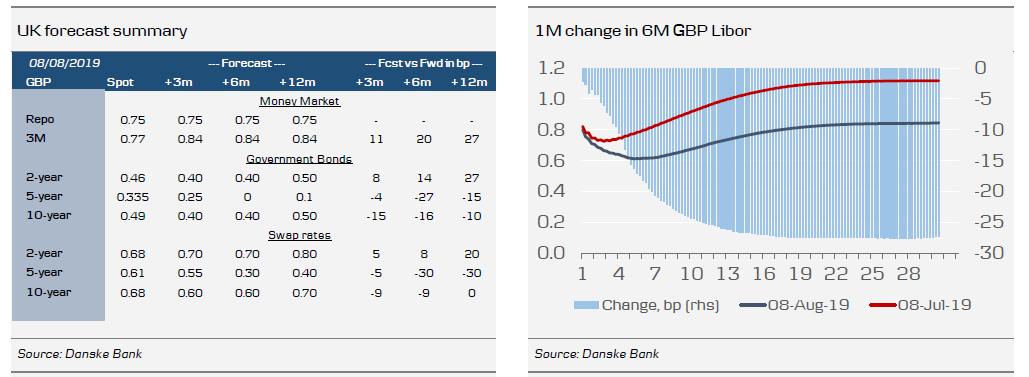

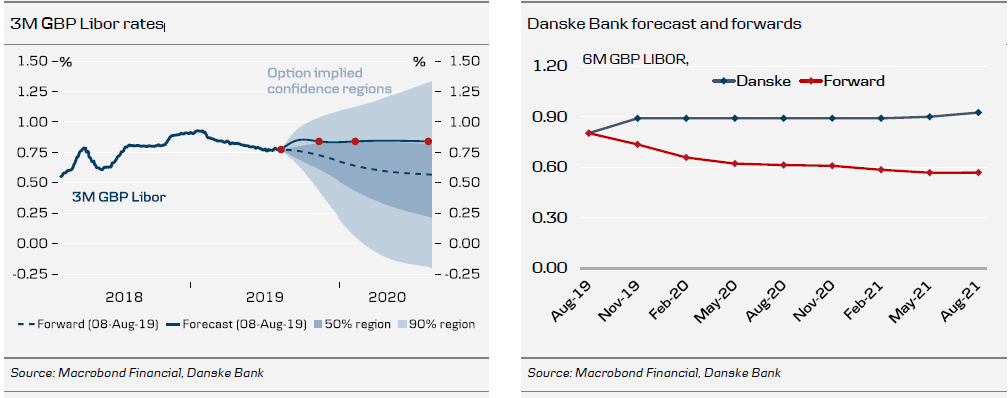

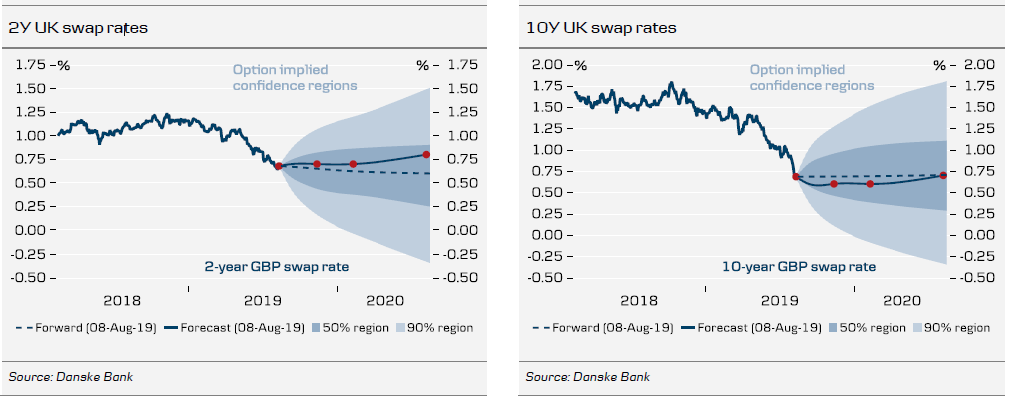

UK forecasts

