Yesterday's preliminary GDP shocked the market and rightfully so. Japanese Preliminary GDP q/q fell to -0.4%, this was a shock to the market and apparently was the case of inventory write downs. Either way the yen certainly went through a strong patch of volatility as a result and at one point was down to 115.444. It would seem that the market has experienced heavy selling pressure, but the bulls have grabbed it by the horns and pushed it up higher.

Why is that?

There are a number of reasons anyone could actually point to, but the main reason is Abenomics. It’s what has got the Yen so fired up in the long run on the charts – devlaution wise that is. Abenomics has brought about massive changes to the Yen and the Japanse economy. After a decade of slow growth and weak leaders, Shinzo Abe finally seized power back in the government and has since gone on to make his mark on the economy.

The months ahead and the weak result is likely to lead to a snap election, and with a snap election it will cement Abenomics for another 4 years. What we can expect from this is more of the same aggressive fiscal policy, and many are now betting that there will be a delay in a further sales tax rise which in turn could lead to further devaluation of the Yen.

When you couple this all together with the recent comments from Kuroda from the Bank of Japan. You get a perfect storm for further devaluations in the Yen, especially with the open end policy of the BoJ.

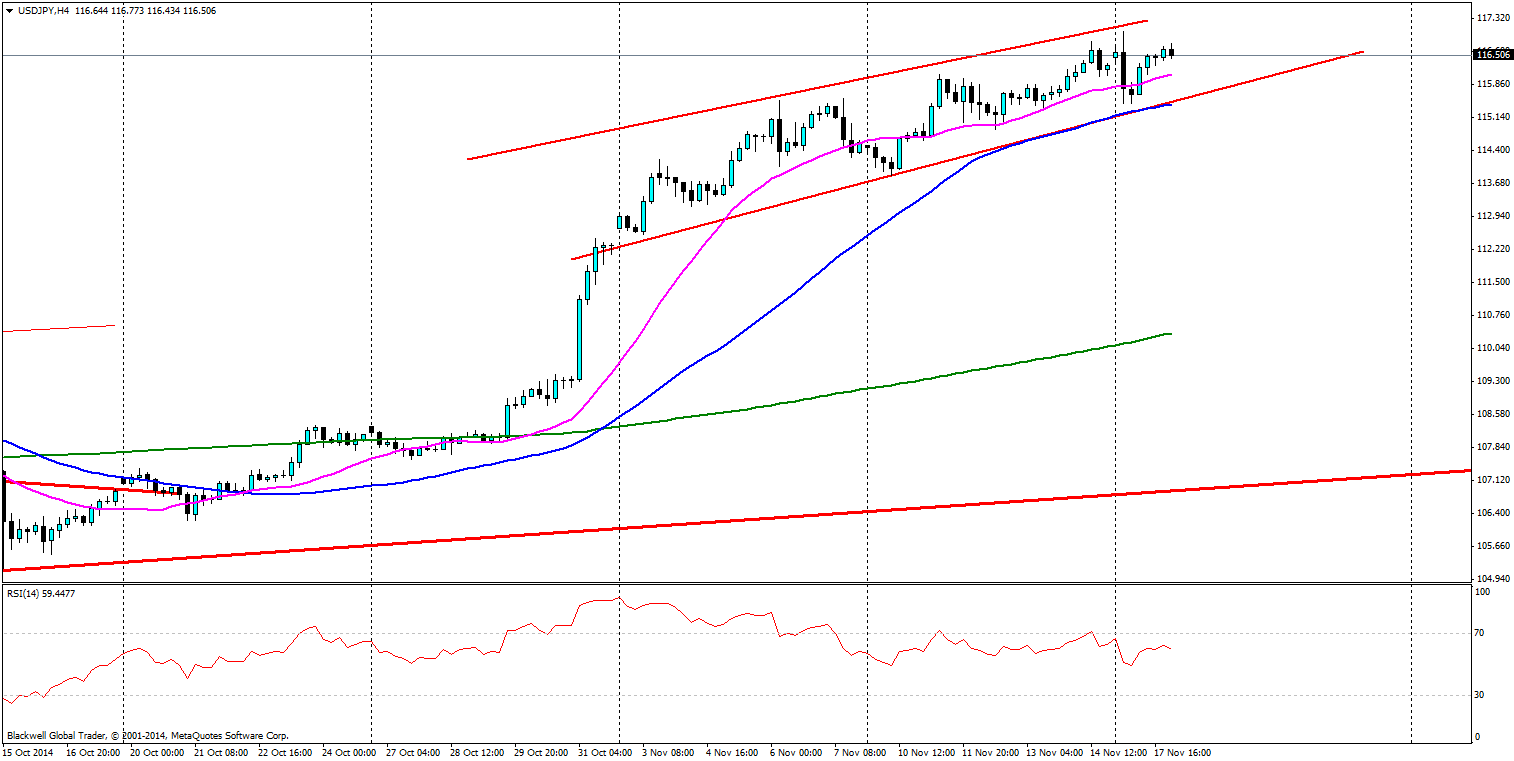

Currently after the astonishing rise of the USD against the Yen we’ve been stuck in a channel which has remained quite strong. It’s likely traders will look to play of this channel in the short to medium term as the market aims higher.

