Investing.com’s stocks of the week

Wall Street was closed yesterday (Tuesday) in a steady trend, despite the fact that during most of trading hours the trend was in a positive territory.

On the one hand investors are encouraged from the GDP data released in the Eurozone and continue to expect monetary activities of the U.S. Federal Reserve and the ECB in Europe.

On the other hand, investors were concerned that the debt crisis will worsen even more.

However, investors also focused on a series of macro data added to the positive atmosphere in early trading.

In Europe encouraging (relatively) data have been published about the growth in the Eurozone, which amounted to a negative figure of 0.2% - according to forecasts.

Growth in Germany, the strong economy in the Eurozone, amounted to 0.3% compared with analysts' expectations of 0.2% growth in the second quarter.

Based on the reports, the local stock exchanges traded in price increases.

Meanwhile, investors continue to hope that a significant move of the European Central Bank (ECB), with a focus on purchases of government bonds (which are still pending approval of the Government of Germany).

Spanish Prime Minister Mariano Rajoy said he will ask the European Central Bank to purchase additional Spanish bonds, as he works to increase the period of unemployment benefits for 5.7 million unemployed in the country.

And in the United States, increasing expectations of monetary process of the U.S. Federal Reserve, which according to rumors is expected to make a third Bond Purchase Program (QE3), which will focus on purchases of covered bonds – mortgage.

