- BoJ announces JGB purchases

- Japanese yen’s slide continues

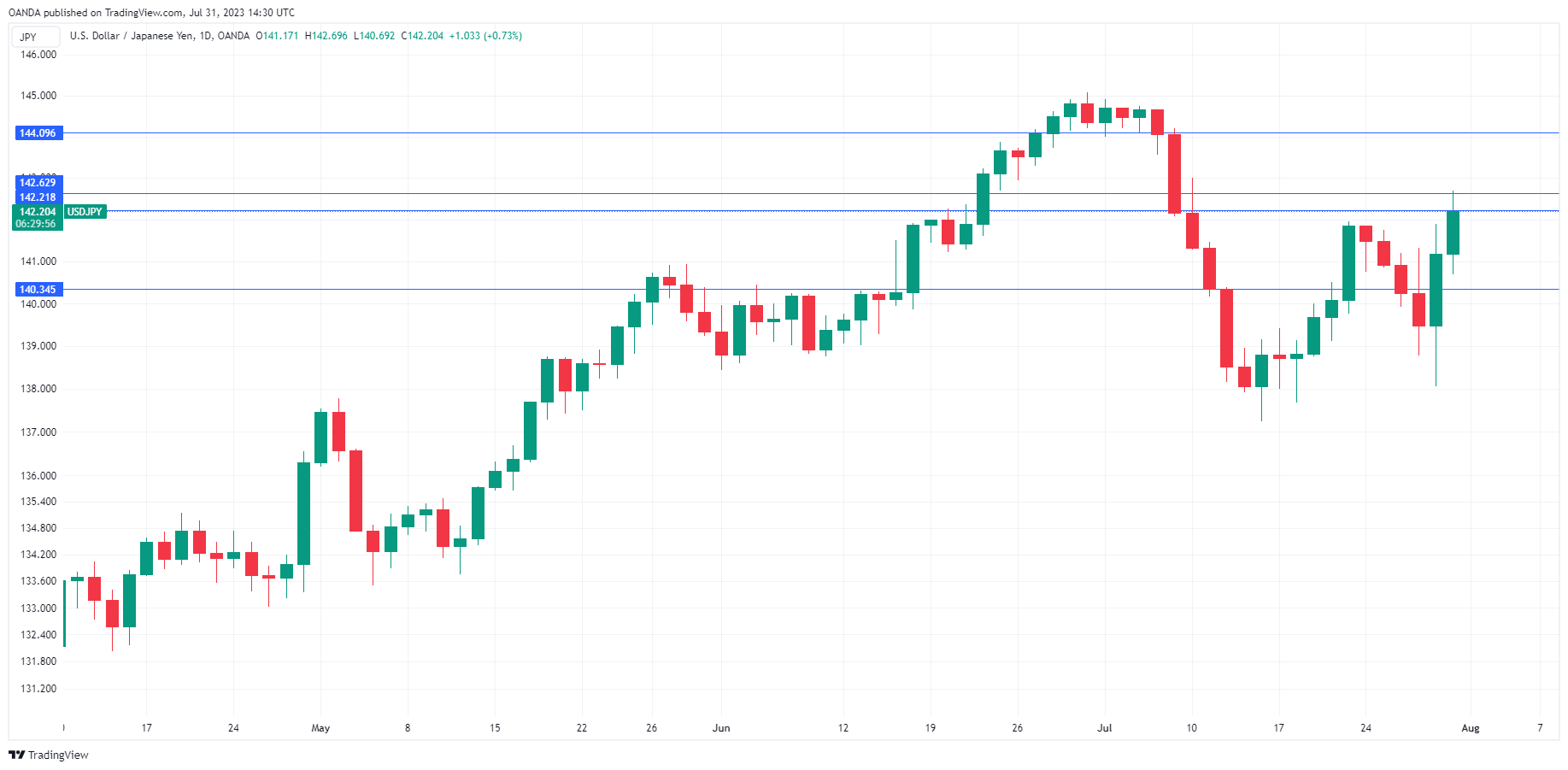

The Japanese yen has extended its slide on Monday and is trading at 142.22, down 0.75% against the US dollar.

BoJ surprises with JGB purchases

The Japanese yen continues to show sharp volatility, which can be attributed directly to moves by the Bank of Japan. On Friday, the BoJ caught the markets by surprise and loosened its yield curve control policy. The BoJ maintained its target for 10-year yields at around zero, but said that the 0.5% ceiling would be a reference point rather than a rigid limit and that it would offer to buy 10-year government bonds at 1%. Effectively, this widens the target band on 10-year bonds by a further 50 basis points.

The BoJ’s easing of yield curve control (YCC) raised speculation that the central bank could shift ultra-accommodative policy and this caused the yen to decline by 1.2% on Friday. Earlier on Monday, the BoJ announced it would buy an unlimited amount of JGBs. The BoJ did not wait for JGBs to hit 1% and decided to intervene in the bond market. The Bank’s intervention was a surprise and extended the yen’s losses, which have amounted to 2% since Thursday.

Governor Ueda tried to downplay the tweaking of yield curve control, saying that it did not mark a normalization of policy. Nevertheless, the move was significant, as the BoJ has diluted its yield cap of 0.50%, which it has heavily defended in the past.

In the US, the manufacturing sector remains in recession and has not shown expansion since October. Manufacturing PMI fell to 46.0 in June its worst showing since May 2020. The July Manufacturing PMI will be released on Tuesday, with a consensus of 46.8 points.

USD/JPY Technical

- USD/JPY is testing resistance at 1.4263. Above, there is resistance at 144.09

- There is support at 142.21 and 1.4035