The Japanese yen was trading weaker against its peers in early Asian trading session today as the Bank of Japan left monetary policy unchanged as expected. The BoJ left the short term target rates steady at -0.10% while leaving the 10-Year Japanese bond yield target at near zero. The central bank signaled that it would continue to buy the JGB's at the pace of 80 trillion yen a year. In the meeting, the BoJ also raised its assessment of the economy for the first time in a year noting that the economy is continuing its moderate pace of recovery.

USD/JPY Intra-day Analysis

USD/JPY (117.65):USD/JPY was seen rising after the BoJ's meeting as price continued to recover off the three day low posted yesterday at 116.54. On the 4-hour chart, the hidden bullish divergence is formed as USD/JPY made a higher low while the Stochastics has printed a lower low. Price is likely to test the previous highs near 118.50, which could be breached leaving further upside in the short term. However, with the weekly chart showing a hidden bearish divergence, failure to breakout above 118.50 could signal near term weakness as USD/JPY is likely to slide towards 114.00 where the initial support lies.

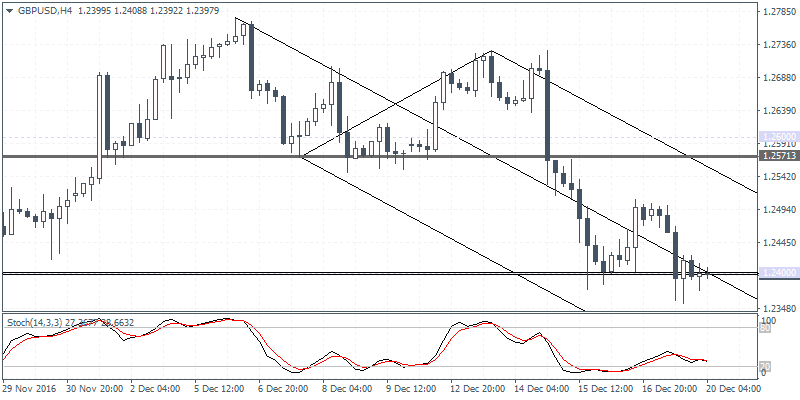

GBP/USD Intra-day Analysis

GBP/USD (1.2397): GBP/USD turned bearish yesterday as the price fell back to the $1.2400 support level. However, with the daily Stochastics seen signaling a bullish crossover off the oversold levels, the near term bias is towards the upside. On the 4-hour time frame, GBP/USD is seen consolidating near the 1.2400 handle. An upside breakout here could trigger further gains towards 1.2571 where resistance is likely to be established after price broke through this level last week.

AUD/USD Daily Analysis

AUD/USD (0.7255):AUD/USD extended the declines from last week, posting a four-day losing streak. The bearish flag pattern remains in play with the downside target to 0.7225 followed by 0.7079. Price action remains within reach of the first downside target to 0.7225 which forms the support zone near 0.7225 - 0.7183. A short term rebound off this level could signal near term upside back to the previous support which could now turn to resistance at 0.7340.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.