Relief again, what's next?

The market is back on the runway for another EU summit take off. Over the past few days news flow has turned increasingly constructive in terms of the meeting outcome and the market has responded correspondingly.

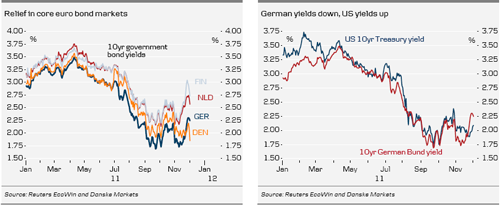

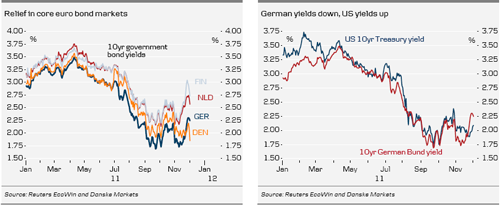

Equities are up by an impressive 10% since the end of last week and both core and periphery spreads to Germany have tightened significantly over the past few days. 10-year Italian bond are yielding 6.47% – their lowest since the best level at 11 November, following the previous EU summit.

Interestingly, German bonds are also seeing huge relief: although yields have not declined that much, German bonds have been tightening significantly versus the US.

EU summit and ECB meeting - make or break?

There are two major important events in the week ahead: the EU summit on Friday (with a pre-meeting of Merkel and Sarkozy on Monday) and the ECB meeting on Thursday. These two events will determine whether the current relief rally will continue, or whether we will see a renewed setback. It all depends on the policy response being credible, transparent and sufficiently bold.

We acknowledge three important developments in recent days:

1. Eurozone members are now considering using bilateral agreements to achieve further fiscal integration, including the possibility to enforce budget discipline on individual countries. Among the pros for making bilateral agreements is that the implementation would be faster because it does not include Treaty changes and it does not need to be ratified by every single member state.

2. ECB officials appear to be opening the door for the ECB to play a bigger and more explicit role in stabilising the European bond markets, if the political moral hazard issues are solved. The bilateral EU agreement on fiscal coordination could be the token needed for the ECB to step up the bond purchase programme, or to announce more explicit support for the sovereign bond markets. In a recent testimony to the European Parliament ECB governor Draghi said that:

“We might be asked whether a new fiscal compact would be enough to stabilise markets and how a credible longer-term vision can be helpful in the short term. Our answer is that it is definitely the most important element to start restoring credibility ...Other elements might follow, but the sequencing matters. And it is first and foremost important to get a commonly shared fiscal compact right. “

To us this indicates that the ECB would be less reluctant to step up the SMP programme if EU countries reach an agreement on fiscal coordination. The question is, however, if not the ECB needs to post a more explicit commitment to intervene in the bond markets to improve market confidence.

3. Finally (according to some newswires), IMF officials have been indicating that the monetary fund could be more closely involved in the effort to stabilise the European sovereign bond markets. Two versions have been floated. One in which the ECB lends money to the IMF, which under conditionality provides the funds to the relevant country. Another model is where the IMF sets up a precautionary lending facility, which is pre-committed to the country in question.

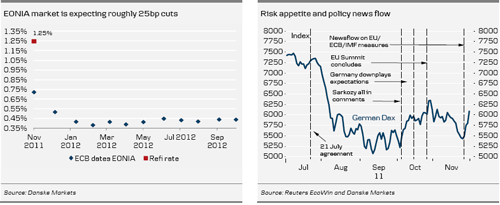

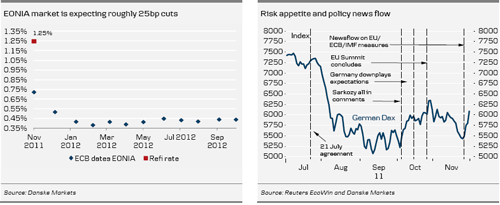

4. Regarding the ECB meeting on Thursday, we expect the central bank to cuts its refi rate by 25bp to 1.0% and retain an easing bias through a downgrade on the outlook for both growth and inflation. Moreover, we expect Draghi to introduce 24-month LTROs with full-allotment and average rates with a reduction in collateral requirements for both the LTRO and MROs.

Will the policy response be sufficient this time?

According to the EONIA market a 25bp cut is relatively close to market expectations. However, such a response will probably be at risk of disappointing the market, unless Draghi indicates that the ECB is close to stepping up the support for the government bond markets.

An outcome in which the major EU countries reach an agreement about fiscal coordination and the ECB steps up the support for the government bond markets – possibly supported by the IMF – would be a very positive outcome, in our view.