DOW 0.02%↑ S&P 0.01%↓ NSDQ 0.18%↓

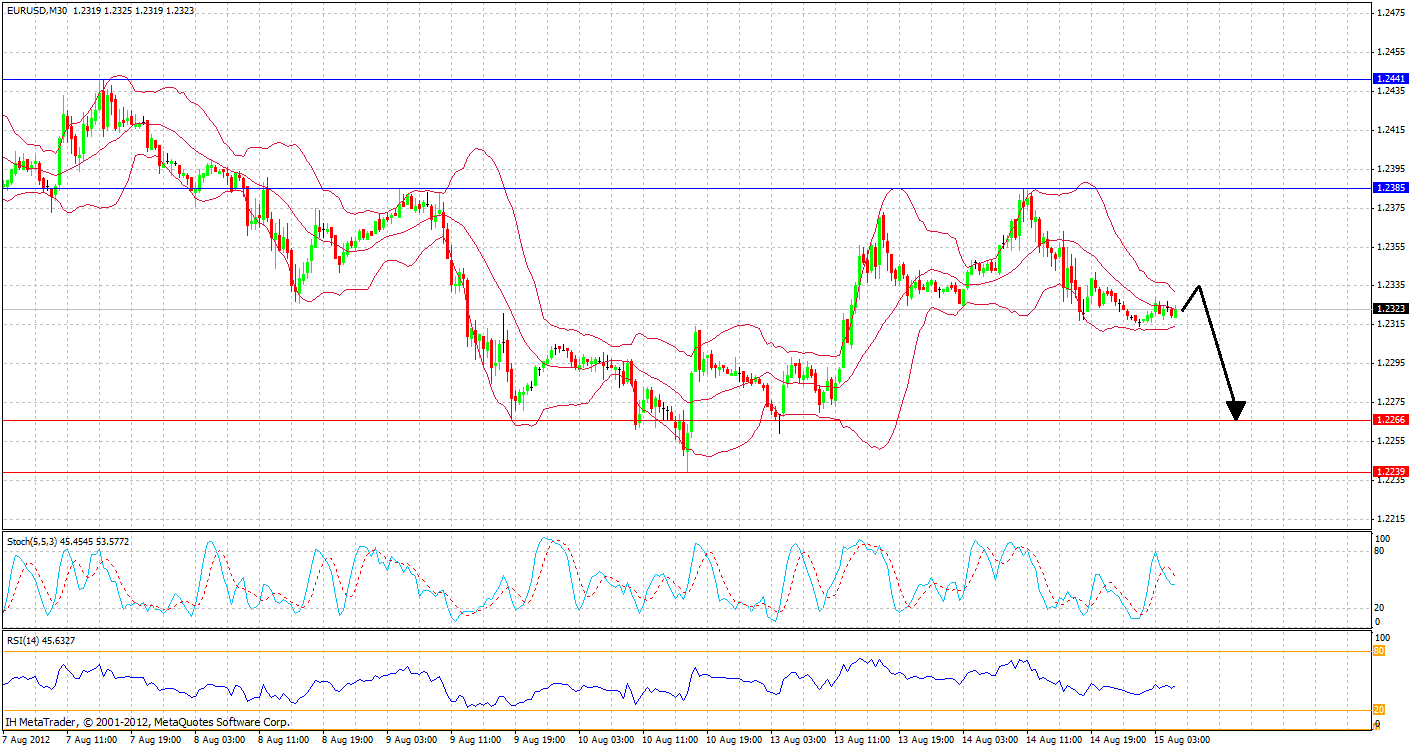

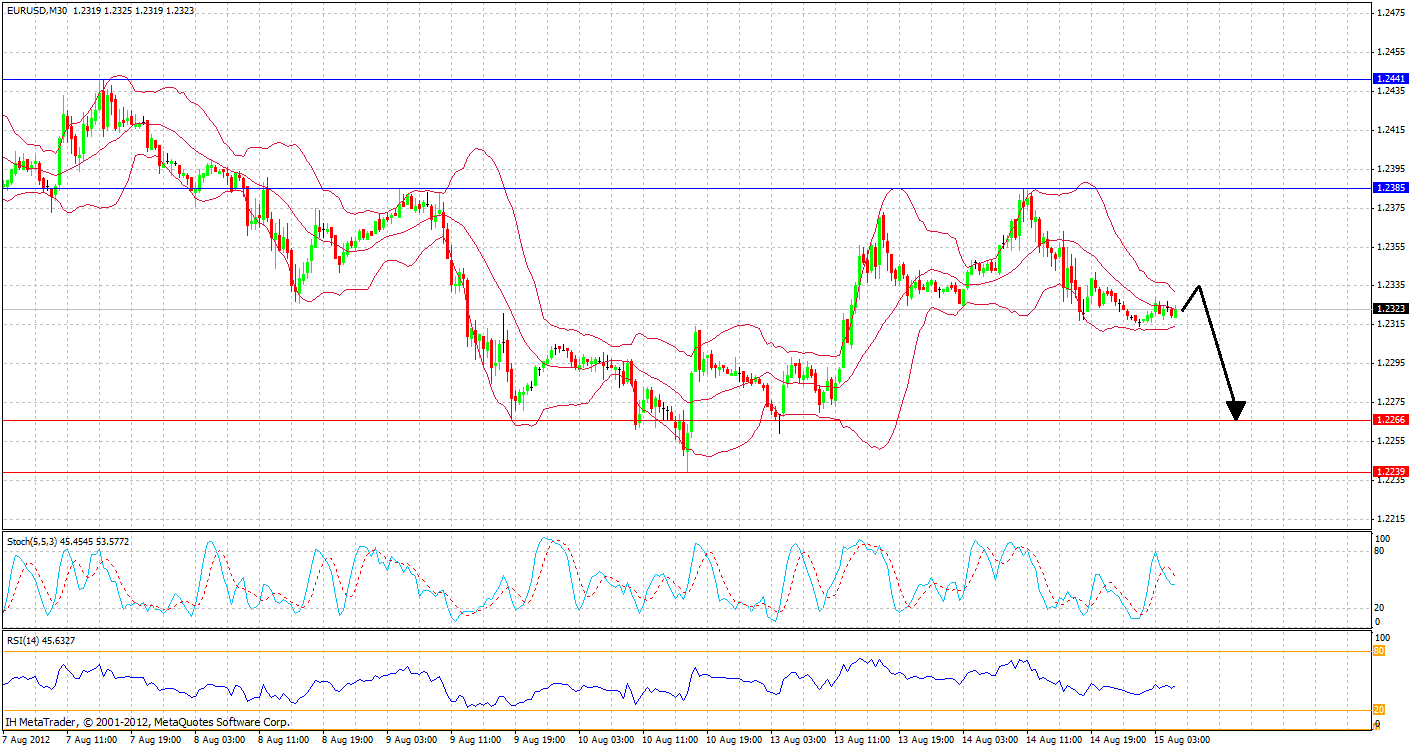

EUR/USD:

EUR/USD trading at 1.2323 an increase of 0.04% in writing.

