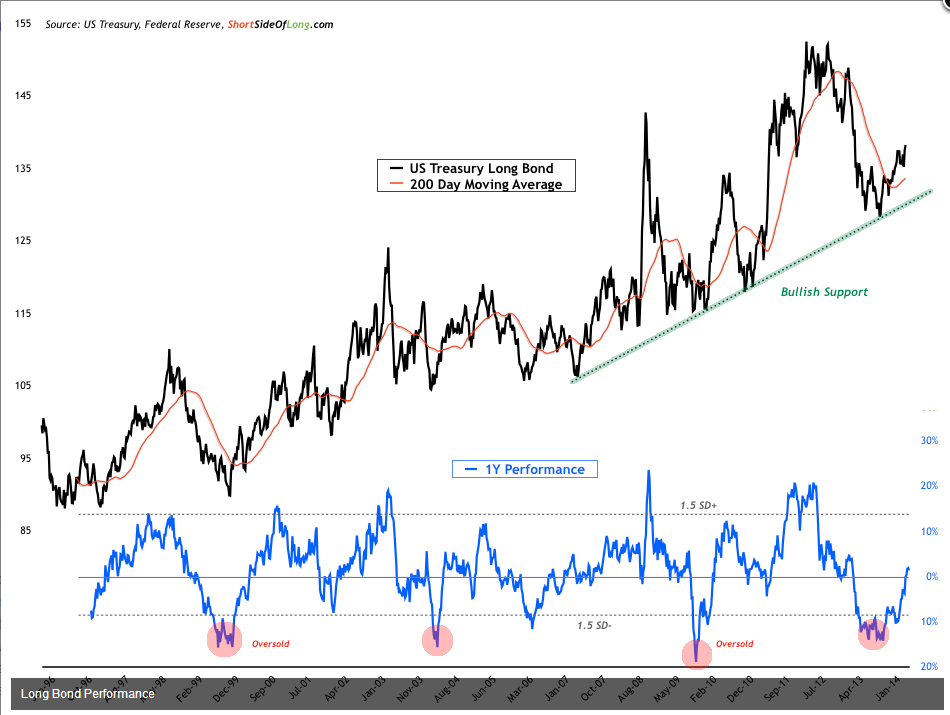

Chart 1: The long maturity end of the bond market has rebounded in ’14…

Long Bond Performance Source: Short Side of Long

Coming into 2014, just about every trader, investor, economist, financial forecaster, the weather man and even their dogs were anticipating a further rise in interest rates. However, when everyone thinks the same way, chances are no one is really doing any thinking at all and something completely different will happen.

After selling off sharply throughout 2013 and suffering one of the worst rolling annualised performances in the last 20 plus years, the U.S Treasury Long Bond has rebounded strongly in the first half of 2014, surprising the consensus.

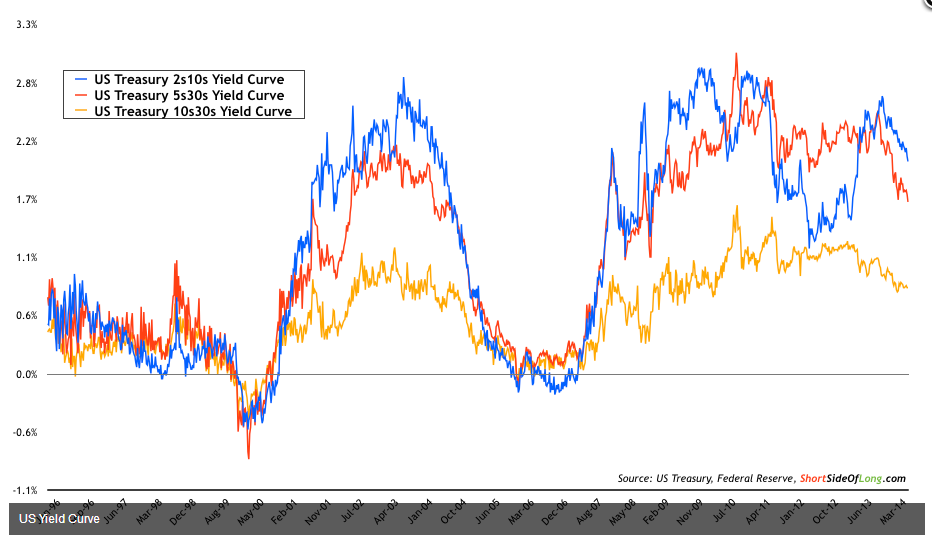

Chart 2: …while the short end has sold off, flattening the yield curve

Source: Short Side of Long

However, not all of the maturities performed as well as the 30-Year Long Bond. As we can clearly see in Chart 2, the main story of 2014 has been about the flattening yield curve. As the market started to anticipate a potential Federal Reserve hike in interest rates, the short end of the curve has began to sell off (interest rates have risen). At the same time, the rebound in prices from the long end has now flattened the yield curve to some of the lowest levels in years (Treasury 5s and 30s).