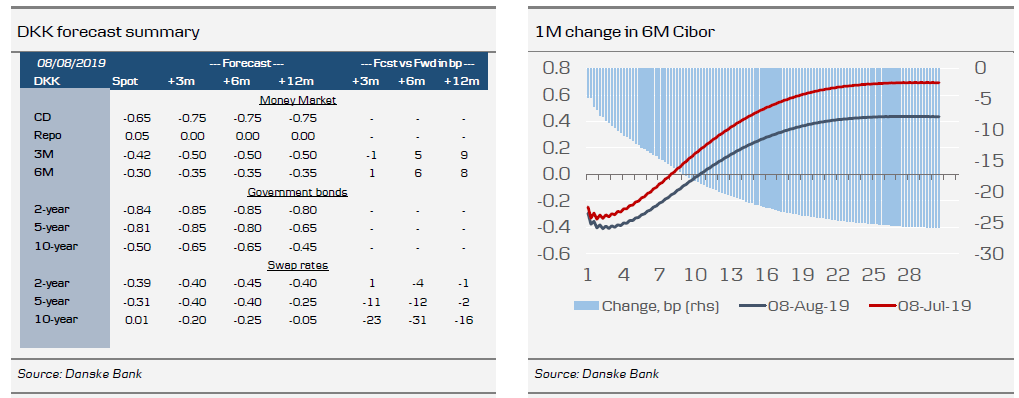

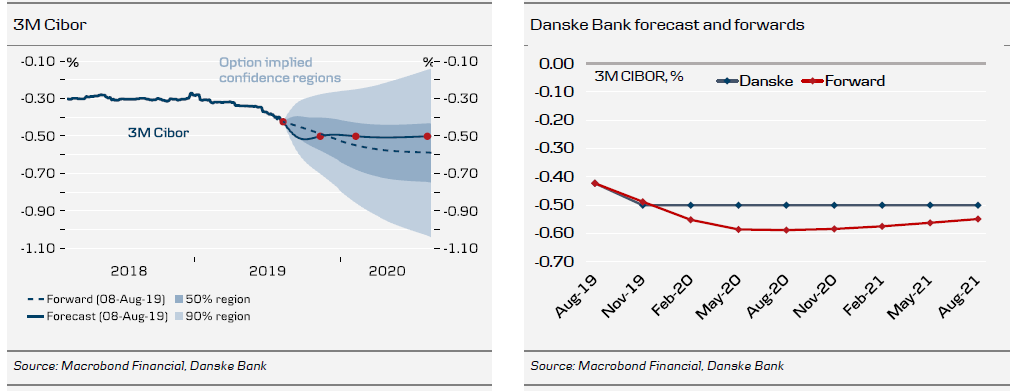

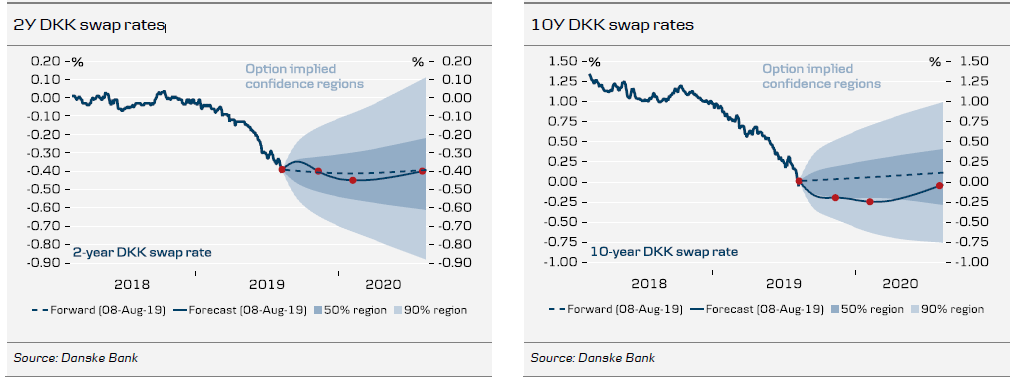

Denmark forecasts