The pair may find support at 1.2266 Thursday low and resistance at- 1.2385 Tuesday high.

Meanwhile, the Euro gain strength against the British Pound and against the Japanese Yen, when the -EUR/GBP add a 0.06% to 0.7863 and –EUR/JPY add 0.11% to 97.11.

EUR/USD" title="EUR/USD" width="1409" height="747" />

EUR/USD" title="EUR/USD" width="1409" height="747" />

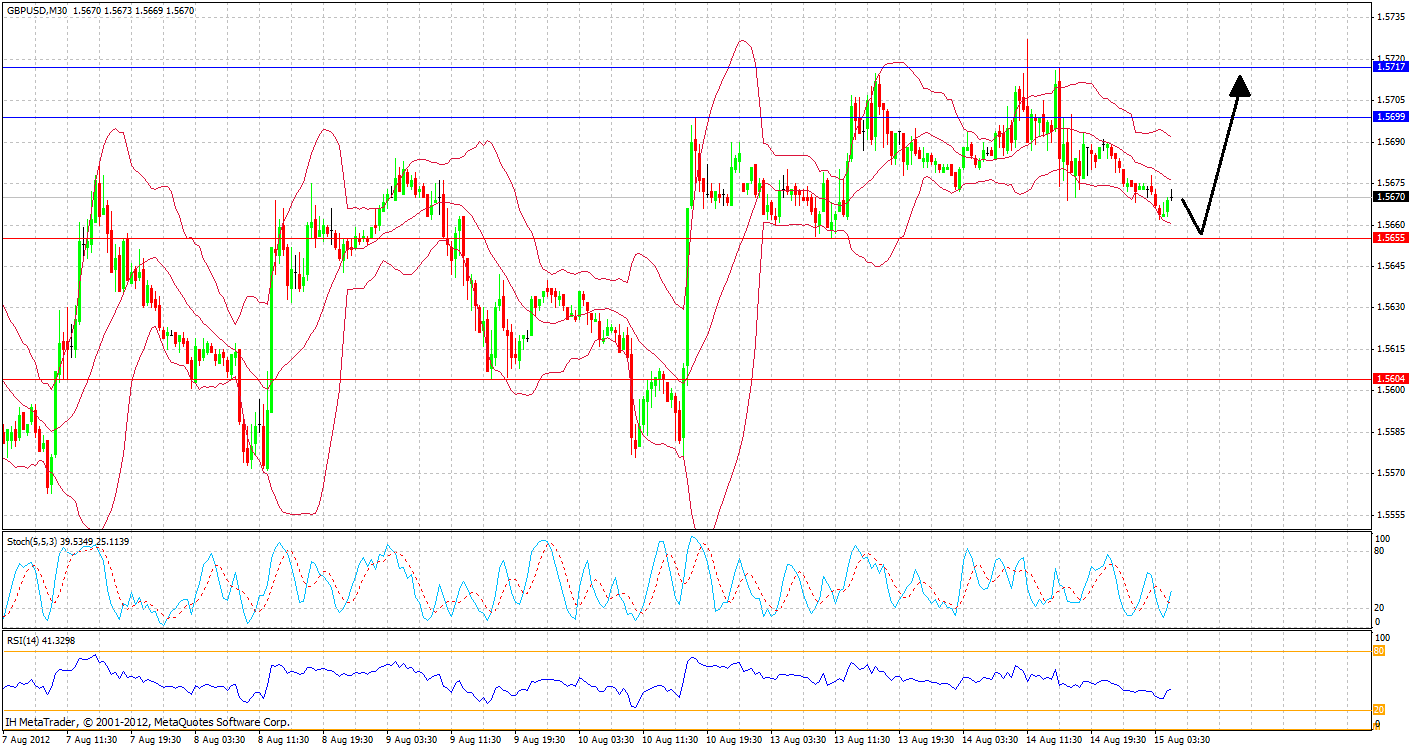

