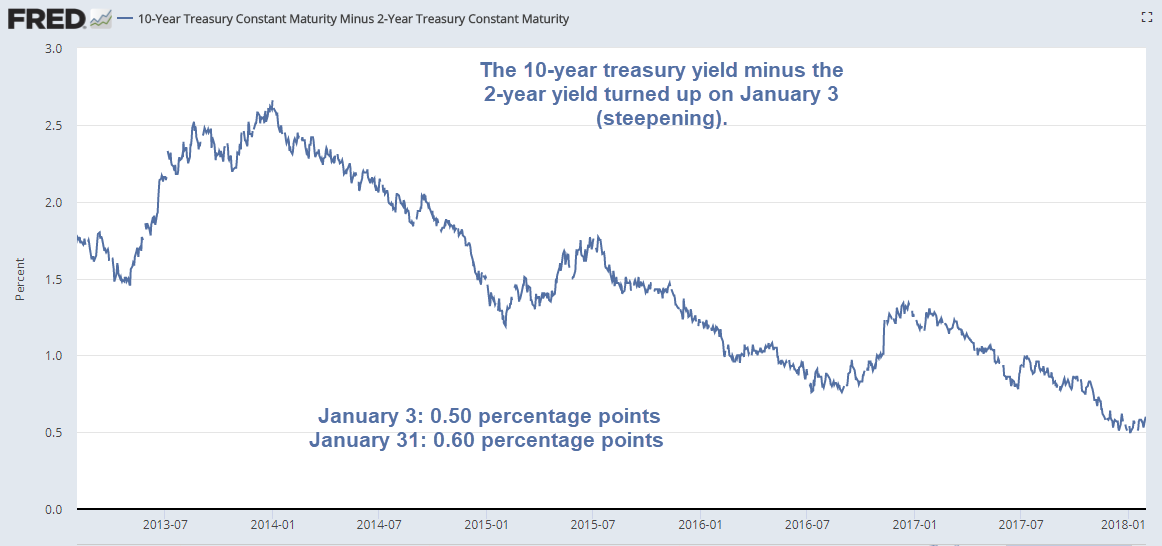

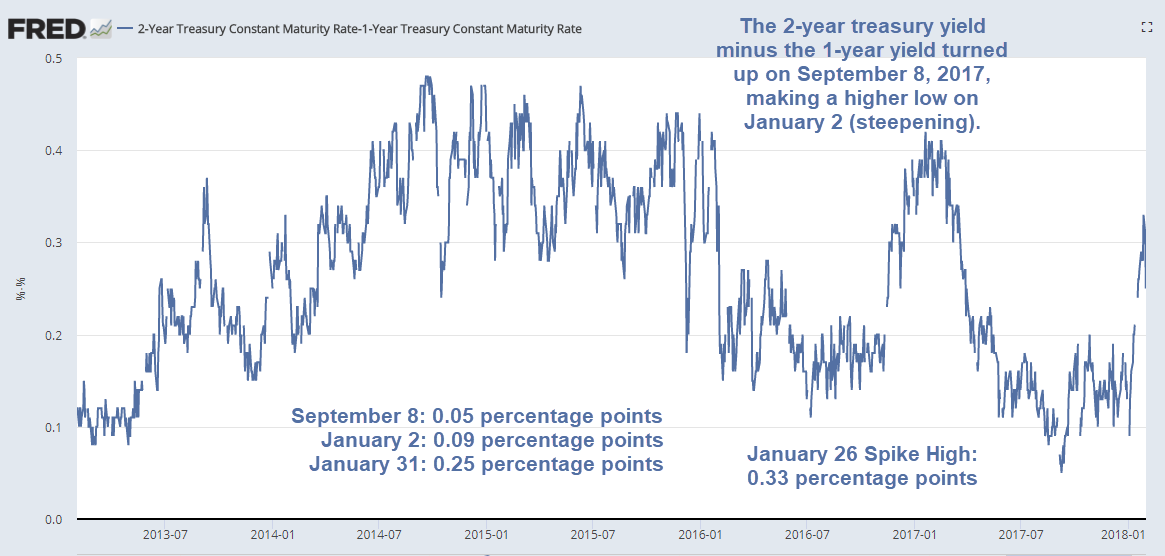

Some claim the yield curve is flattening, others say it's steepening. The steepening side started to gain more credibility from January 2.