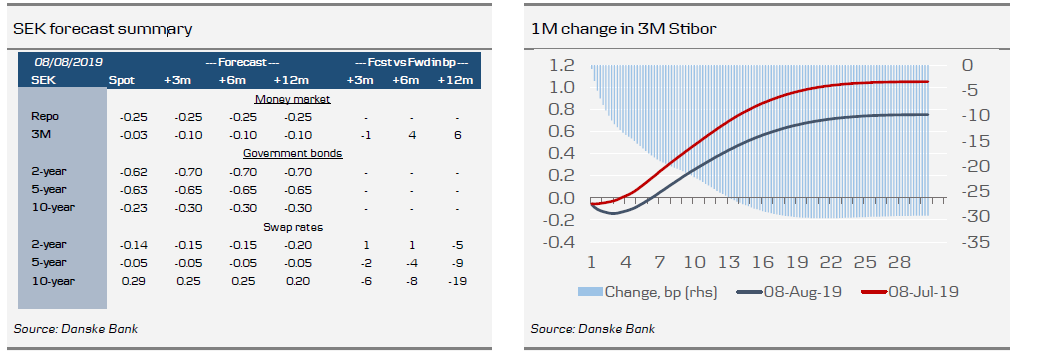

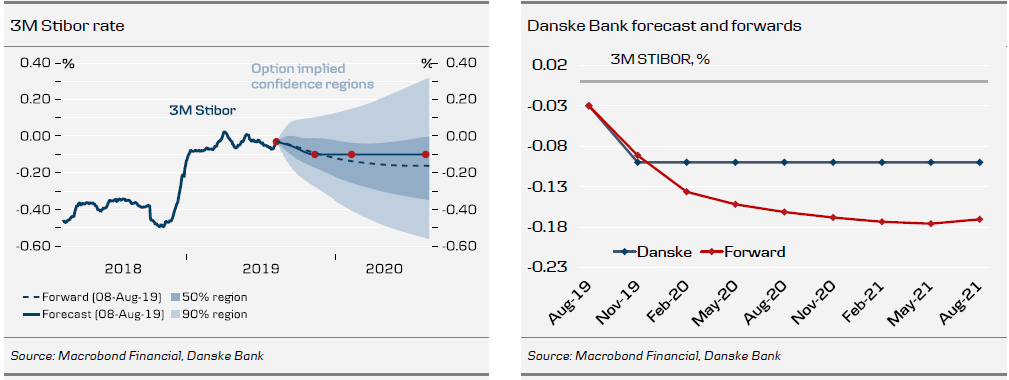

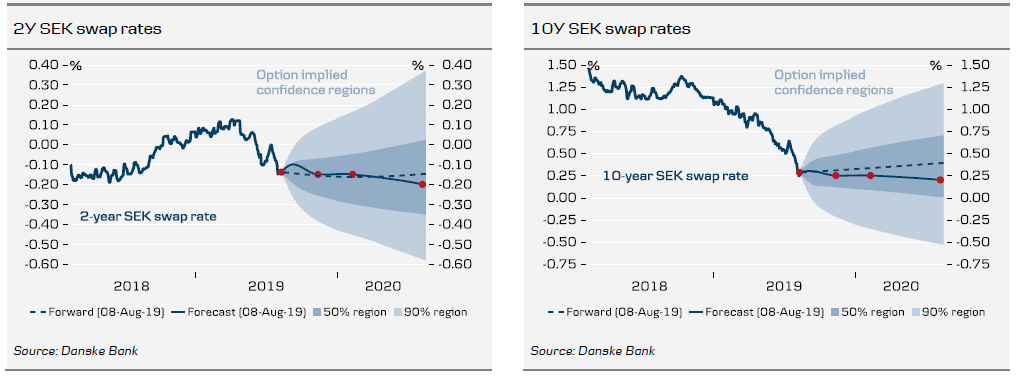

Sweden forecasts