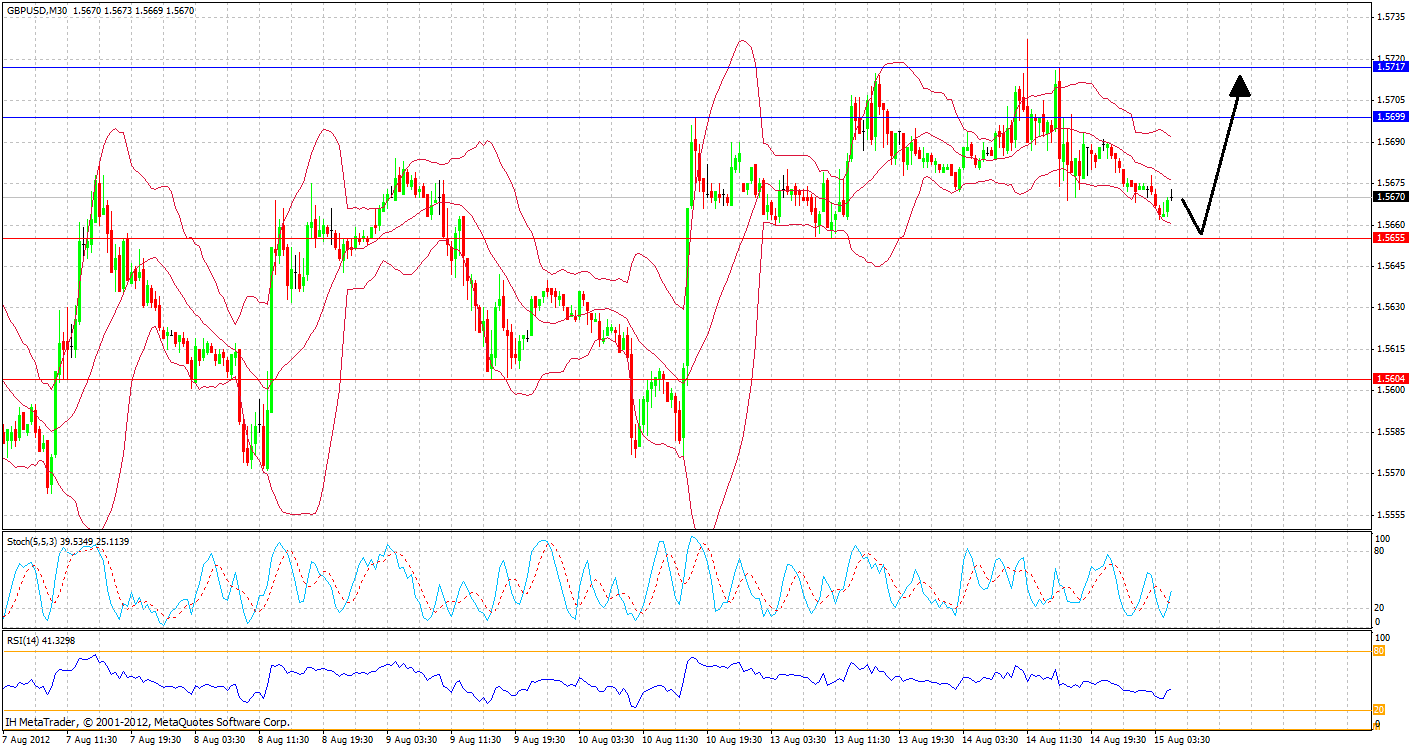

GBP/USD:

The British Pound weakens against the U.S Dollar today, trading at 1.5670 a decrease of 0.04%.

The pair may find support at 1.5655 Monday low and resistance at 1.5717 Monday high.

Meanwhile, the British Pound weakens against the Euro and gain strength against the Japanese Yen, while the EUR/GBP add a 0.06% to 0.7863 and the GBP/JPY add 0.05% to 123.45.