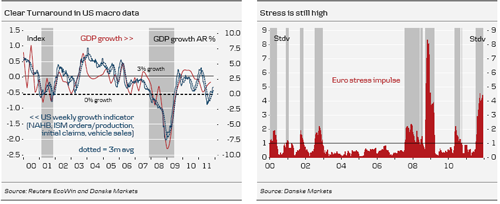

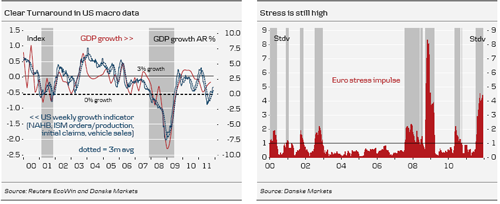

As was the case ahead of the 6 October EU summit, expectations are now gradually building up and short risk positions are squared out. Most would probably prefer to be neutral ahead of next week’s ECB meeting and the following EU summit. With position squaring continuing and because of the better macroeconomic backdrop in the US, we believe that the positive tones in the market could continue in the remaining days ahead of the summit.

With regard to the outcome of the summit and the following market reaction, we will – given past experience of EU summits – hope for the best but be prepared for the worst. If the summit does not end up with a transparent and credible policy response, the risk is that the market goes into another tailspin.

That said, the macroeconomic backdrop in terms of US data has improved considerably over the past few months. This implies that the underlying trend for US rates is now up. Unless the euro crisis escalates to new highs, we have passed the trough for US bond yields this time.

The market is back on the runway for another EU summit take off. Over the past few days news flow has turned increasingly constructive in terms of the meeting outcome and the market has responded correspondingly.

Equities are up by an impressive 10% since the end of last week and both core and periphery spreads to Germany have tightened significantly over the past few days. 10-year Italian bond are yielding 6.47% – their lowest since the best level at 11 November, following the previous EU summit.

Interestingly, German bonds are also seeing huge relief: although yields have not declined that much, German bonds have been tightening significantly versus the US.

EU summit and ECB meeting - make or break?

There are two major important events in the week ahead: the EU summit on Friday (with a pre-meeting of Merkel and Sarkozy on Monday) and the ECB meeting on Thursday. These two events will determine whether the current relief rally will continue, or whether we will see a renewed setback. It all depends on the policy response being credible, transparent and sufficiently bold.

We acknowledge three important developments in recent days:

1. Eurozone members are now considering using bilateral agreements to achieve further fiscal integration, including the possibility to enforce budget discipline on individual countries. Among the pros for making bilateral agreements is that the implementation would be faster because it does not include Treaty changes and it does not need to be ratified by every single member state.

2. ECB officials appear to be opening the door for the ECB to play a bigger and more explicit role in stabilising the European bond markets, if the political moral hazard issues are solved. The bilateral EU agreement on fiscal coordination could be the token needed for the ECB to step up the bond purchase programme, or to announce more explicit support for the sovereign bond markets. In a recent testimony to the European Parliament ECB governor Draghi said that:

“We might be asked whether a new fiscal compact would be enough to stabilise markets and how a credible longer-term vision can be helpful in the short term. Our answer is that it is definitely the most important element to start restoring credibility ...Other elements might follow, but the sequencing matters. And it is first and foremost important to get a commonly shared fiscal compact right. “

To us this indicates that the ECB would be less reluctant to step up the SMP programme if EU countries reach an agreement on fiscal coordination. The question is, however, if not the ECB needs to post a more explicit commitment to intervene in the bond markets to improve market confidence.

3. Finally (according to some newswires), IMF officials have been indicating that the monetary fund could be more closely involved in the effort to stabilise the European sovereign bond markets. Two versions have been floated. One in which the ECB lends money to the IMF, which under conditionality provides the funds to the relevant country. Another model is where the IMF sets up a precautionary lending facility, which is pre-committed to the country in question.

4. Regarding the ECB meeting on Thursday, we expect the central bank to cuts its refi rate by 25bp to 1.0% and retain an easing bias through a downgrade on the outlook for both growth and inflation. Moreover, we expect Draghi to introduce 24-month LTROs with full-allotment and average rates with a reduction in collateral requirements for both the LTRO and MROs.

Will the policy response be sufficient this time?

According to the EONIA market a 25bp cut is relatively close to market expectations. However, such a response will probably be at risk of disappointing the market, unless Draghi indicates that the ECB is close to stepping up the support for the government bond markets.

An outcome in which the major EU countries reach an agreement about fiscal coordination and the ECB steps up the support for the government bond markets – possibly supported by the IMF – would be a very positive outcome, in our view.

As was the case ahead of the 6 October EU summit, expectations are now gradually building up and short risk positions are squared out. Most would probably prefer to be neutral ahead of next week’s ECB meeting and the following EU summit. With position squaring continuing and because of the better macroeconomic backdrop in the US, we believe that the positive tones in the market could continue in the remaining days ahead of the summit.

With regard to the outcome of the summit and the following market reaction, we will – given past experience of EU summits – hope for the best but be prepared for the worst. If the summit does not end up with a transparent and credible policy response, the risk is that the market goes into another tailspin.

That said, the macroeconomic backdrop in terms of US data has improved considerably over the past few months. This implies that the underlying trend for US rates is now up. Unless the euro crisis escalates to new highs, we have passed the trough for US bond yields this time.