Risk and uncertainty in the Japanese economy is leading to a tug o' war between those seeking safety, and those expecting more QE from the BoJ. Weak industrial figures thanks to the slowing Chinese economy are causing headaches for the BoJ and fanning the calls for more stimulus.

The yen range has remained intact with the current range with wide daily swings of 100+pips. The battle being waged in the market has led to these swings thanks to risk aversion and poor Japanese economic results. Industrial production fell to -0.5% m/m, well short of the +1.0% expected, followed by a disappointing Tankan manufacturing index at 12, down from 15. The rout was rounded out by the flash manufacturing PMI at 51.0, down from 51.7.

The market is beginning to expect another round of QE from the Bank of Japan to ward off another recession. Those fears are being put aside by the risk seeking investment driven by the economic slowdown in China. This is only going to heat up leading into October, a month that traditionally sees jittery equity markets.

This week will see Japanese trade data released, which could show further slowing in manufacturing exports. The account balance is expected to show further erosion of the trade surplus. Core machinery orders are expected to rise, however, could miss estimates given the recent poor manufacturing data. Already this week we have seen Japanese average cash earnings come in short of estimates at 0.5% vs 0.7% expected.

Watch for plenty of data out from the US side of the equation this week. The ISM non-manufacturing PMI is due shortly, with US trade balance and unemployment claims later this week. If last week’s poor NFP result is anything to go by, US dollar bulls could be sorely disappointed.

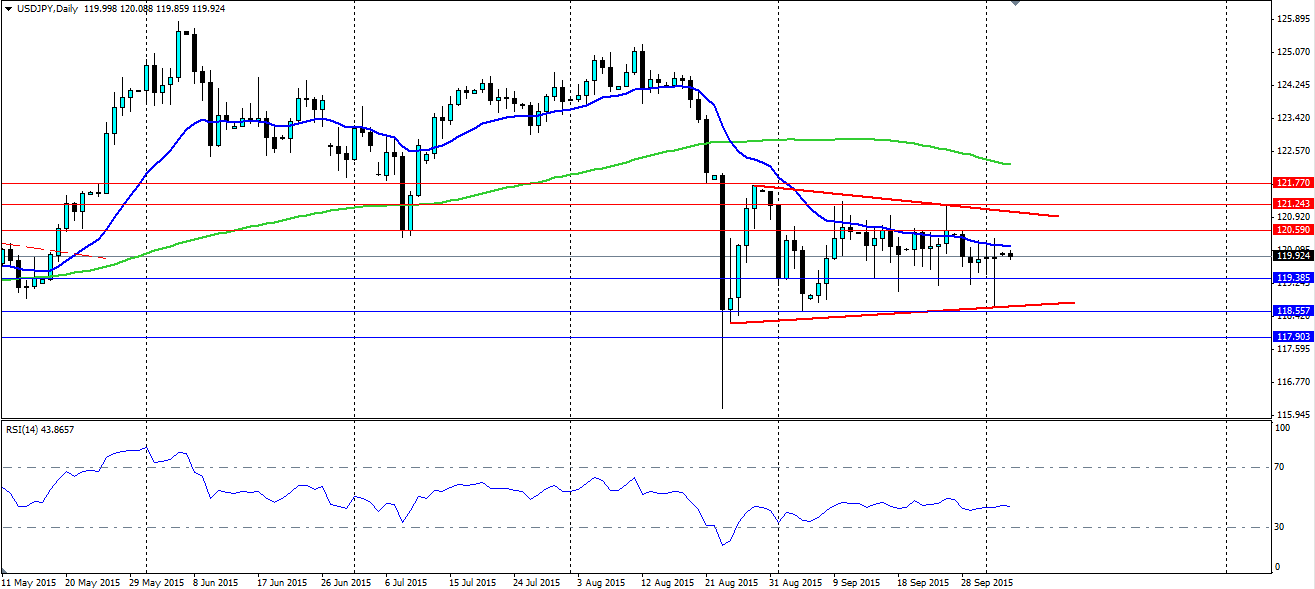

Technicals show the respect this pair has for the current range which will provide plenty of opportunities to trade the highs and lows. The RSI is decidedly neutral as is the 20 day MA which gives us our neutral bias, at least until the range fails. The long wicks either side show there are plenty of market participants watching and defending the range. So expect it to continue to dominate proceedings. Look for support at 119.38, 118.55 and 117.90 with resistance at 120.59, 121.24 and 121.77.