GBP/USD" title="GBP/USD" width="1409" height="747" />

GBP/USD" title="GBP/USD" width="1409" height="747" />

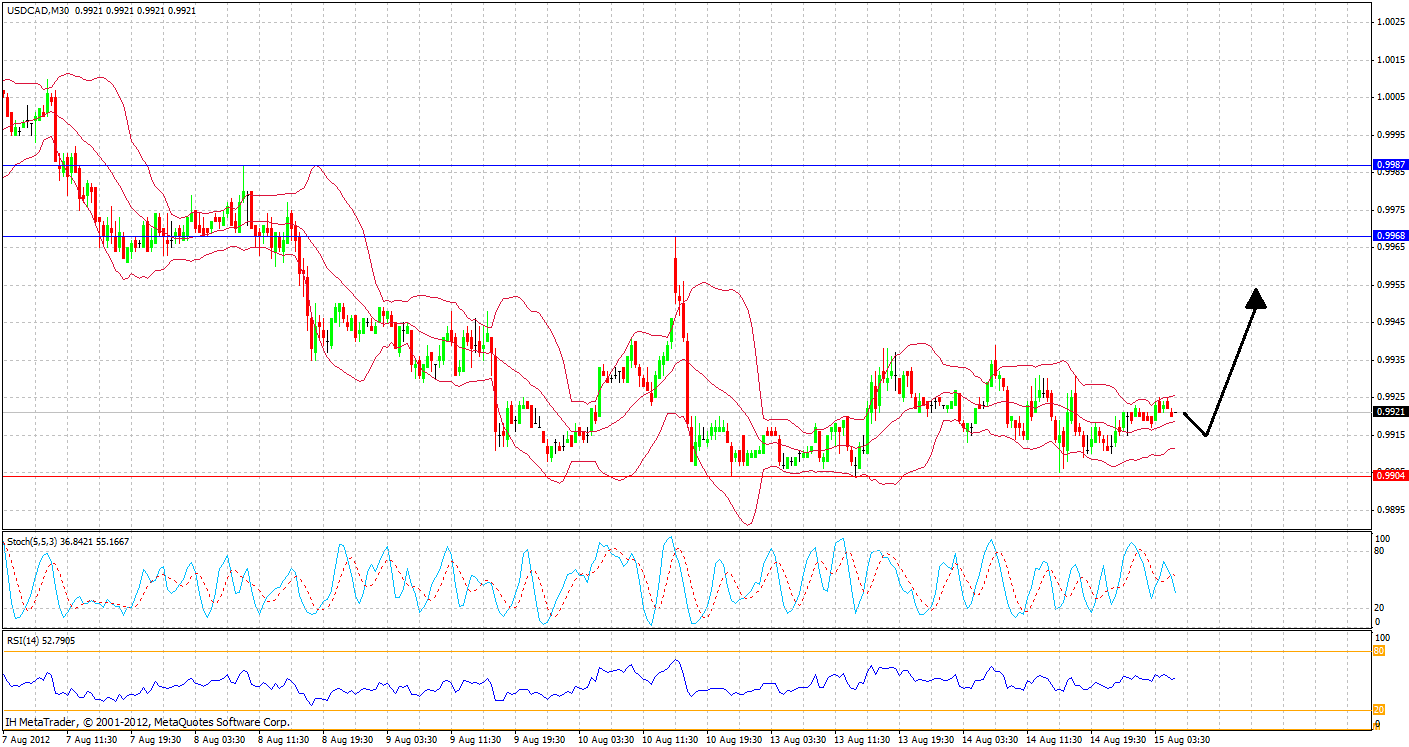

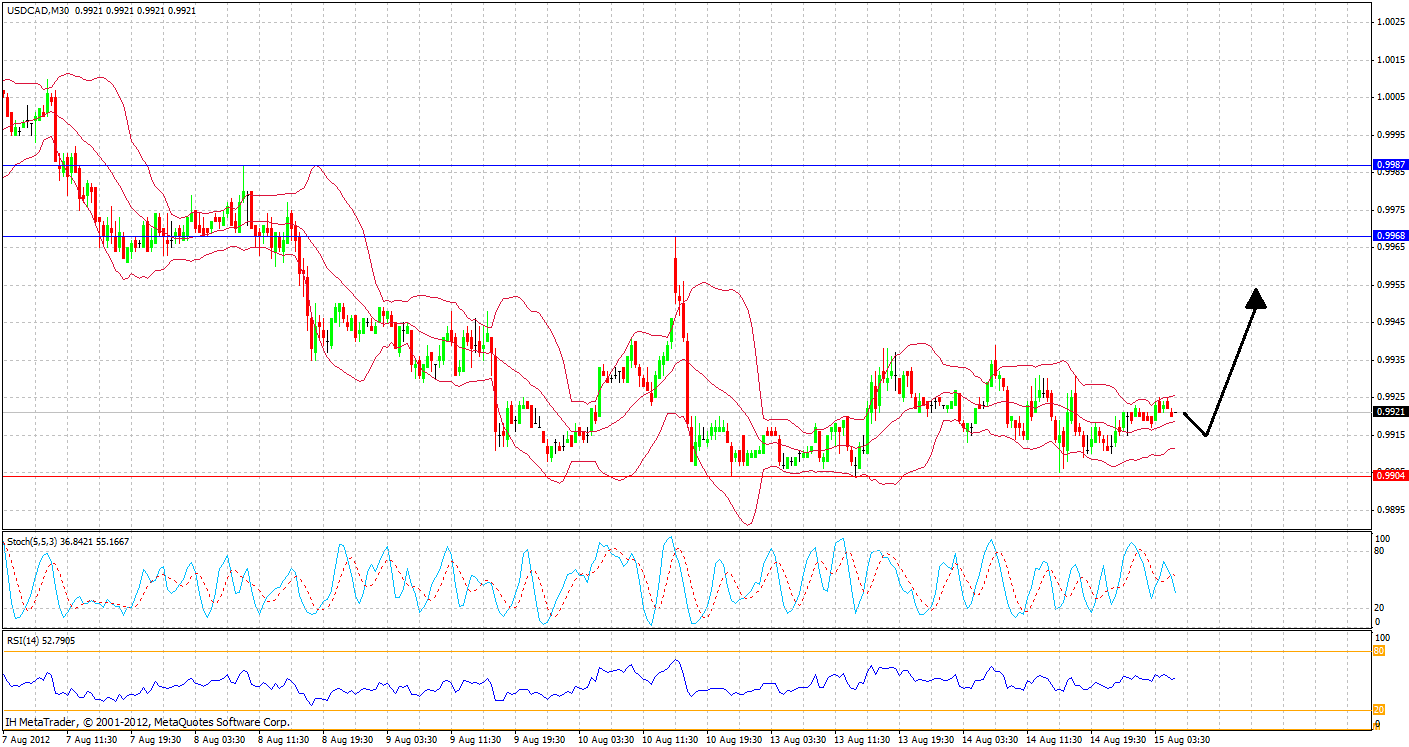

USD/CAD:

The U.S Dollar weakens against the Canadian Dollar today, trading at 0.9921 a decrease of 0.01%.

The pair may find support at 0.9904 Tuesday low and resistance at 0.9968 Friday high.

Meanwhile, the U.S Dollar weakens against the Euro and gain strength against the British pound, while the EUR /USD add 0.04% to 1.2323 and the GBP/USD drop 0.04% to 1.5670.

