The yen saw significant gains against both the euro and US dollar throughout yesterday's trading session, after the Bank of Japan announced that their measures to increase inflation were not quite as strong as forecasted. Meanwhile, crude oil saw gains following better than expected German news which led to risk taking in the marketplace. Today, the main piece of economic news is likely to be the British Claimant Count Change at 9:30 GMT. A better than expected figure could boost higher-yielding assets during mid-day trading.

Economic News

USD - Dollar Takes Moderate Losses amid Investor Risk Taking

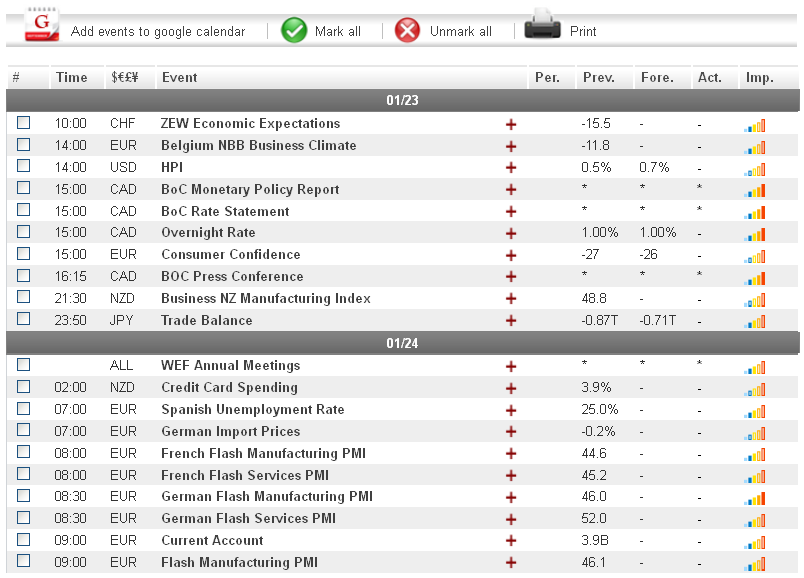

The US dollar took modest losses against several of its higher-yielding currency rivals during European trading yesterday, following a better than expected German ZEW Economic Sentiment figure, which led to risk taking in the marketplace.

The USD/CHF lost more than 40 pips during mid-day trading, eventually reaching as low as 0.9274, before bouncing back to 0.9300 later in the day. The GBP/USD advanced close to 60 pips after the German data was released. The pair traded as high as 1.5879 before dropping back to 1.5855.

Today, a lack of significant news out of the US means that any dollar fluctuations are likely to come as a result of international indicators. The British Claimant Count Change could lead to additional losses for the greenback if it comes in above the forecasted 0.3K. Additionally, the dollar could take losses against the CAD if the Bank of Canada voices optimism regarding the future of the Canadian economy at the BOC Press Conference, scheduled for 16:15 GMT.

EUR - Euro Reverses Gains vs. USD

A significantly better than expected German ZEW Economic Sentiment figure helped the euro gain more than 70 pips against the US dollar during morning trading yesterday. That being said, the common-currency was not able to maintain its bullish trend, and began falling shortly after the news was released. The EUR/USD dropped from a peak of 1.3366 to 1.3296 by the end of the European session. Against the British pound, the euro fell some 50 pips during mid-day trading to eventually reach as low as 0.8380.

Any significant euro movements today are likely to come as a result of the British Claimant Count Change and MPC Meeting Minutes, both scheduled to be released at 9:30 GMT. Analysts are forecasting the Claimant Count Change to indicate a worsening employment situation in the UK, which if true, may generate risk aversion among investors and cause the euro to extend yesterday's losses. Furthermore, if the MPC Meeting Minutes signal any kind of economic slowdown in England, riskier currencies like the euro may turn bearish.

JPY - BOJ Decision Turns Yen Bullish

The Japanese yen saw major gains against both the US dollar and euro yesterday, after the Bank of Japan announced that the steps it will be taking to increase inflation turned out to not be as aggressive as originally forecasted. The USD/JPY fell more than 150 pips during Asian and early morning trading, eventually reaching as low as 88.35. The EUR/JPY lost more than 240 pips during the same time period to trade as low as 117.31.

