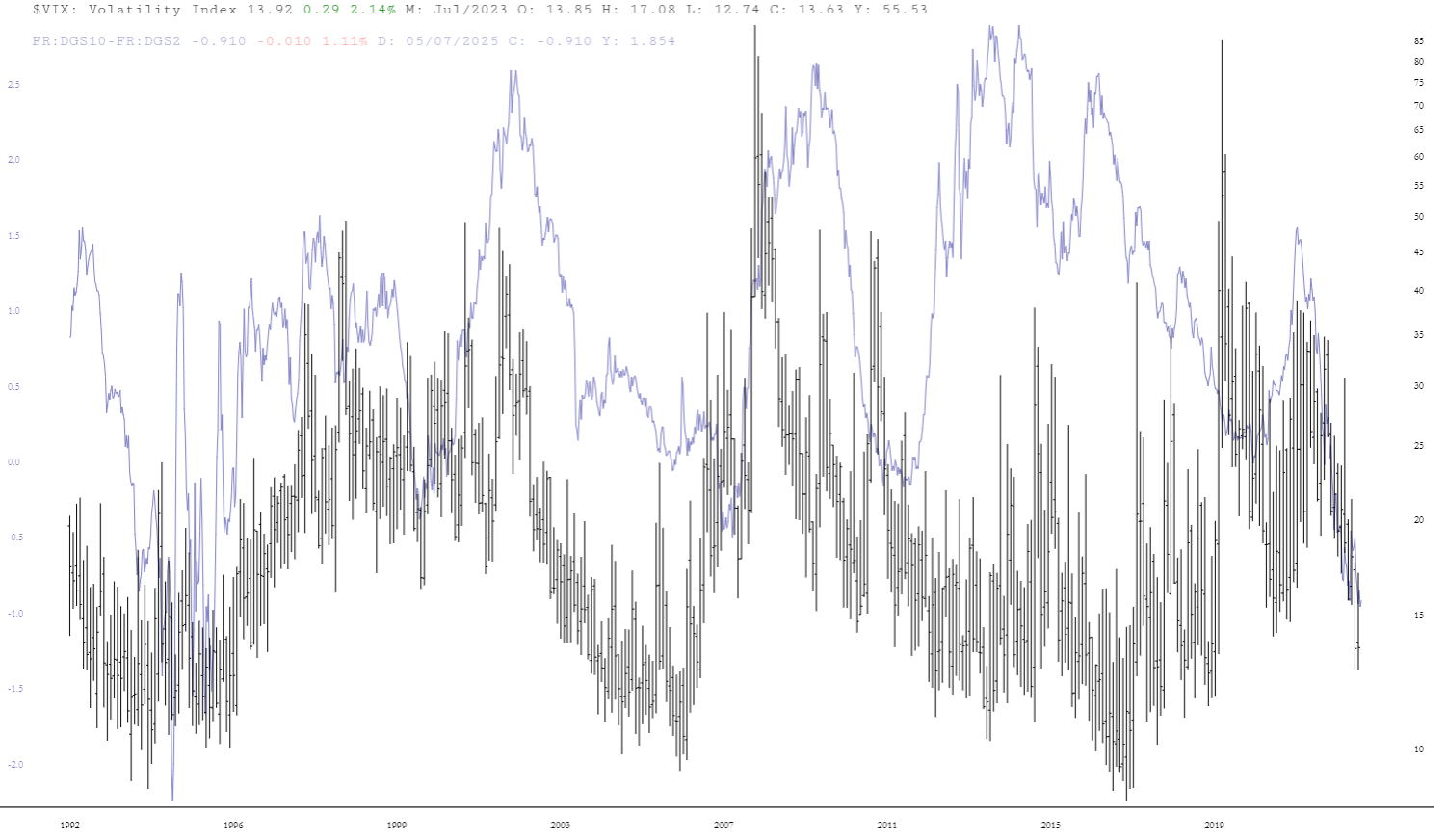

The VIX has been a coincident indicator with the 2s10s yield curve. Both have usually turned higher fairly early in a bear market cycle, well before the market topped in some cases.

The yield curve is steepening right now with long-term bonds exhibiting a potential bullish breakout in the making. For stock market bears, it doesn’t matter how the yield curve steepens when financial assets are valued for a Goldilocks scenario. A breakout in yields will move the 30-year mortgage towards 8 percent, if not 10 percent or higher eventually. If instead the 10-year tumbles and the yield curve steepens, it’s because traders are pricing in large, imminent rate cuts from the Federal Reserve.

