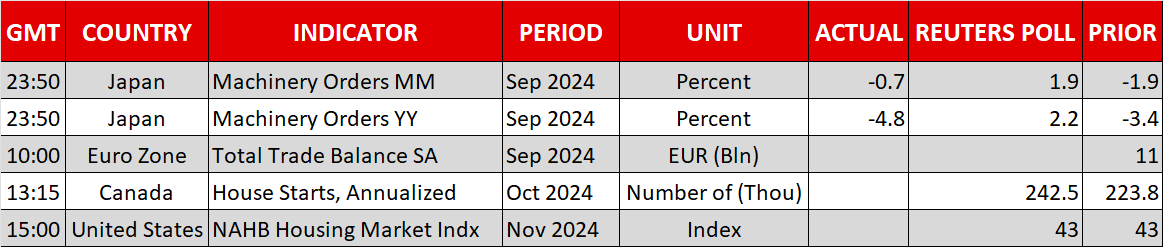

- Gold rebounds as Biden lets Ukraine use long-range missiles on Russia

- Yen slips again after Ueda offers no clues on December hike

- Equities mixed as Trump trade fades

Ukraine war escalates as Biden U-turns on missiles

The conflict between Ukraine and Russia took a dangerous turn on Sunday after President Biden gave Kyiv the green light to use long-range US missiles inside Russia. Biden had long resisted the move as Russia had warned it would consider such action as an act of war by NATO.

The decision comes after Moscow stepped up its attacks on Ukrainian power plants just as temperatures have started to plummet. But the timing is nevertheless questionable as Biden has just two months left in office before Donald Trump is inaugurated as the next president of the United States.

The possibility of Trump potentially reversing Biden’s decision or de-escalating the conflict one way or another might explain why the response in oil markets has been muted. Even if Ukraine decides to target Russia’s oil facilities with long-range missiles, investors don’t seem to be anticipating a huge hit to supply.

However, this is still a significant development for all parties involved and it comes at a time when the US and its allies are struggling to contain the situation in the Middle East.

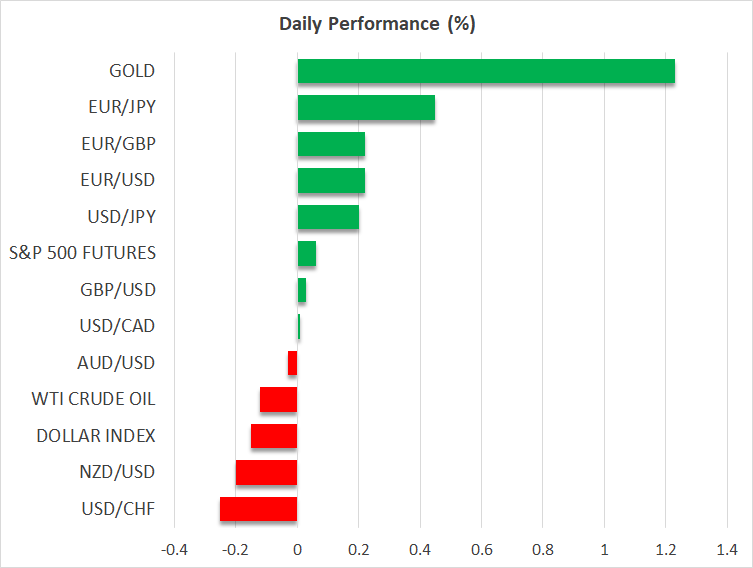

Hence, gold is rallying on Monday on the back of the geopolitical risks, gaining about 1% as it recovers from a two-week slump.

US Dollar could be entering a neutral phase

But neither the US dollar nor the Japanese yen was able to attract much buying interest, with gold being the primary beneficiary of the safe-haven flows for the time being.

US Treasury yields appear to be peaking as the Trump-fuelled rally starts to abate, so the dollar may struggle to stretch its gains beyond current levels. However, a big downside correction doesn’t seem to be on the cards either as Fed rate cut expectations would have suffered a blow regardless of the outcome of the US election.

Fed chief, Jerome Powell, reinforced the hawkish rhetoric of his colleagues last week by signalling that they are not in a hurry to cut rates amid a still strong economy and inflation not falling as fast as hoped. The continued outperformance of the US economy was underlined by better-than-expected retail sales numbers on Friday.

This week looks set to be a quieter one with only the flash PMIs by S&P Global, as well as more comments from Fed speakers, likely being able to provide the markets with any direction.

Yen dips as Ueda offers no rate hike clues

The yen, on the other hand, wasn’t able to extend Friday’s bounce back as investors were disappointed by BoJ Governor Ueda’s cautious stance. There had been speculation that Ueda might use today’s speech to flag a rate hike at the BoJ’s December 18-19 policy meeting. However, whilst Ueda did not rule anything out and maintained a clear tightening bias, the language on the timing of a hike was as vague as ever.

The yen subsequently weakened to around 155 per dollar.

Nvidia earnings awaited as Trump trade cools

On Wall Street, the major indices reversed a good chunk of their post-election rally last week as higher yields and doubts about Trump’s picks for his cabinet began to weigh on sentiment. E-mini futures are mixed on Monday as are equities globally.

But whilst there’s been a bit of a reality check for the markets in terms of how positive Trump 2.0 can be for US stocks, there’s likely to be some profit-taking as well as caution setting in before Nvidia’s (NASDAQ:NVDA) earnings on Wednesday.