Turning to today, yen traders will want to pay attention to British employment data and its impact on risk taking in the marketplace. If unemployment in the UK increased last month, investors may shift their funds to safe-haven assets, which would give the JPY an additional boost.

Crude Oil - US Inventories Data Set to Impact Crude Prices Today

The price of crude oil gained close to $0.80 a barrel during European trading yesterday, after positive German economic sentiment data led to risk taking in the marketplace. The commodity traded as high as $96.41 during the mid-day session, before a downward correction brought prices to the $96.05 level.

Today, oil traders will want to pay attention to the US Crude Oil Inventories figure, scheduled to be released at 15:30 GMT. Following last week's lower than expected figure, crude oil prices saw a significant boost. If today's news once again comes in below the expected figure, it will likely be taken as evidence that demand for oil in the US is increasing, which would help the commodity remain bullish.

Technical News

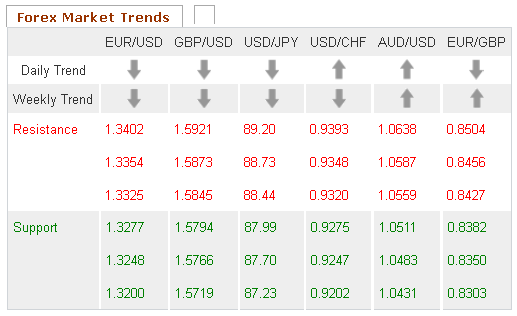

EUR/USD

A bearish cross has formed on the daily chart's MACD/OsMA, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the weekly chart, which is currently in overbought territory. Opening short positions may be the smart choice for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has crossed into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the Slow Stochastic on the daily chart has formed a bullish cross. Traders may want to open long positions for this pair.

USD/JPY

The Relative Strength Index on the weekly chart has crossed into overbought territory, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which has formed a bearish cross. Opening short positions may be the wise choice for this pair.

USD/CHF

While the MACD/OsMA on the weekly chart has formed a bullish cross, most other long-term technical indicators show this pair trading in neutral territory. Traders may want to take a wait and see approach for this pair, as a clearer trend may present itself in the coming days.

The Wild Card

USD/ZAR

The Slow Stochastic on the daily chart has formed a bearish cross, signaling that a downward correction could occur in the near future. Additionally, the Relative Strength Index on the same chart is approaching the overbought zone. This may be a good time for forex traders to open short positions ahead of possible downward movement.

Economic News

USD - Dollar Takes Moderate Losses amid Investor Risk Taking

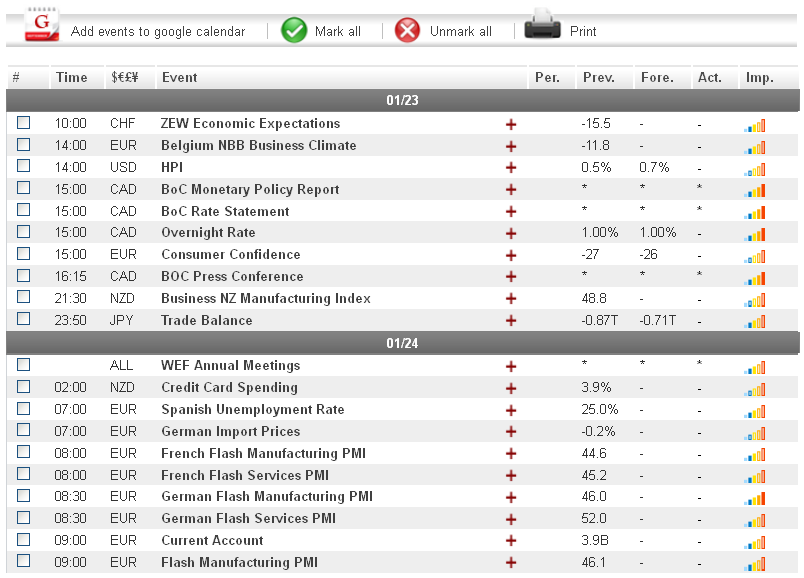

The US dollar took modest losses against several of its higher-yielding currency rivals during European trading yesterday, following a better than expected German ZEW Economic Sentiment figure, which led to risk taking in the marketplace.

The USD/CHF lost more than 40 pips during mid-day trading, eventually reaching as low as 0.9274, before bouncing back to 0.9300 later in the day. The GBP/USD advanced close to 60 pips after the German data was released. The pair traded as high as 1.5879 before dropping back to 1.5855.

