The Japanese yen is trading quietly at the start of the week. In the North American session, USD/JPY is trading at 146.60, up 0.11%.

The yen has plunged 3.05% in August against the US dollar and is trading at its lowest level since November 2022.

Powell, Ueda speak at Jackson Hole

There was a degree of anticipation as major central bankers gathered at the Jackson Hole summit. The meeting has been used as a launch-pad for shifts in policy, but one would be hard-pressed to point to any dramatic news from the summit.

Bank of Governor Kazuo Ueda stayed true to his script that underlying inflation remains lower than the BoJ’s target of 2% and as a result, the BoJ will stick with the current ultra-easy policy. Ueda has followed his predecessor Haruhiko Kuroda and insisted that he will not lift interest rates until there is evidence that domestic demand and stronger wage growth replace cost-push factors and keep inflation sustainably around the 2% target.

Ueda continues to argue that inflation is below target and that he expects inflation to fall, but core inflation indicators continue to point to broad-based inflationary pressures and have remained above the 2% target for around 15 months. Still, the BoJ is sticking to its loose policy and trying to dampen speculation that it will tighten policy. The BoJ tweaked its yield curve control policy in July but at the time, Ueda insisted that the move was not a step towards normalization of policy.

Federal Chair Jerome Powell delivered the keynote speech on Friday, but anyone looking for dramatic headlines walked away disappointed. Powell reiterated that the battle to lower inflation to the 2% target “still has a long way to go”.

Powell was somewhat hawkish with regard to interest rates, saying that the Fed would “proceed carefully” with regard to raising rates or putting rates on hold and waiting for additional data. There was no mention of rate cuts, a signal that the Fed isn’t looking to trim rates anytime soon. The future markets responded by raising the odds of a rate hike in September to 21%, up from 14% a week ago.

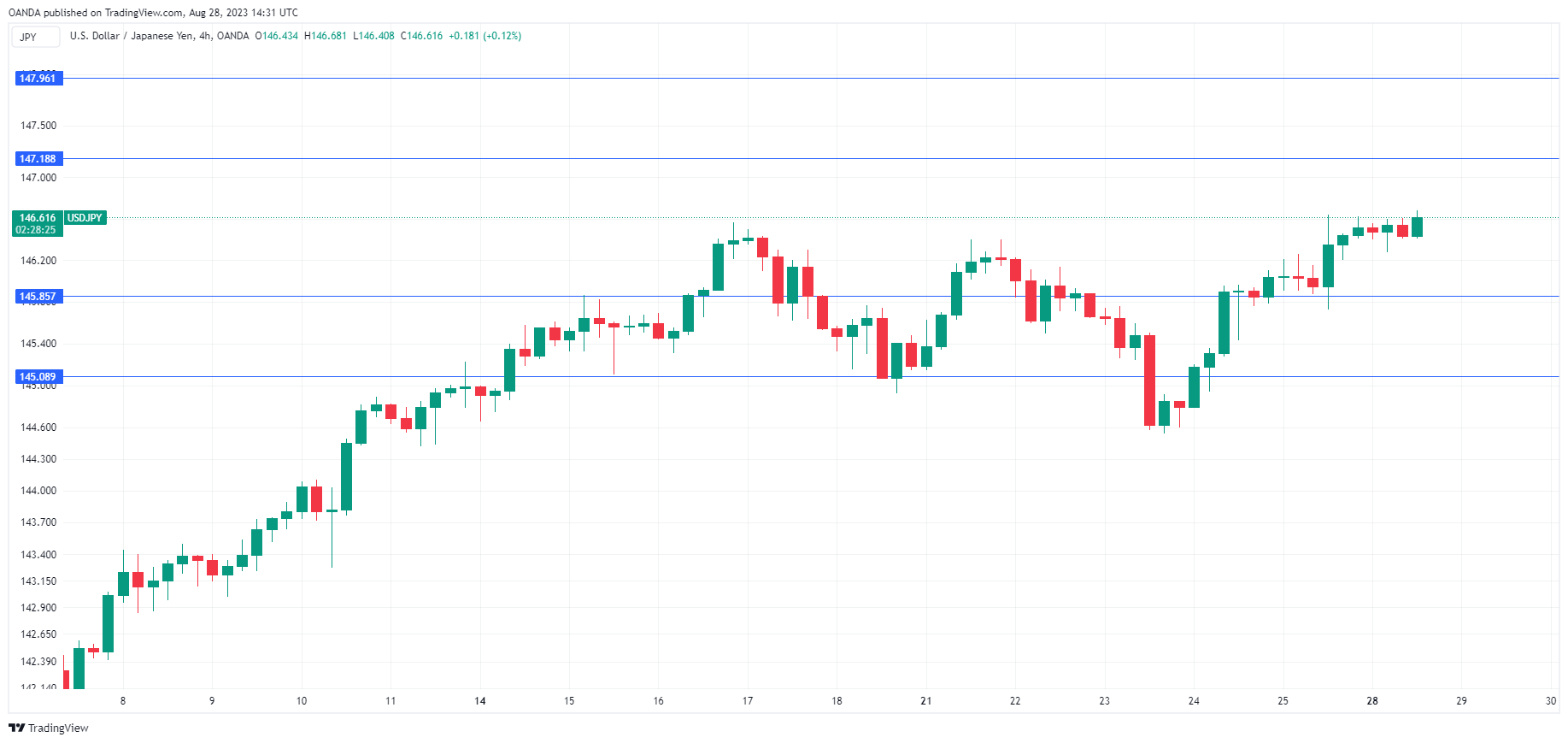

USD/JPY Technical

- There is resistance at 147.19 and 147.95

- 145.86 and 145.10 provide support