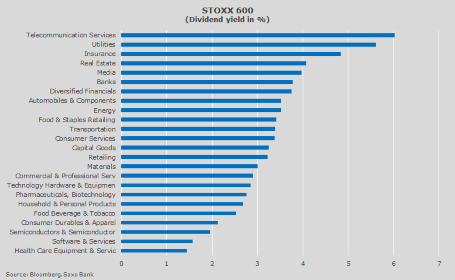

European stocks have the highest dividend yields amongst developed equity markets. High yield stocks are an attractive substitute to falling credit market yields. Telecommunication services stocks pay 6 percent dividend yield on average.

Many dividend opportunities in Utilities and Telecommunication Services

The chart below shows the average dividend yield across 24 industry groups in the STOXX 600 index. In essence it shows the low growth industries in the top (Utilities and Telecommunication Services) and the high growth industries in the bottom (Health Care Equipment & Services and Software & Services).

As we wrote back in 2011, European high yield stocks are not the land of milk and honey when only looking at pure dividend yield. A very high dividend yield often indicates a very uncertain future and thus falling share prices which often are not offset by high dividends. It is therefore not a straight conclusion to just jump into every high yield stock. Investors have to check the cash flow to equity coverage ratio (earnings before extraordinary items to dividends are used for financials) in order to not be lured by high dividend yields.

Among the three industries with the highest dividend yield on average these stocks are our top picks for high dividend yield with a good coverage:

- Cable & Wireless Communications (Telecommunication Services) with 11.0 percent dividend yield

- Deutsche Telekom (Telecommunication Services) with 7.8 percent dividend yield

- GDF Suez (Utilities) with 9.2 percent dividend yield

- Electricite de France (Utilities) with 7.2 percent dividend yield

- CNP Assurances (Insurance) with 6.9 percent dividend yield

- Tryg (Insurance) with 5.3 percent dividend yield