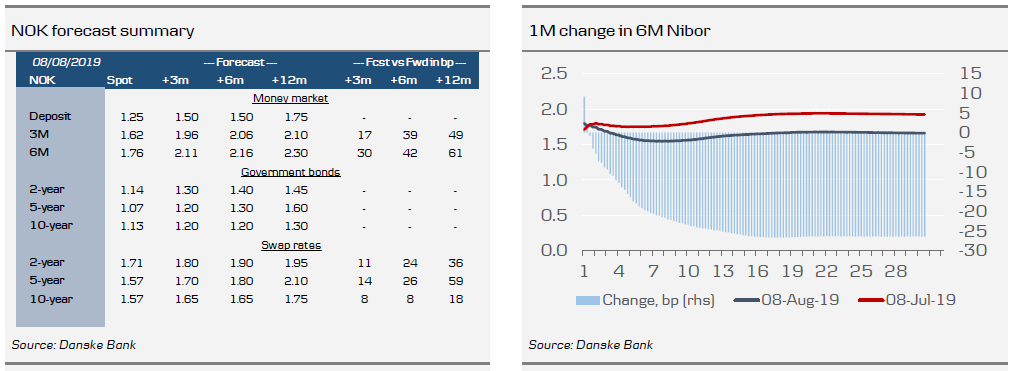

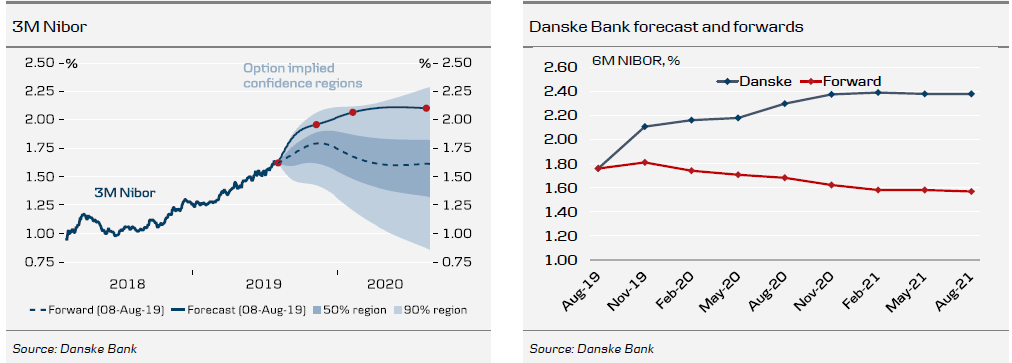

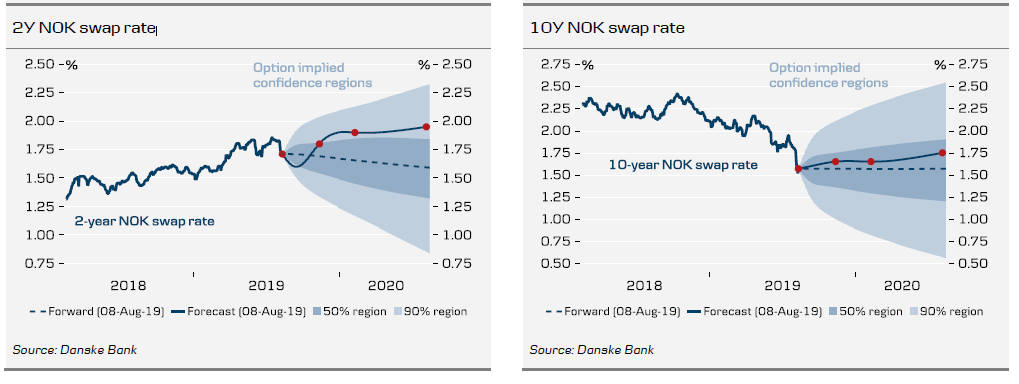

Norway forecasts