Stock markets staged a strong rally overnight with the S&P 500 up 13.18 pts, or 0.70% to close at new record high of 1885.52. The Dow also rose 74.95 pts, or 0.46% to close at 16532.61, not far from the historical high of 16588.25. Asian equities followed with Nikkei trading up over 200 pts at the time of writing and is back above 15000 handle. Yen is the biggest loser this week in the current risk seeking environment and is so far down over 1% versus swiss franc, euro, Canadian dollar and New Zealand dollar. The euro is the second strongest currency this week so far as markets are getting more confidence that the ECB will leave policies unchanged this week in spite of recent weak inflation data. The strength in the common currency took swiss franc higher together, which even exceeded euro as the strongest currency this week. Main focus will remain on ECB meeting on Thursday and non-farm payroll on Friday. But we'll also have US ADP employment report today which could trigger some volatility in all markets.

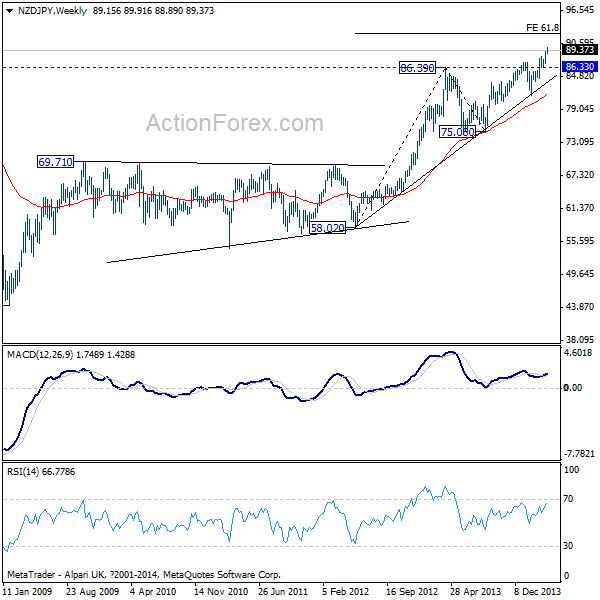

The NZD/JPY is a pair that is worth watching in the current risk seeking mode. The cross extended the medium term up trend to as high as 89.91 so far and momentum remains solid. Near term outlook stays bullish as long as 86.33 support holds. Current rise should extend to 61.8% projection of 58.02 to 86.39 from 75.08 at 92.62 in medium term. Nonetheless, we'll start to be cautious on topping as it approaches 97.76 historical high.

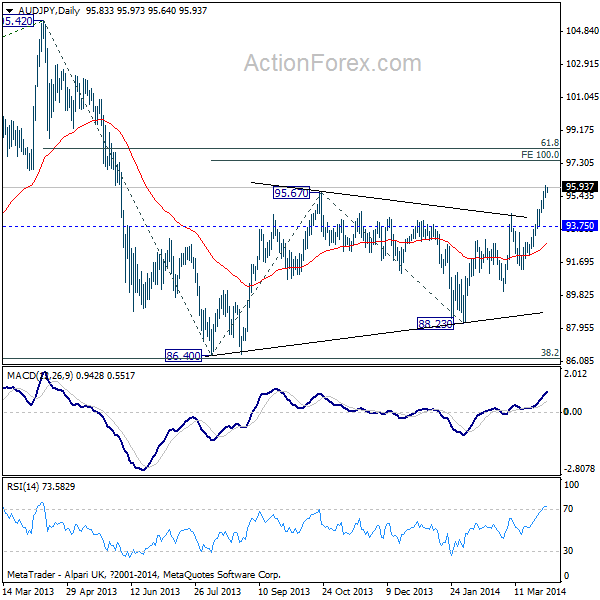

AUD/JPY is another pair to watch as recent break of 95.67 resistance confirmed resumption of the medium term rise from 86.40. Current rally would now likely extend to 100% projection of 86.40 to 95.67 from 88.23 at 97.50. At this point, it's unsure whether rise from 86.40 is a corrective move or an impulsive move. Thus, we'll be cautious on strong resistance from 61.8% retracement from 105.42 to 86.40 at 98.15 to limit upside. Nonetheless, near term outlook will stays bullish as long as 93.75 minor support holds.

On the data front, Japan monetary base rose 54.8% yoy in March. Australia building approvals dropped more than expected by -5.0% mom in February. UK will release construction PMI while eurozone will release PPI in european session. Main focus of the day is on ADP employment report from US which is expected to show 190k growth in March.