USD/CAD" title="USD/CAD" width="1409" height="747" />

USD/CAD" title="USD/CAD" width="1409" height="747" />

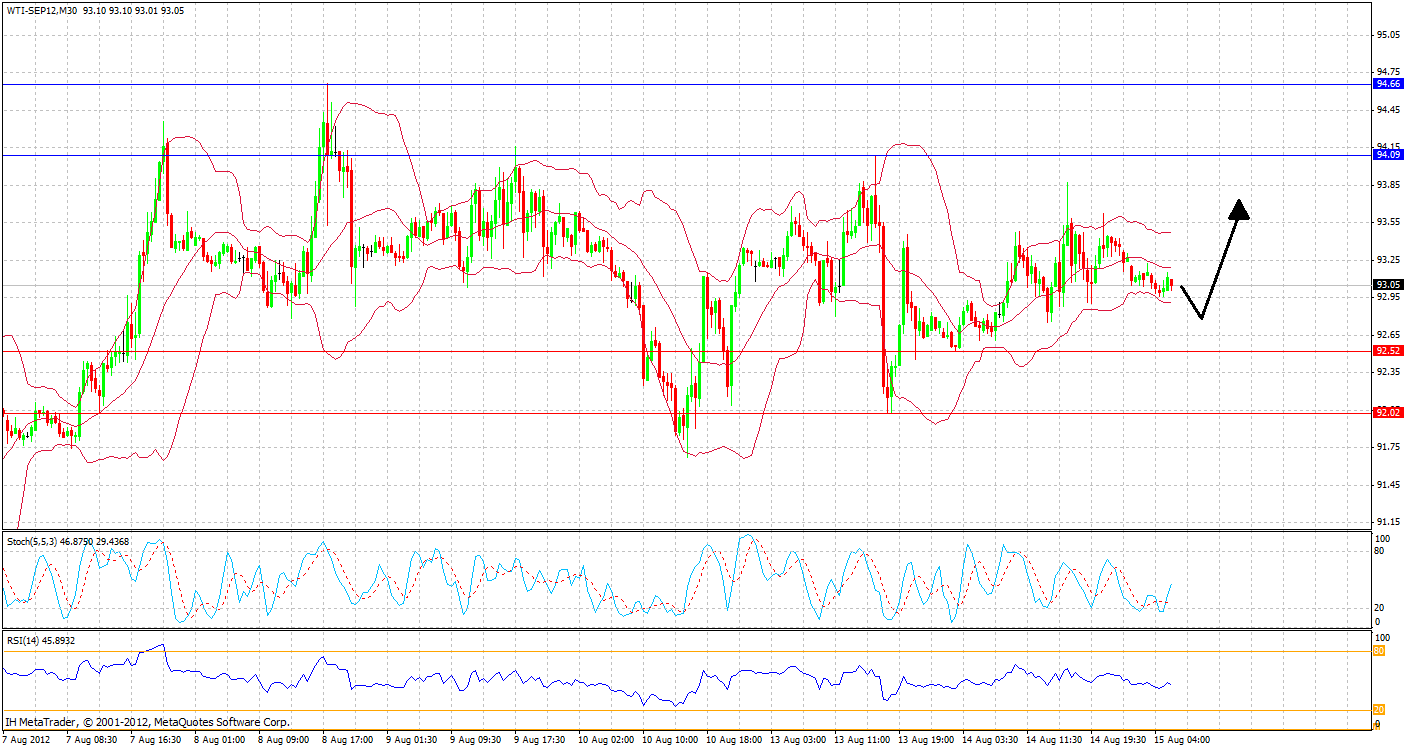

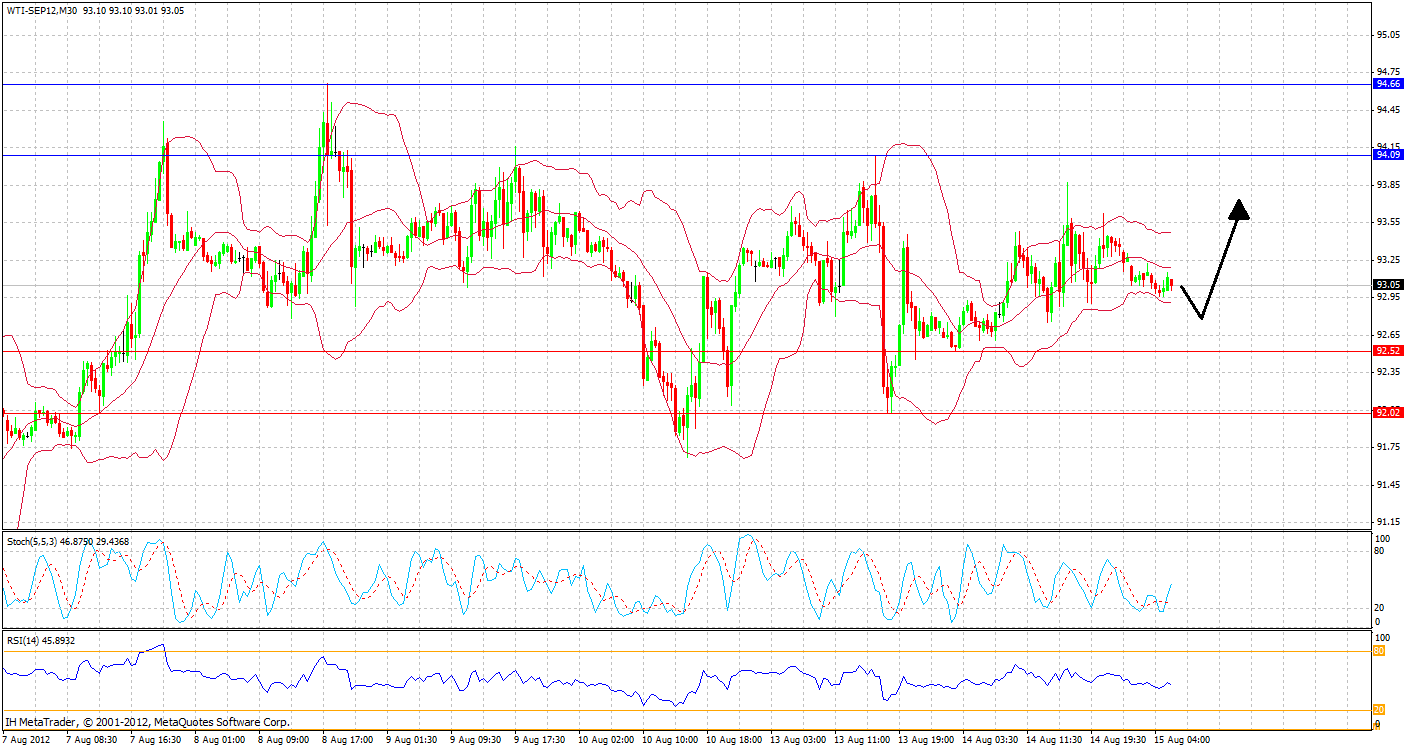

WTI- Crude Oil:

The WTI weakens today, trading at 93.05 a decrease of 0.31%.

May find support at 92.52 Tuesday low and resistance at 94.09 Monday high.

On the one hand investors are encouraged from the GDP data released in the Eurozone and continue to expect monetary activities of the U.S. Federal Reserve and the ECB in Europe.

On the other hand, investors were concerned that the debt crisis will worsen even more.

However, investors also focused on a series of macro data added to the positive atmosphere in early trading.

In Europe encouraging (relatively) data have been published about the growth in the Eurozone, which amounted to a negative figure of 0.2% - according to forecasts.

Growth in Germany, the strong economy in the Eurozone, amounted to 0.3% compared with analysts' expectations of 0.2% growth in the second quarter.

Based on the reports, the local stock exchanges traded in price increases.

Meanwhile, investors continue to hope that a significant move of the European Central Bank (ECB), with a focus on purchases of government bonds (which are still pending approval of the Government of Germany).

Spanish Prime Minister Mariano Rajoy said he will ask the European Central Bank to purchase additional Spanish bonds, as he works to increase the period of unemployment benefits for 5.7 million unemployed in the country.

And in the United States, increasing expectations of monetary process of the U.S. Federal Reserve, which according to rumors is expected to make a third Bond Purchase Program (QE3), which will focus on purchases of covered bonds – mortgage.