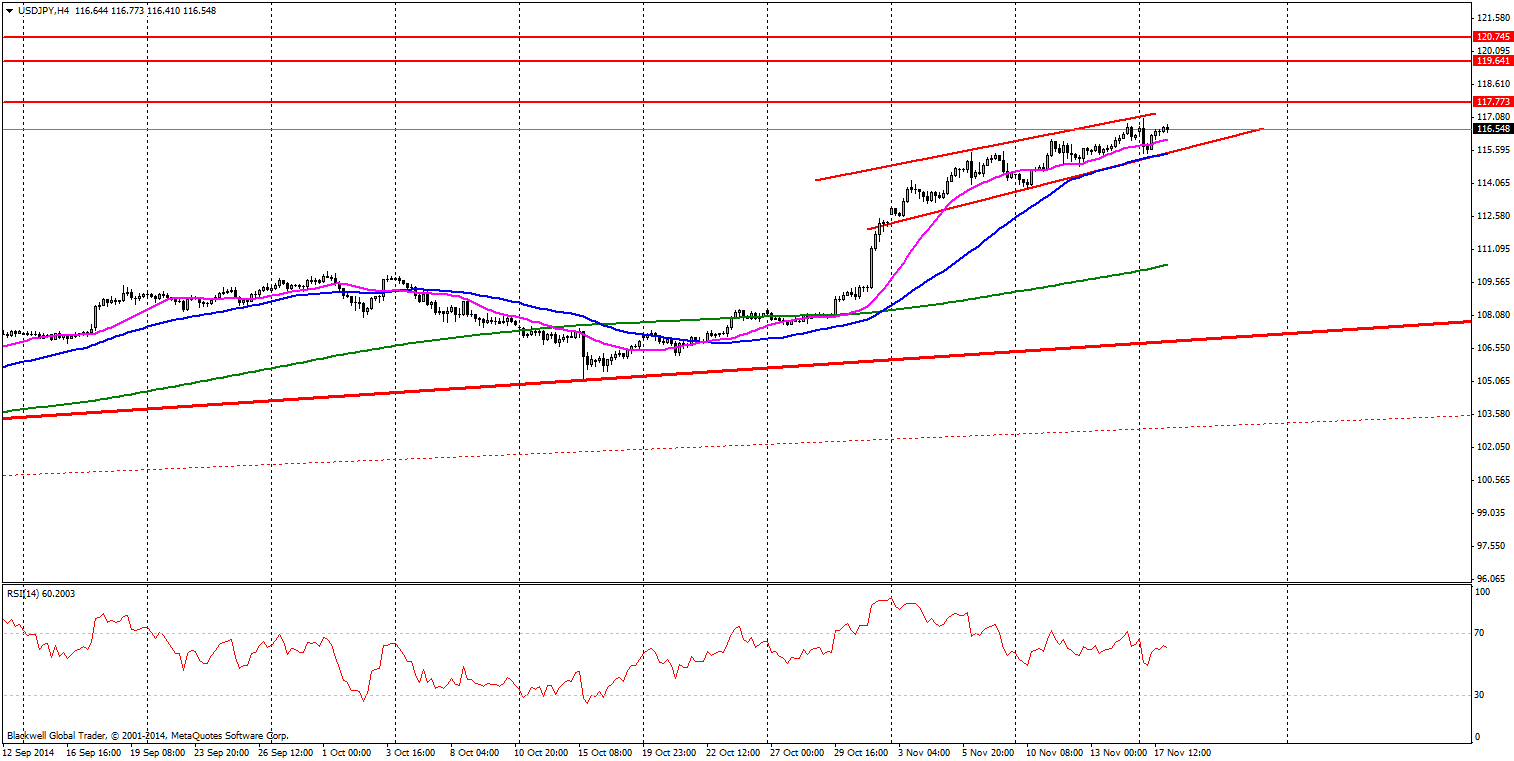

A quick glance at the daily chart shows us potential levels to aim for

Currently the nearest level of resistance is at 117.773 and it would not surprise me to see a push up to this level in the long run. Markets will be gunning for some sort of resistance in this uncharted territory, this point may see some massive profit taking and we may see some strong pinbar action on this level.

The next levels higher are 119.641 and 120.745, now these levels are a fair bit higher, but the markets are priced in till at least 119.641 in the long with the advent of more Abenomics. So it’s very much likely that after the 117.773 level fails we see a run for 119.641, and any breakthrough of 119.641 should probably look for a pause around the 120.745 level, as it represents a critical level.

Overall, price action and technicals are playing out nicely as the fundamental aspects of the Yen help drive it higher on the USD/JPY charts.