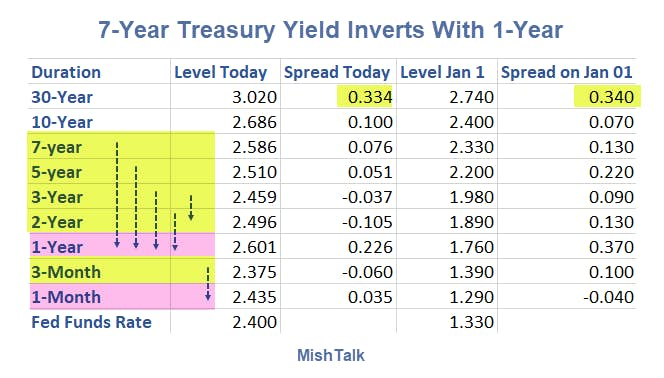

The yield curve is inverted in six places. Notably, the 1-year T-Bill yield inverts with all durations through 7 years.

Strong Recession Signal

Today, the 1-YearT-Bill rate inverted with higher duration notes up to and including the 7-Year note. I count 6 inversions, 4 of them with the 1-Yr bill.

A 1-year T-Bill inversion with the 10-Year note is only 8.5 basis points away.

his is the strongest recession signal yet.

Debt Watch

Despite the flattening and now inverting yield curve, note that the spread between the 10-year and 7-year bond actually rose over the course of 2018.

The spread between the 30-Year long bond and the 10-year note is nearly what it was a year ago.

I believe this is a strong bond market signal that the end of the bond bull market approaches. It's possible it's already over. But I do expect one more strong push lower in yields as recession hits in 2019.

We have enormous deficits as far as the eye can see from a starting point of $21 trillion in debt.

Got Gold?

Mike "Mish" Shedlock