The popularity of trading Bitcoin has now reached the point where none other than the New York Times sees fit to declare cryptocurrencies, or more specifically initial coin offerings, “The Easiest Path To Riches On The Web.” Not to be left out, CNBC this past week published a brief tutorial on trading crypto with your smartphone and MarketWatch featured a teenage bitcoin millionaire who now forecasts a $1 million price target.

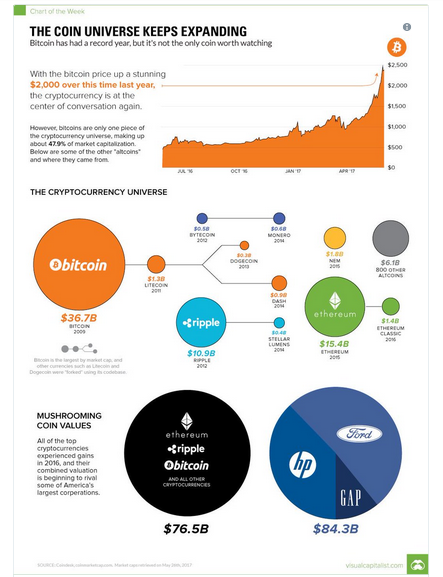

These are exactly the sorts of headlines and stories that characterize a speculative mania otherwise known as a “bubble.” For anyone who was around during the dotcom mania this should quickly bring back memories of all the folks who flocked to day-trading tech stocks. But to really understand the mania, you need to look no further than the primary argument in buying crypto in the first place. Investors here claim the value comes from the limited supply. The trouble is there is an unlimited number of types of coins that can be created!

What makes the “initial coin offering” craze that much crazier than the day-trading mania is that these are essentially nothing more than very thinly-veiled ponzi schemes. In fact, someone saw fit to to actually create a PonziCoin (at least they’re up front about it).

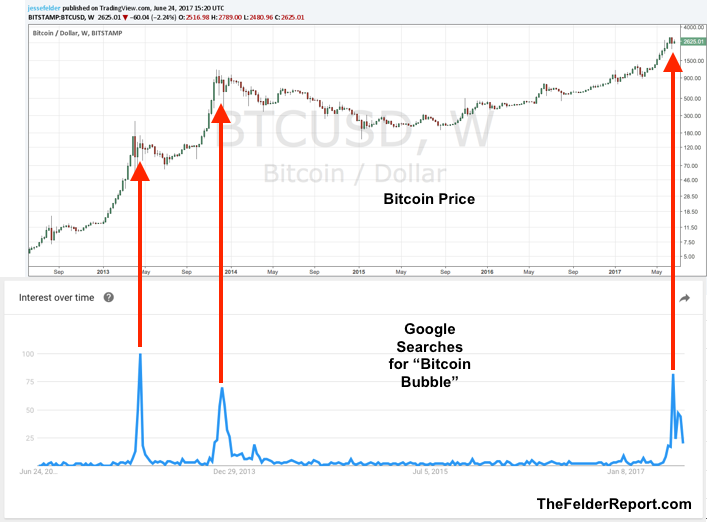

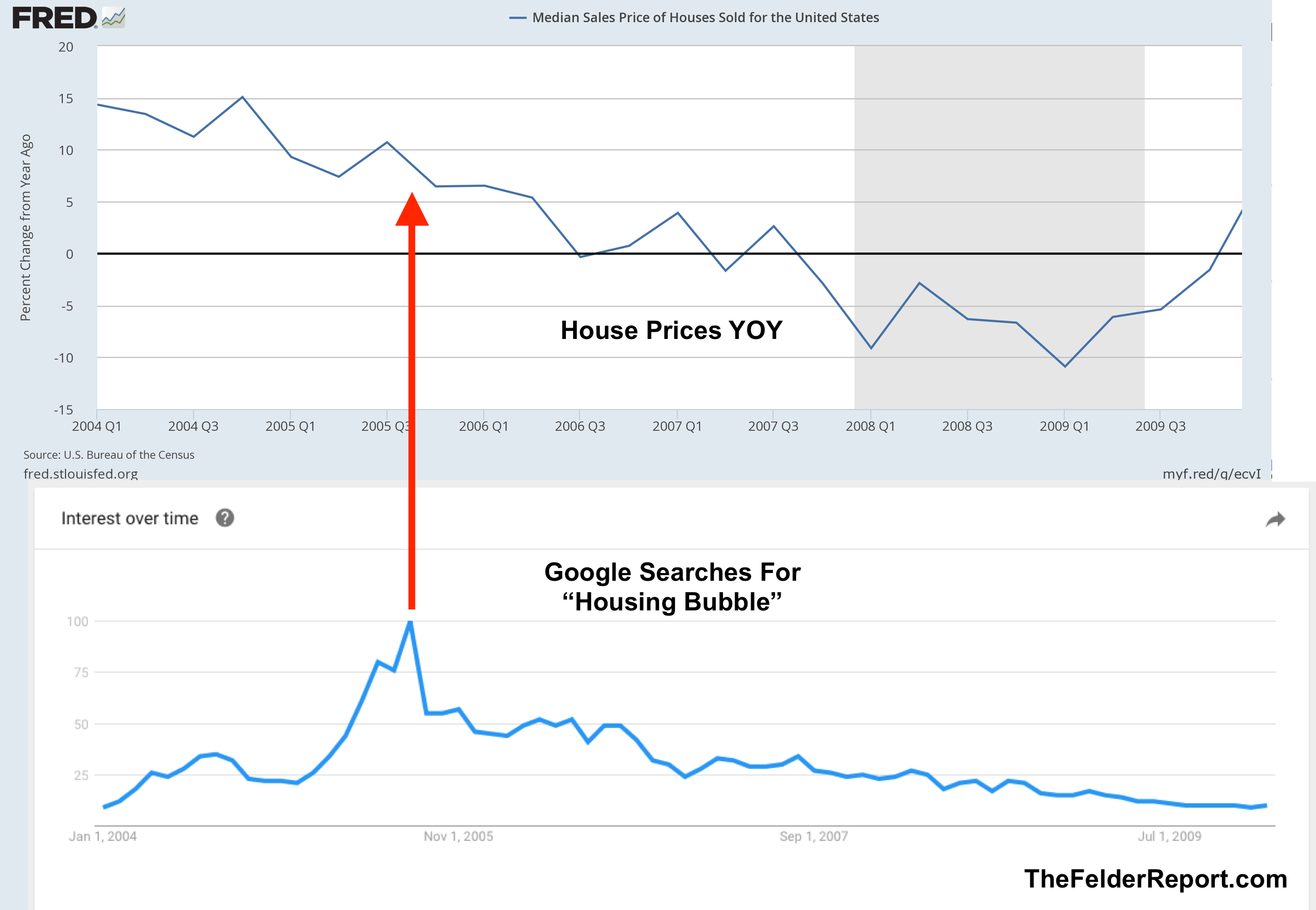

Now some will make the argument that it can’t be a bubble when so many are calling it a bubble. These folks should have learned this lesson during the housing bubble. The fact is it’s only a bubble once everyone acknowledges it’s a bubble. And by the time they do the game is up.

We’re seeing the very same thing in Bitcoin today. Crypto traders know it’s a bubble. Like every bubble (or ponzi scheme) they’re counting on a greater fool paying an even more insane price so they can realize a profit. But it looks like we may have already reached the point of maximum foolishness. Time will tell.