DOW 0.02%↑ S&P 0.01%↓ NSDQ 0.18%↓

EUR/USD:

EUR/USD trading at 1.2323 an increase of 0.04% in writing.

The pair may find support at 1.2266 Thursday low and resistance at- 1.2385 Tuesday high.

Meanwhile, the Euro gain strength against the British Pound and against the Japanese Yen, when the -EUR/GBP add a 0.06% to 0.7863 and –EUR/JPY add 0.11% to 97.11.

EUR/USD" title="EUR/USD" width="1409" height="747" />

EUR/USD" title="EUR/USD" width="1409" height="747" />GBP/USD:

The British Pound weakens against the U.S Dollar today, trading at 1.5670 a decrease of 0.04%.

The pair may find support at 1.5655 Monday low and resistance at 1.5717 Monday high.

Meanwhile, the British Pound weakens against the Euro and gain strength against the Japanese Yen, while the EUR/GBP add a 0.06% to 0.7863 and the GBP/JPY add 0.05% to 123.45.

GBP/USD" title="GBP/USD" width="1409" height="747" />

GBP/USD" title="GBP/USD" width="1409" height="747" />USD/CAD:

The U.S Dollar weakens against the Canadian Dollar today, trading at 0.9921 a decrease of 0.01%.

The pair may find support at 0.9904 Tuesday low and resistance at 0.9968 Friday high.

Meanwhile, the U.S Dollar weakens against the Euro and gain strength against the British pound, while the EUR /USD add 0.04% to 1.2323 and the GBP/USD drop 0.04% to 1.5670.

USD/CAD" title="USD/CAD" width="1409" height="747" />

USD/CAD" title="USD/CAD" width="1409" height="747" />WTI- Crude Oil:

The WTI weakens today, trading at 93.05 a decrease of 0.31%.

May find support at 92.52 Tuesday low and resistance at 94.09 Monday high.