USD/JPY has posted considerable losses in the Tuesday session. In North American trade, USD/JPY is trading at 112.48, down 0.63% on the day. In Japan, Average Cash Earnings accelerated to 0.9%, above estimate of 0.6%. Consumer Confidence edged down to 44.7, shy of the forecast of 45.1 points. In the US, JOLTS Jobs Openings was unexpectedly soft, dropping to 5.88 million. This was well short of the estimate of 6.05 million. On Wednesday, the US releases Import Prices.

When the Federal Reserve makes the financial headlines, the discussion is usually focused on interest rates. The Fed took advantage of a strong US economy in 2017, raising interest three times. Another quarter-point hike is widely expected later in January. As of this month, the Fed has started to shrink its massive balance sheet of $4.4 trillion. The balance sheet ballooned during the financial crisis of 2008-2009, and good times have allowed the Fed to begin trimming its portfolio. Incoming Fed Chair Jerome Powell, who takes over in February, has estimated that the balance sheet could drop to anywhere between $2.4 trillion to $2.9 trillion after several years of cuts. Fed policymakers have not indicated a magic number for the balance sheet, but the cuts indicate a vote of confidence in the US economy.

In his first address of the New Year, Bank of Japan Governor Haruhiko Kuroda held the course, stating that the BoJ would continue “patiently” with its ultra-accomodative monetary policy, although he acknowledged positive economic conditions. Kuroda hinted that any changes in policy would be incremental, as he said that the deflationary mindset would not disappear easily. Kuroda is slated to end his 5-year term in April, but will he be staying on? The Japanese government hasn’t made up its mind, and Prime Minister Shinzo Abe said as much on Sunday. Abe said that Kuroda has met his expectations, but admitted that he had not made up his mind about the reappointment. With Japan posting seven straight quarters of growth and inflation moving higher, there’s a strong likelihood that Kuroda will be given the green light for another term at the helm of the central bank.

USD/JPY Fundamentals

Tuesday (January 9)

- 00:00 Japanese Consumer Confidence. Estimate 45.1. Actual 44.7

- 6:00 US NFIB Small Business Index. Estimate 108.4. Actual 104.9

- 10:00 US JOLTS Job Openings. Estimate 6.05M. Actual 5.88M

- 22:45 Japanese 10-year Bond Auction

Wednesday (January 10)

- 8:30 US Import Prices. Estimate 0.4%

*All release times are GMT

*Key events are in bold

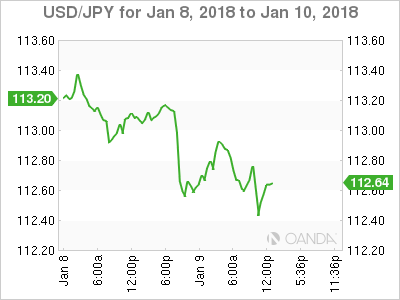

USD/JPY for Tuesday, January 9, 2018

USD/JPY January 9 at 11:25 EDT

Open: 113.09 High: 113.18 Low: 112.37 Close: 112.48

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 109.11 | 110.10 | 111.53 | 112.57 | 113.55 | 114.59 |

USD/JPY dropped considerably in the Asian session. The pair posted small gains in the European session but then retracted. USD/JPY has edged lower in North American trade.

- 111.53 is providing support

- 112.57 has switched to a resistance role following losses by USD/JPY on Tuesday

Current range: 111.53 to 112.57

Further levels in both directions:

- Below: 111.53, 110.10 and 109.11

- Above: 112.57, 113.55, 114.59 and 115.50

OANDA’s Open Positions Ratios

USD/JPY ratio is unchanged in the Tuesday session. Currently, long positions have a majority (54%), indicative of trader bias towards USD/JPY reversing directions and moving lower.