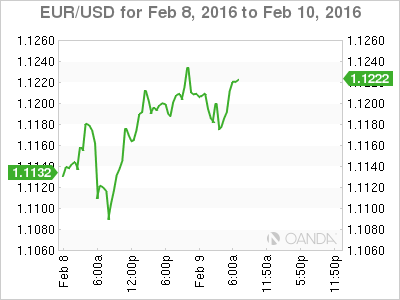

Global growth fears have fixed income dealers looking for clues on the FOMC’s policy trajectory. Currently, the market is unwinding bets that the Fed would tighten rates further this year. Softer U.S economic data continues to raise speculation that the pace of future Fed rate increases would be much slower than what Ms. Yellen and company currently perceives.

The Fed Chair will be key this week – she is due to testify Wednesday on the Semiannual Monetary Policy Report before the House Financial Services Committee, in Washington. Dollar bulls will be looking for some support, but will they get it? Her testimony usually comes in two parts: first she reads a prepared statement, and then the committee will hold a Q&A session. These unscripted answers can lead to heavy market volatility.

European and US equity markets have started this week under renewed pressure as a multiple of factors again slam risk assets.

1. The Greek crisis has returned to headlines over recent days, providing a familiar source of deep uncertainty for European markets.

• Athens stock exchange fell -9% yesterday, dropping to its lowest level since 1990, for its fifth consecutive day of losses.

• Talks between Greece/IMF and European creditors ended on Feb. 5th with all major issues still open.

• More pension cuts were at issue, the government’s budget gap for 2016 was too large and the creditors said the government was not presenting a credible strategy to close the gap.

2. Bank selloff gains momentum, fanning contagion fears

• Talk of widening credit default swap (CDS) spreads and new signs of elevated credit risks are sending European banking assets lower.

• Widening sovereign bond spreads in peripheral Europe is only exacerbating market concerns of potential contagion within the credit markets.

• Yesterday, European bourses closed near session lows, down -3%+ across the board and with big declines in the banking sector.

With such market uncertainty, risk aversion trading remains investors most dominant play. Core European and U.S Treasury markets have surged on the backs of safe haven flows. Despite much of Asia remaining closed for Lunar New Year, even Japan’s 10-year JGB yields have fallen below “Zero” on safe-haven flows.

• U.S 10-year dropped to a one-year low below +1.75%

• German 2-year Bunds now have a negative yield of more than -0.5%.

• Gold and silver prices rally another +3% as silver has now joined gold above the 200 day SMA.

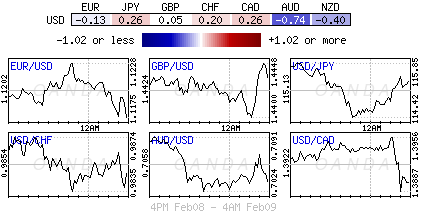

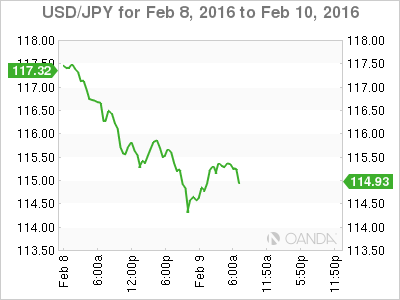

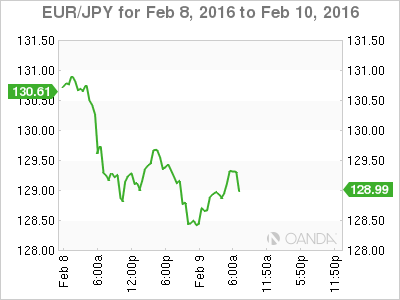

• The Dollar Index again looses ground, led by declines against the yen (¥114.20 low print o/n).

Japan’s Economic Minister Ishihara continues to attribute recent gains in yen to “external factors” while remaining upbeat in the BoJ’s progress being made on the rate of inflation. He stated that the recent decision by the BoJ (NIRP) shows their determination to end deflation. He believes that the decline in interest rates will eventually lead to a rise in capital expenditure (CAPEX), but like most things, this requires time.

The BoJ’s decision to embrace NIRP recently seems to have backfired on Governor Kuroda. For many, yen is the problem trade at the moment – the market was short it, and after the BoJ rate cut got themselves a good bit shorter. But, with the market pricing out some of the Fed’s tightening (2 hikes vs. 4) coupled with the current market financial stress has led to more risk aversion – more yen buying. Dealers are getting apprehensive; if yen continues to straighten they will be expecting the BoJ to be proactive to protect their currency. Separate comments from Finance Minister Aso overnight suggest that the government is still paying close attention to FX rates, calling recent moves “volatile.”

Japanese Ministers are not the only ones “jawboning’ their own currencies. Swiss National Bank (SNB) President Jordan again reiterated that the CHF currency ($0.9807) was overvalued. Jordan indicated that they are “not” yet at rock bottom regarding the deposit rate (currently at -0.75%). The length of time under negative interest rates will depend on the global economy.