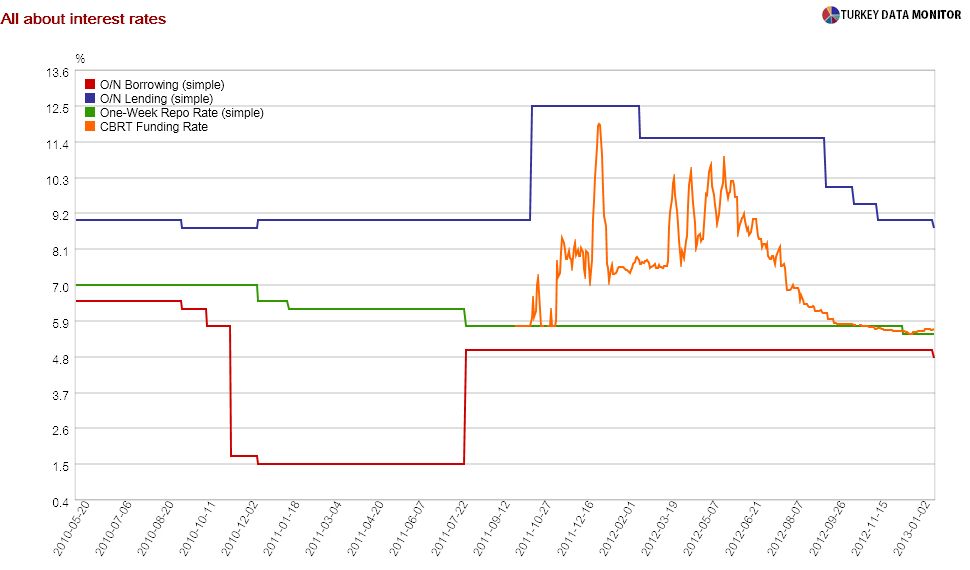

The Central Bank did lower the floor of the interest rate corridor, the borrowing rate, by 25 basis points (bp) as I was hinting it would in my latest post. As I mentioned in the intro. to my latest Hurriyet Daily News column, only four out of twelve economists polled by business channel CNBC-e were expecting a cut, so this is kind of a surprise. However, the real surprise is the cut in the lending rate (also 25 bp), which was expected by only one economist in the CNBC-e sample.

Explaining the floor cut is simple: The Bank is worried about lira appreciation, and if you are one of my loyal readers, you already knew that the rear effective exchange rate (REER) had passed the 120 threshold, above which the Bank had said it would react.

As for the ceiling, you may argue the following: If the Bank is worried about credit growth, why would it cut its lending rate to banks and make their funding cheaper? The graph above offers some clues. As you can see from the Bank’s effective funding rate, the lending rate is not binding at the moment.

Besides, I learned from banking analysts that banks fund consumer loans with wholesale funding and swaps, while Central Bank money is for commercial credit- don’t ask me why! The Central Bank would worry more about slowing down consumer than commercial credit, as the former contributes more to the current account deficit.

Besides, the Bank also hiked reserve requirement ratios (RRRs) for short maturities to curb credit growth. This is why I am saying today’s move is “sort of” a surprise. After all, as Citi economists noted, combating capital flows with the corridor and credit with RRRs is exactly what the Bank did in 2011. So this all feels like groundhog day

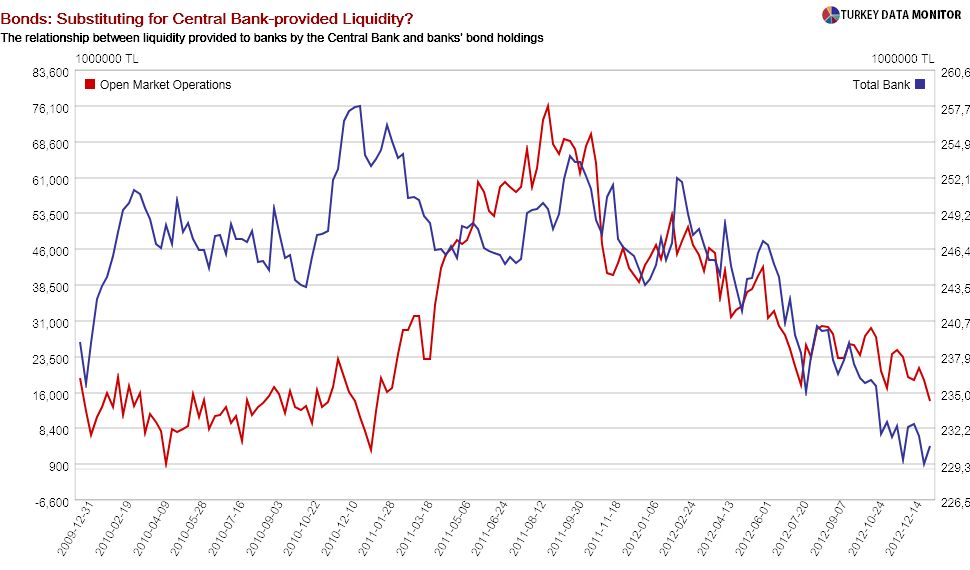

This is all fine, except that RRRs did not manage to curb credit back in 2011; the banking regulator had to save the day with its set of macroprudential measures in June 2011. This was because “banks largely ignored the cost channel and were not particularly intimidated by the liquidity channel”, as my friend Murat Ucer of Turkey Data Monitor succinctly put. After all, banks can switch from government bonds to loans in a low interest-rate environment if the Central Bank starts to tighten liquidity. Here’s what happened late 2010 and in the first half of 2011:

As for the one-pager accompanying the rate decision, a couple of comments are in order: First, I find it odd that the Bank is saying that demand rebalancing is continuing- I would argue it is coming to an end. Other than that, the key was what the Bank omitted from the December one-pager:

“in the following period, if deemed necessary for financial stability, a measured adjustment in the interest rate corridor might also be considered”: The Central Bank is getting rid of its easing bias, so unless capital flows continue to be very strong, no more cuts. But that’s a huge if, especially if Turkey gets the coveted second ratings upgrade.

“total demand conditions support the disinflation process”.: Again, against the easing bias, as the Bank acknowledges the economic recovery- and its influence on inflation. But they want to sound optimistic on inflation, and so they are also saying that “inflation may increase slightly in January due to adjustments in tobacco prices, but will resume its downward trend afterwards” and that “core inflation indicators are expected to continue their downward trend”.

The Bank also dropped the paragraph where it argued that its actions were expansionary and supported overall economic activity. This is not because they think their actions no longer support growth, but because they see the economy picking up.

What about the impact of today’s move on Turkish asset prices? Obviously, the floor cut and the Bank’s determined stance against capital inflows will take some heat off the lira. As for bond rates, despite the cut in the borrowing rate, I would expect limited fall in yields, if any, because with the RRR hikes, the banks’ demand for liquidity will increase and the effective funding rate probably increase a bit.

And by the way, that effect would be at the short end of the curve, which responds to liquidity and funding costs; the longer end is likely to be negatively affected by inflation expectations (I expect inflation to increase to 7 percent this month; inflation expectations are very adaptive in Turkey) and the heavy Treasury redemption schedule in the next couple of months…

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Yep, Another Surprise From The Central Bank Of Turkey- Well, Sort Of

Published 01/23/2013, 05:08 AM

Updated 07/09/2023, 06:31 AM

Yep, Another Surprise From The Central Bank Of Turkey- Well, Sort Of

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.