- BoJ steps in to preserve yield target as US 10-year jumps to 2.55%, dollar/yen shoots up

- Equities mixed as tepid optimism for Russia-Ukraine talks overshadowed by recession fears

- Oil prices slip again as China locks down Shanghai amid virus spike

Yen goes back into freefall as BoJ defends yield ceiling

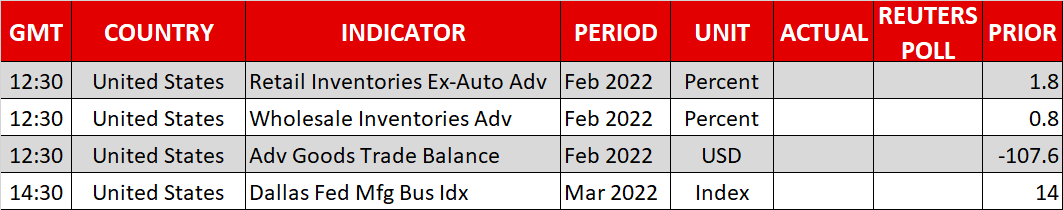

After a short-lived bounce-back, the Japanese yen resumed its freefall in currency markets on Monday, sinking against all of its major peers. The latest nosedive came after the Bank of Japan offered to buy unlimited amounts of five- to 10-year Japanese government bonds, capping the 10-year yield precisely at the upper target of 0.25% of its yield curve control band.

The BoJ’s absence from the bond market raised eyebrows on Friday when the 10-year yield reached 0.24%. However, its late intervention wasn’t exactly met with enthusiasm as its first offer attracted no bids and the Bank was forced to make a second offer, underlining how liquidity in Japan’s bond market has dried up after years of quantitative easing.

With other central banks on a sure path to normalize policy amid burgeoning inflation around the world, the yen has little support right now. Even its safe-haven status has come under doubt as soaring energy and commodity prices have pushed Japan’s current account balance into deficit.

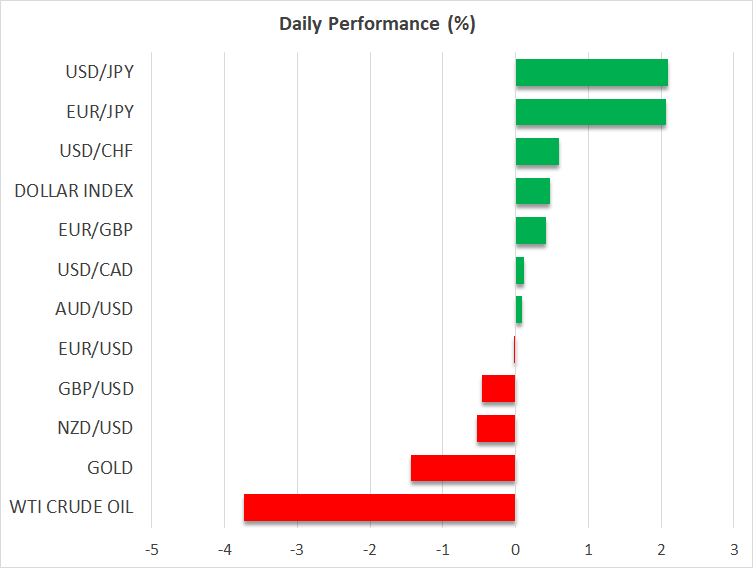

The US dollar is scaling fresh highs today, hitting the 124-yen level for the first time since August 2015. The yen has also slumped against the commodity-linked currencies that are benefiting from the war-fuelled rally in commodity prices. The Australian, Canadian and New Zealand dollars have all risen to 6½-year highs against the yen, while the euro and pound have made impressive gains too.

Fed rate hike bets go into overdrive

Meanwhile, the greenback is headed back up towards its two-year peak from earlier this month against a basket of currencies as rate hike bets have been heating up since the March FOMC decision two weeks ago. After several Fed officials, including Chair Powell himself, came out in support for a 50-basis-point rate hike at the next meeting over the past week, futures markets are now pricing at least eight and a half 25-bps rate increases for the rest of the year.

The hawkish soundbites at the Bank of Canada have also been getting louder lately, helping the loonie climb to two-month highs versus its US counterpart.

The euro and pound on the other hand have been struggling against the dollar as investors are sceptical how much the ECB and Bank of England will be able to tighten given that the inflation squeeze on consumers, as well as the hit to businesses from the sanctions on Russia, are expected to be much bigger in Europe.

However, the US economy isn’t free of recession risks either. A key part of the US yield curve has inverted today, with the 5-year Treasury yield rising above the 30-year one. The March jobs report due on Friday is unlikely to reflect any impact of tightening monetary policy just yet, whereas the ISM PMIs and core PCE price index also coming up this week will probably put the spotlight on inflationary pressures again.

Hopes of talks progress keeps stocks afloat as higher yields start to hurt

But the latest jump in yields hasn’t proven to be too much of a headwind for equities as stock markets globally have mostly recovered from the selloff that was sparked by Russia’s invasion of Ukraine.

That could change, though, if the rally in government bond yields doesn’t slow down. US stock futures are pointing to a subdued start to the trading week as the 10-year Treasury yield crosses the 2.5% mark. European stocks are looking more upbeat, however, likely buoyed by the cautious optimism around the next round of ceasefire talks between Russia and Ukraine that’s due to take place in Turkey on Tuesday.

Ukrainian President Volodymyr Zelensky has once again indicated that he is willing to discuss neutrality to reach a peace deal, while Russia’s declaration that “phase one” of its “military operation” is over and will focus its offensives in eastern Ukraine was seen as another confirmation by some that the invasion wasn’t going according to plan.

Oil under pressure again as Shanghai locked down

In Asia, however, China’s benchmark CSI-300 index ended the day 0.6% lower after authorities placed Shanghai in a nine-day lockdown. The two-phase lockdown was ordered to contain a fresh spike in Covid-19 cases and to allow health officials to carry out mass testing.

Tesla (NASDAQ:TSLA), which operates a factory in the city, has halted production for four days, highlighting how the pandemic continues to cause disruption to manufacturers and supply chains.

Oil prices tumbled by almost 4% on the news, while reports that the US is considering releasing more of its Strategic Petroleum Reserves also weighed on the commodity.

Conflicting signals on the state of the Iran nuclear talks may be providing some support, however, and so are expectations that OPEC will not boost supply more than it has already pledged when it meets on Thursday.