I’ll admit I once was a fan. Taking control from the hands of the government and giving it to the free market is always a good idea.

Governments are greedy, wasteful and slow.

Worse, when they mess up, they have the gracious luxury of paying for their mistakes with other people’s money.

So when a new sort of partnership emerged that put some control of our ever-bloated corrections system into the hands of private citizens, many investors jumped in with both feet.

“Give us more!” they shouted.

It made sense. Allowing the free market system to eliminate waste works... and it works well.

But in this case, it didn’t. It was a flat-out failure.

The reason why brings us squarely back to a theme we pondered two weeks ago. For the very same reasons Amtrak is a failure, our nation’s prison system is an expensive joke.

The private sector should have helped. It should have cut waste. It should have boosted efficiency.

But alas, it didn’t.

Washington’s tentacles continued to strangle the potential-filled industry.

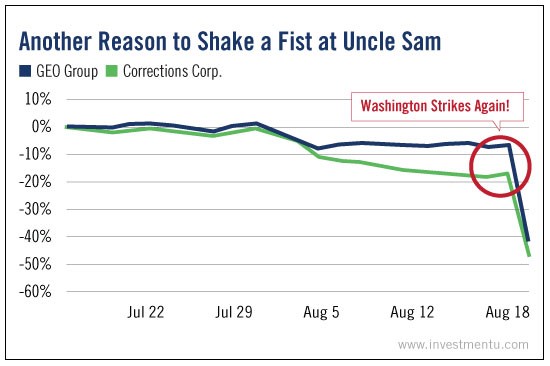

News late last week was the final blow for many investors. When word spread that the U.S. Justice Department will no longer team up with private prisons, the kings of the prison yard saw their shares plunge.

Shares of Geo Group Inc (NYSE:GEO) and Corrections Corporation of America (NYSE:CXW) plunged 39% and 35%, respectively.

It’s just as we discussed two weeks ago - any company that relies on Uncle Sam or his brethren at the state level is doomed for failure.

In fact, when we dig into it, we find these “private” prisons aren’t private at all.

Here’s what most investors don’t know.

Of the 60 private prisons with more than 500 beds in the U.S., 73% of them got a subsidy from Uncle Sam to help pay for construction.

Again, the tentacles of big government are long and nimble.

If that’s not enough to scare you, don’t forget it’s our government that ultimately controls the prison market.

It’s not as if these companies decide who they let in the door or how much they pay - a key factor for any successful venture. Instead, private prisons rely on government contracts for revenue and the nation’s fickle judicial system for a steady supply of customers.

Despite their stature on public exchanges, their income is still swiped from the pockets of taxpayers.

The public sector still calls the shots for private prisons. Until any Joe Sixpack can send his mother-in-law to prison for bad cooking, that fact won’t change.

We’ll end up getting exactly what we saw three days ago, where private prison operators are at the mercy of politicians. With one campaign promise or one emotional vote on Capitol Hill, billions of dollars’ worth of contracts can be erased... and shareholders will get slaughtered.

With no chance of private-sector revenue, it’s a fatal flaw.

Folks long on the industry will say the plunge was overdone. They’ll tout the fact that GEO Group gets a mere 16% of its revenue from Uncle Sam, while Corrections Corp. gets only 11%. And they’re right that last week’s news won’t be a death knell for private prisons.

In fact, today’s investors are likely getting a good deal... in the short term.

In the long term, this sort of public-private incest will prove costly.

But this time, it’s not just the taxpayer who will be on the hook for the government’s waste. Investors will pay as well.