The last week trends have been remained in the currency market on Monday. The Japanese yen decreased on the chart, by 1.1% to its lowest level in a month at 102.85 yen per U.S. dollar. In our opinion, some investors closed short positions being influenced by the negative Friday data from the U.S. labor market. So, the yen decline was likely speculative. The economic data Japan came out last night. Current account deficit in November exceeded forecasts and increased to the highest level since 1985 (592.8 billion yen), ($ 5.7 billion). This was due to an increase in imports of hydrocarbons after the closing of a number of Japanese Atomic Power Stations.Increase in the influenced weakening of the yen today.

An additional factor was the announcement of a major transaction where is the necessity to convert yen into dollars. The Suntory Holdings Ltd. - Japanese manufacturer of alcoholic beverages purchases the Beam Inc. for $ 16 billion, it owns brands such as Jim Beam and Canadian Club. Besides all of this, weakening of the yen was also due to the message of continuation of buying the U.S. government bonds by the Japanese government. The total amount for November was 1.48 trillion yen ($ 14.7 billion). Japan is buying U.S. bonds for five consecutive months for the first time in the past two years.

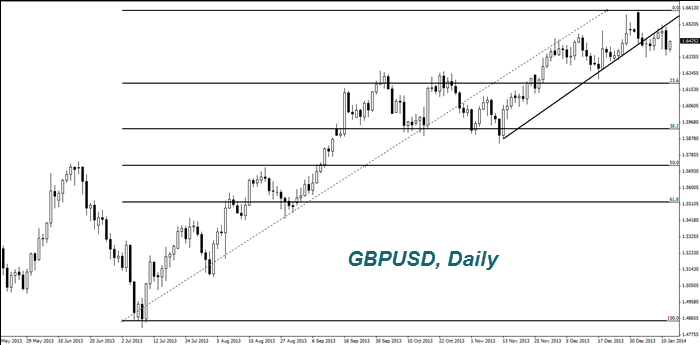

Today at 9-30 GMT we expect a series of macro indicators from the UK. We believe that the most significant of these can be the consumer price index for December, calculated month to month. It is expected to grow by 0.5%. The inflation increase may be negative for the pound

At 13-30 GM, in the US, there are the most important retail sales data for December coming out. In our opinion, the preliminary forecasts are negative for the U.S. dollar. It should be noted that this is not all news for today. After macroeconomic information, the market expects another event that may be positive, on the contrary. We expect the bank executives performances, Philadelphia Fed in 17-45 GMT and Dallas at 18-20 GMT. Previously, they stated of necessity for further reductions in asset. This supports the U.S. dollar exchange rate.

The Australian dollar now slightly corrected after its rapid growth. Investors are taking profits on anticipation of weak economic statistics from China. Tomorrow morning, there will be information on the volume of new loans in RMB in December. According to preliminary estimates it will decrease to 570 million yuan. China is a major trading partner of Australia.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Yen Weakens Against The Dollar

Published 01/14/2014, 09:57 AM

Updated 12/18/2019, 06:45 AM

Yen Weakens Against The Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.