Why won't long-term yields stop falling?

First of all, the global uncertainty stirred up by the US-China trade war has continued to set the agenda. There are plans for presidents Trump and Xi to meet at the next G20 summit but we doubt that a new deal will be in the making. Instead, we believe the situation is pointing to a further escalation of the trade war, and the big thing to watch out for is whether the EU can avoid becoming more tangled up than it is already.

Due to trade war fears and other factors, the global business cycle is no longer pointing upwards, but is set for a further slowdown. In our recent quarterly publication The Big Picture , 10 June, we lowered our projections for global growth for both 2019 and 2020.

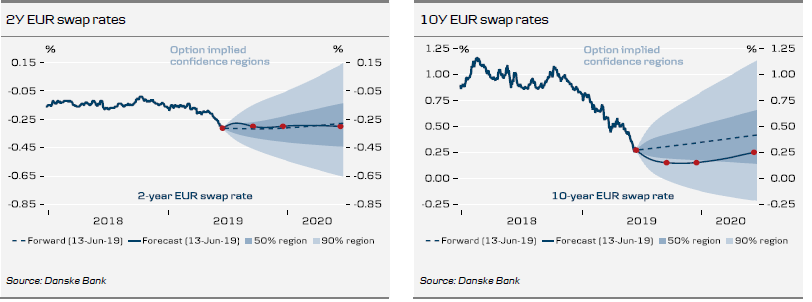

Secondly, we are getting new signals from the ECB. At first glance, the ECB disappointed the markets last week by 'only' extending its forward guidance into H2 20. The market had expected the central bank to move in the direction of new rate cuts or a relaunch of its QE programme. It is important to emphasise, however, that the ECB has by no means precluded the possibility of new monetary policy easing. Governor Draghi specifically mentioned the possibility of rate cuts if prospects were to take a sharp turn for the worse, and markets are in fact pricing the key lending rate to drop by close to 10bp to minus 0.50%. The severe flattening of the 2Y10Y yield curve may also indicate that the market is anticipating new ECB stimuli in the form of a new QE programme.

Market expressing lack of confidence in the ECB

However, the market is not a big believer in the ECB successfully jumpstarting the economy or getting inflation to point upwards. Many market participants are using the 5Y5Y EUR inflation swap (average 5Y inflation rate in five years' time) as an indicator of the rate of confidence that inflation will return to 2%. So, as the market continues to forecast inflation going lower, this is in fact a sign of no confidence in the ECB. The 5Y5Y measure has dropped from 1.6% early this year to currently 1.14%. In other words, the market is saying that it no longer believes the ECB can get inflation back to a level close to 2%. Obviously, low inflation expectations are set to weigh on nominal rates and also constitute another important reason for the continuing drop in long-term yields.

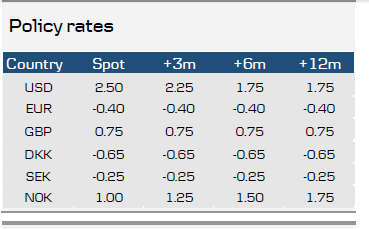

It has also become clear over the past month that rate cuts are underway from the US Federal Reserve. We have also adjusted our forecast and now expect three 25bp Fed rate cuts in H2 19.

Thirdly, the market continues to focus on the very low neutral rate of interest. As we noted, in our previous issue of Yield Outlook we lowered our assumptions for the neutral rate of interest, which plays a key role in market pricing of long-term nominal forward rates. In December 2018, the ECB released a comprehensive paper reviewing various estimates for the neutral rate of interest (e*). All of those estimates showed a protracted fall in the neutral rate of interest over the past ten years to the current level of between minus 1.5% and around 0%. We have assumed a neutral rate of interest at the mid-point of this range. We have also assumed that the neutral rate of interest will continue to fall in coming years.

Low rates for a very long time

On 13 June we published the research note Global Research: Euro area rates to stay very low for very long . In this paper we took a closer look at what has driven the neutral real rate of interest lower in Europe and discussed the consequences for long nominal interest rates. We basically conclude that current yields are not particularly low, and as we also argued in the previous edition of Yield Outlook , the market is unlikely to speculate in rate hikes from the ECB in coming years.

This does not mean that yields cannot rise again. For example, an improving economy would point to higher yields through higher inflation expectations and thus slightly higher long nominal rates. However, there is no longer a trend that would inevitably pull yields higher over time. Also, the economic cycle no longer points to higher yields, but in fact to lower yields.

Finally, it is important to highlight the special market dynamics we are currently seeing. The volume of bonds trading at negative yields in EUR is rising almost daily. This in turn means investors are being pushed further and further out the yield curve - causing the curve to flatten. Investors are also being pushed further out on the credit curve, which could mean investing in Spanish government bonds rather than low-yielding German Bunds.

Negative 10Y government yields now the norm

All in all, this means we expect 10Y German Bunds to trade with a negative yield for the coming 12 months. We also estimate the trend in the next three months will continue to be down. Our 3-month forecast for the 10Y yield in Germany is -0.35% compared to the current level of -0.25%. Risk appetite will be the primary determinant of the level over 12 months. Risk appetite is currently low due to the trade conflict, but we expect it to improve slightly in the coming 12 months and take the German 10Y government yield to 0.25% on a 12-month horizon.

Our forecast does not contain any further easing from the ECB in the form of additional rate cuts or a new QE programme. We have assumed the market would continue to expect further stimuli and the risk clearly is that the ECB could ease monetary policy further. In principal, this could push yields further down than we expect.

Forecasts

Eurozone forecasts

- The eurozone economy currently looks weak. We still expect the economy to pick up slightly over the course of 2019, though the USChina trade war has taken uncertainty to exceptional highs.

- We expect no ECB rate hikes in 2019 or 2020. 10Y Bund yields are set to trade well into negative territory for the next 12 months. Risk is skewed to the downside on a three-month horizon.

To read the entire report Please click on the pdf File Below..