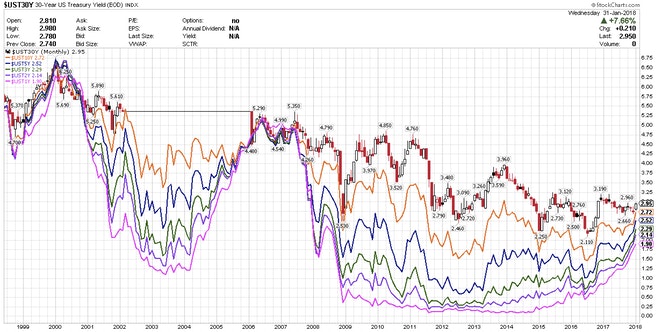

With U.S. yields on a tear, one might think the curve is steepening. It is and it isn't. Pictures will explain.

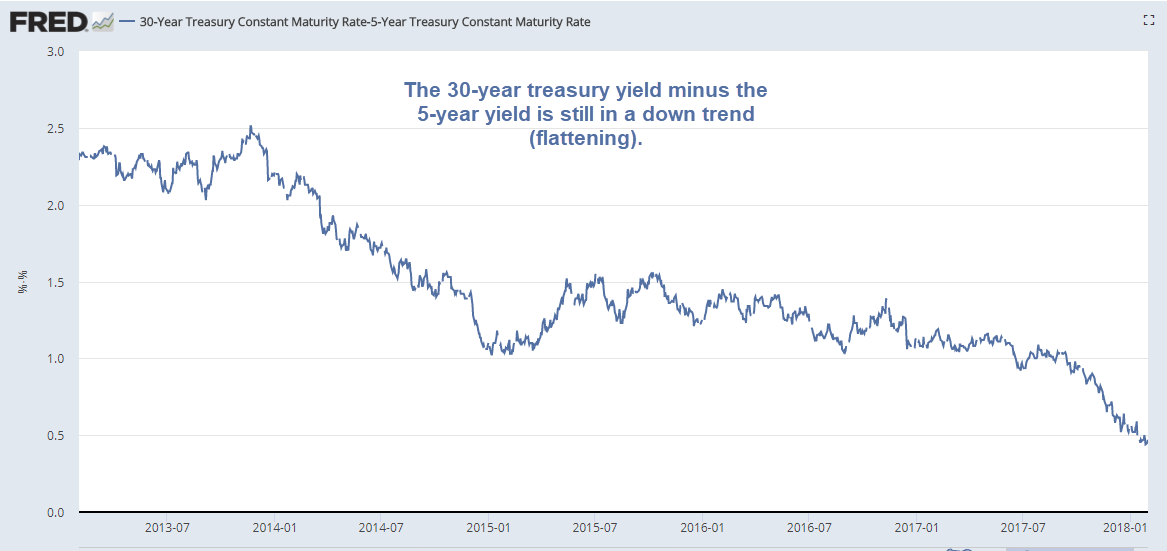

30-Year Yield Minus 5-Year Yield

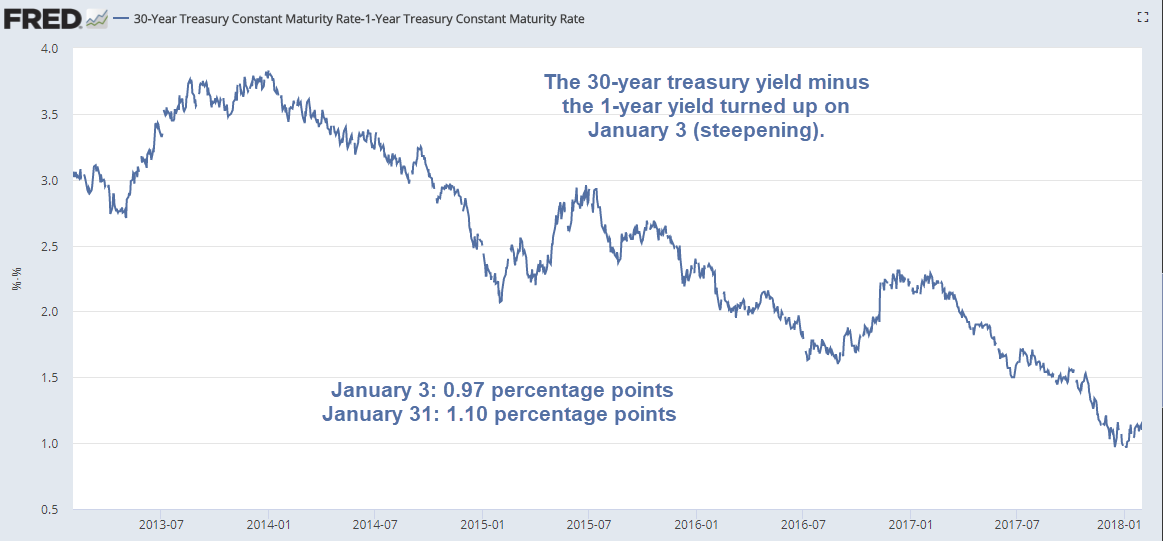

30-Year Yield Minus 1-Year Yield

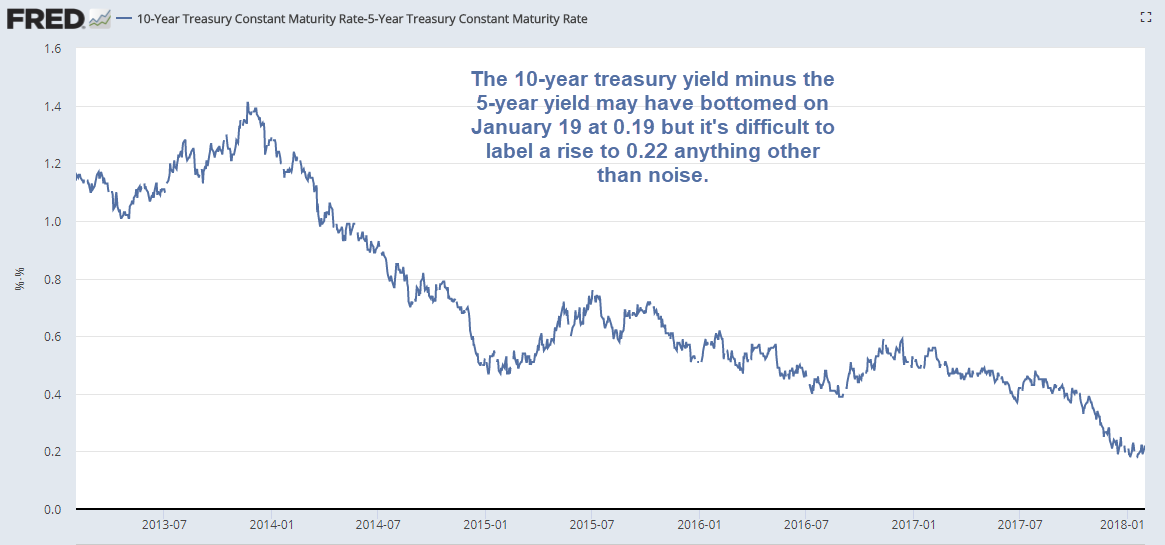

10-Year Yield Minus 5-Year Yield

10-Year Yield Minus 2-Year Yield

5-Year Yield Minus 2-Year Yield

5-Year Yield Minus 1-Year Yield

2-Year Yield minus 1-Year Yield

Synopsis

- The downtrend on 30-year yield spreads is still mostly intact. However, the 30-year vs 1-year spread (or shorter) is steepening.

- Most other spreads have turned up but the spread differentials are mostly tiny.

- Spread differentials are greatest at shorter maturities.

Yield Curve Flattening or Steepening?

Both, depending on where you look.

More realistically, and on average, the yield curve started to steepen on January 2-3.

"Bet Your Heinie" Treasury Bull is Over?

Not so fast. The treasury bull market will not be over until it is certain that the long end of the curve has bottomed. Despite proclamations by Bill Gross and others, it is far too early to make that call.

Gross has incorrectly proclaimed the "end" several times. If another recession hits any time soon, I expect he will be wrong once again.