You’ve heard about the massive glut in oil and natural gas. And you’re likely aware of the global oversupply in aluminum.

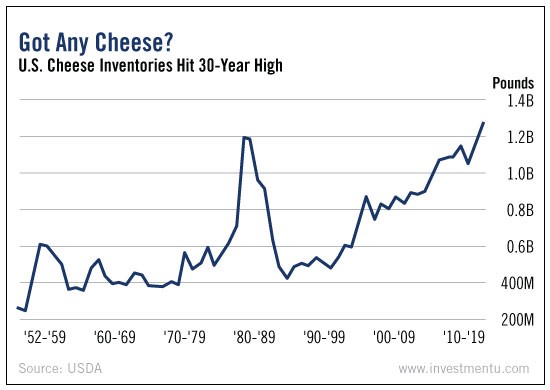

But this week’s chart tells a story you probably haven’t heard.

It involves the swelling reserves of a commodity many consider “precious.” But we’re not talking about gold. No, we’re referring to that other coveted yellow resource.

Cheese.

Americans have a voracious appetite for cheese. According to USDA data, we eat around 35 pounds of it each year. Per person. And that number has increased 43.5% since 1990.

To accommodate growing demand, cheese production had to rise as well. Today, U.S. farms produce nearly 12 billion pounds of cheese each year. That’s up 95% from what we were producing 26 years ago.

Again, that’s a 43.5% increase in demand. And a 95% increase in production.

If you’ve taken even one rudimentary math course, you should be able to spot the issue here.

This massive imbalance has led to a surplus of U.S. cheese, which is at a 30-year high. We’re resting on more than 1.2 billion pounds of it.

In fact, it’s gotten so bad that Uncle Sam has decided to step in.

The USDA just announced plans to buy 11 million pounds of cheese from private inventories and distribute it to food banks. According to the press release:

The purchase, valued at $20 million, will be provided to families in need across the country through USDA nutrition assistance programs, while assisting the stalled marketplace for dairy producers whose revenues have dropped 35% over the past two years.

That sounds nice, but we’ll just have to wait and see how this plays out. One thing we know for sure? Government intervention rarely pays off for investors.

So with the situation in the dairy sector looking dire, why not bet on an alternative market?

No, literally. Why not bet on dairy alternatives? Soy cheese, almond milk, coconut butter...

This market may be smaller than Big Dairy, but it’s growing fast. Worth $8.8 billion in 2015, it’s expected to reach $35.06 billion by 2024.

A near 300% increase.

According to Grand View Research, the U.S. market for dairy alternatives is expected to grow at a compound annual growth rate of 10% over the next eight years.

Just one word of warning: To invest in the companies behind these products, you’ll probably need to do some digging.

As our Editorial Director recently reported, many small organic businesses have been bought up by larger food corporations. Silk, for example, is owned by French company Danone (PA:DANO). And The Hain Celestial Group (NASDAQ:HAIN) now owns DREAM, a full line of dairy alternatives that includes everything from rice milk to soy gelato.

I know what you’re thinking: YUM.

Even if those products disgust you, just remember that you don’t have to actually eat the stuff to make money from it.