Volatility in the yen stepped up a notch as the ECB sent shockwaves through the Euro pairs, and the US labour figures were released. Some positive JPY data was countered by Governor Kuroda suggesting he would do "whatever it takes". Surprisingly the range is still intact for the USD/JPY pair as the market waits to see what the Fed will do with their interest rates when they meet mid-next week.

The volatility in the yen pair shifted into another gear as the fallout from the ECB's decision found its way into the yen pair, via the dollar. The yen made full use of the range, putting both the upper and lower limits under pressure, and surprisingly it held on both sides.

The data had been yen positive, as retail sales and capital spending lifted early in the week. BoJ Governor Kuroda was surprisingly dovish as he searched for his inner Draghi when he said he would do "whatever it takes" on inflation. The Yen reversed the earlier gains, but the market reserved its judgement until it sees action, given the recent inaction from the central bank.

Trade, GDP and current account data is due early this week for the yen and is always watched closely by the market. Also keep an eye on core machine orders mid-week for signs of further weakness in the manufacturing sector. The range will likely remain intact as the market waits to see if the Fed will follow through with the expected rate rise next week.

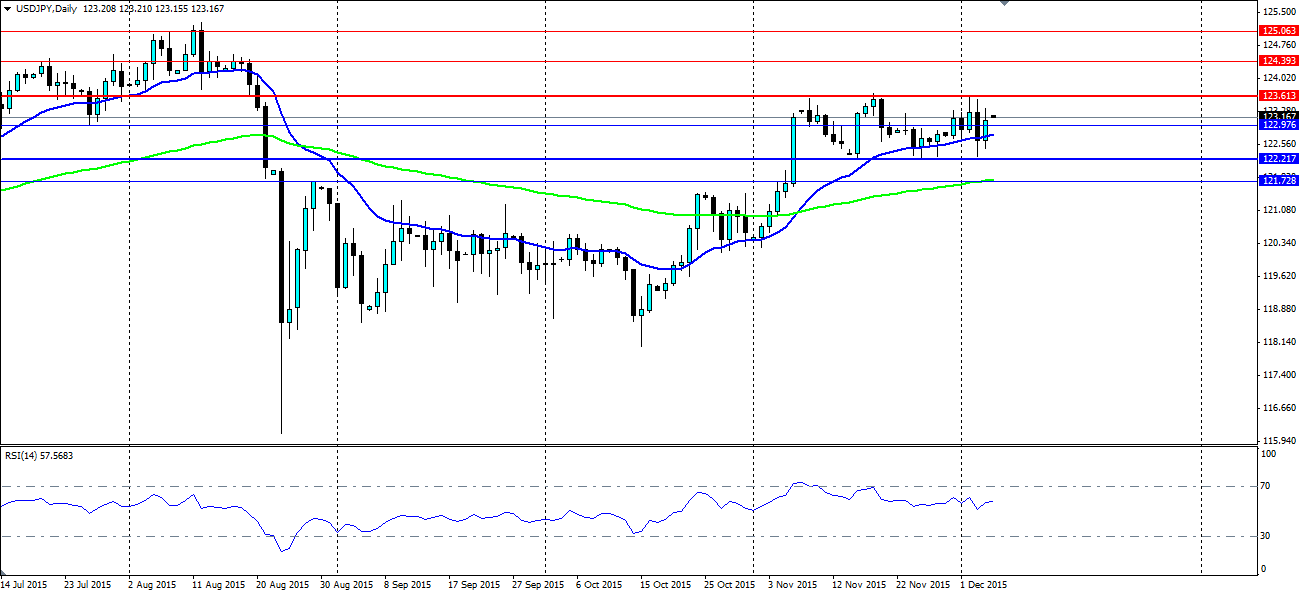

Technicals show a clear range in play for the yen and one that traders will find easy to profit from. With the looming Fed decision, the range will likely remain in play as traders will be reluctant to make a move. Look for the two big levels to play off at 123.61 being the upper bound and 122.21 being the lower. Minor support is found at 122.97, with further support at 121.72. Resistance outside the range is at 124.39 and 125.06.