Today, a lack of significant news out of the US means that any dollar fluctuations are likely to come as a result of international indicators. The British Claimant Count Change could lead to additional losses for the greenback if it comes in above the forecasted 0.3K. Additionally, the dollar could take losses against the CAD if the Bank of Canada voices optimism regarding the future of the Canadian economy at the BOC Press Conference, scheduled for 16:15 GMT.

EUR - Euro Reverses Gains vs. USD

A significantly better than expected German ZEW Economic Sentiment figure helped the euro gain more than 70 pips against the US dollar during morning trading yesterday. That being said, the common-currency was not able to maintain its bullish trend, and began falling shortly after the news was released. The EUR/USD dropped from a peak of 1.3366 to 1.3296 by the end of the European session. Against the British pound, the euro fell some 50 pips during mid-day trading to eventually reach as low as 0.8380.

Any significant euro movements today are likely to come as a result of the British Claimant Count Change and MPC Meeting Minutes, both scheduled to be released at 9:30 GMT. Analysts are forecasting the Claimant Count Change to indicate a worsening employment situation in the UK, which if true, may generate risk aversion among investors and cause the euro to extend yesterday's losses. Furthermore, if the MPC Meeting Minutes signal any kind of economic slowdown in England, riskier currencies like the euro may turn bearish.

JPY - BOJ Decision Turns Yen Bullish

The Japanese yen saw major gains against both the US dollar and euro yesterday, after the Bank of Japan announced that the steps it will be taking to increase inflation turned out to not be as aggressive as originally forecasted. The USD/JPY fell more than 150 pips during Asian and early morning trading, eventually reaching as low as 88.35. The EUR/JPY lost more than 240 pips during the same time period to trade as low as 117.31.

Turning to today, yen traders will want to pay attention to British employment data and its impact on risk taking in the marketplace. If unemployment in the UK increased last month, investors may shift their funds to safe-haven assets, which would give the JPY an additional boost.

Crude Oil - US Inventories Data Set to Impact Crude Prices Today

The price of crude oil gained close to $0.80 a barrel during European trading yesterday, after positive German economic sentiment data led to risk taking in the marketplace. The commodity traded as high as $96.41 during the mid-day session, before a downward correction brought prices to the $96.05 level.

Today, oil traders will want to pay attention to the US Crude Oil Inventories figure, scheduled to be released at 15:30 GMT. Following last week's lower than expected figure, crude oil prices saw a significant boost. If today's news once again comes in below the expected figure, it will likely be taken as evidence that demand for oil in the US is increasing, which would help the commodity remain bullish.

Technical News

EUR/USD

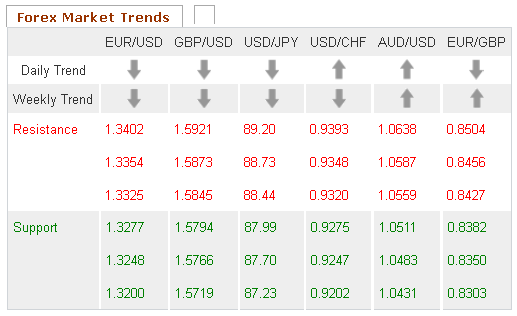

A bearish cross has formed on the daily chart's MACD/OsMA, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the weekly chart, which is currently in overbought territory. Opening short positions may be the smart choice for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has crossed into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the Slow Stochastic on the daily chart has formed a bullish cross. Traders may want to open long positions for this pair.

USD/JPY

The Relative Strength Index on the weekly chart has crossed into overbought territory, indicating that a downward correction could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which has formed a bearish cross. Opening short positions may be the wise choice for this pair.

USD/CHF

While the MACD/OsMA on the weekly chart has formed a bullish cross, most other long-term technical indicators show this pair trading in neutral territory. Traders may want to take a wait and see approach for this pair, as a clearer trend may present itself in the coming days.

The Wild Card

USD/ZAR

The Slow Stochastic on the daily chart has formed a bearish cross, signaling that a downward correction could occur in the near future. Additionally, the Relative Strength Index on the same chart is approaching the overbought zone. This may be a good time for forex traders to open short positions ahead of possible downward movement.