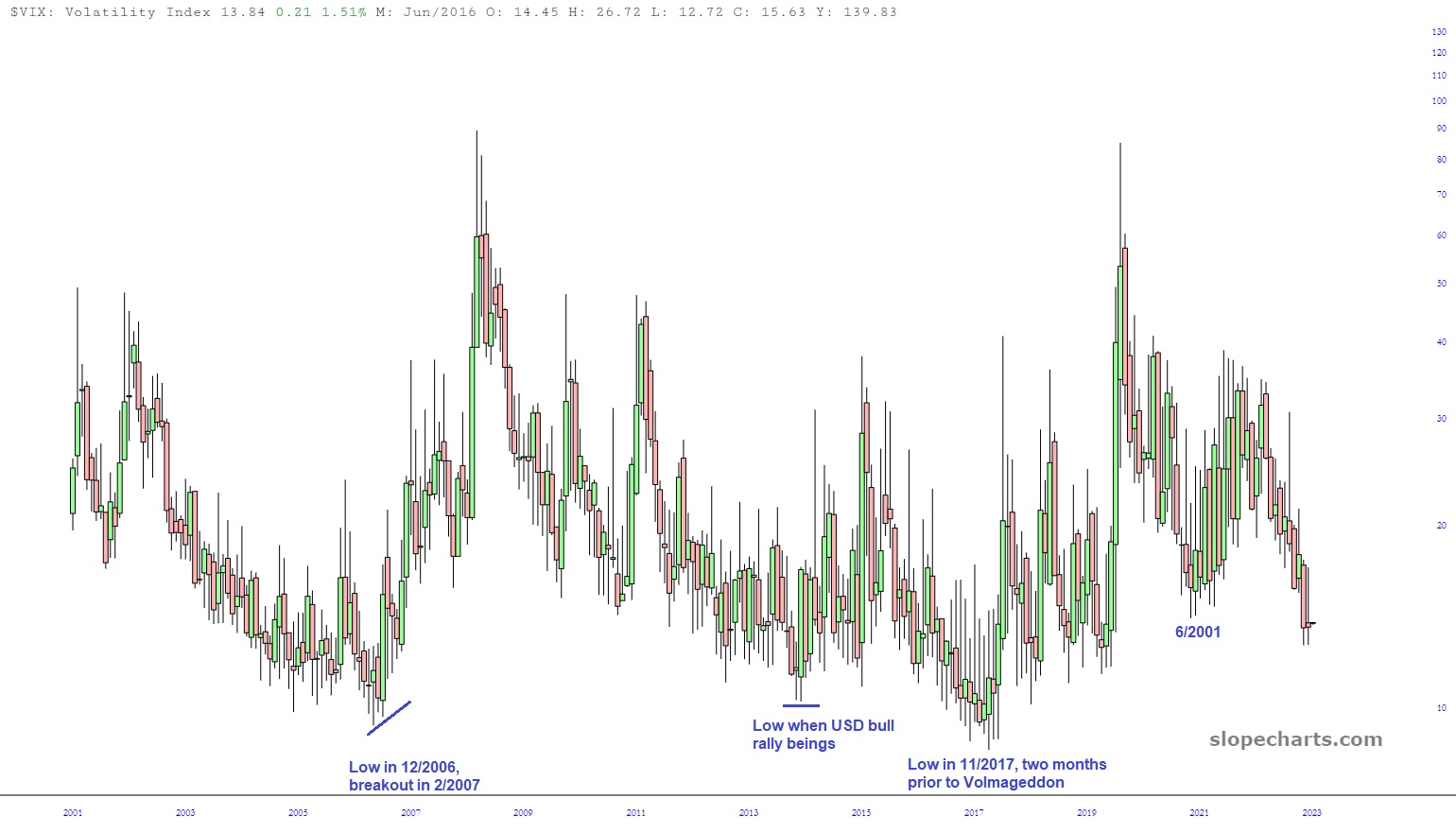

Should the yield curve and VIX steepen from here, bears hunting for individual issues and sector/industry trades will start finding more success and more targets. A final top in the major indexes could be ahead though, as it was well after the August 2019 and December 2006 lows. If the VIX and 2s10s go sideways or down, the Fed’s BTFP punch bowl still hasn’t run dry and better shorting opportunities will come later, at even more favorable prices.