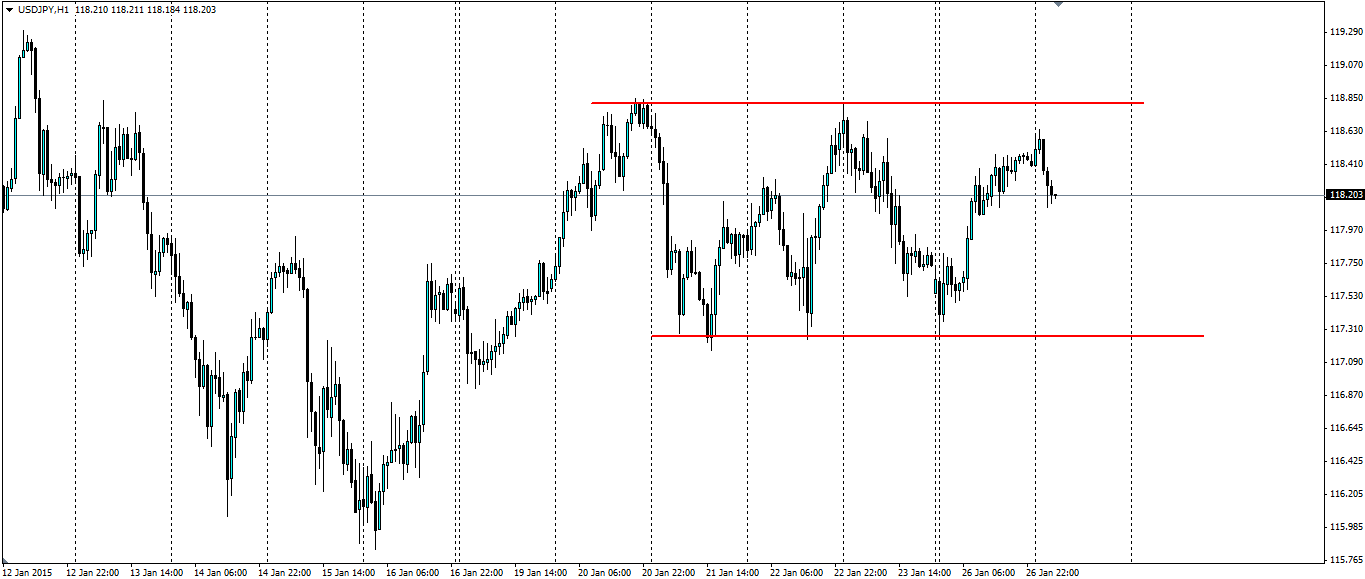

The yen has moved into a strong range with some well tested levels of support and resistance. Another wave downward looks to be forming, suggesting a continuation of the range pattern.

Source: Blackwell Trader

The Yen has been in an out of favour with investors recently as the chaos in the European currency markets has led to demand for the safety of the Yen. At the same time further weakening of the Yen in the future is expected as the central bank tries to kick-start the economy and boost inflation by releasing stimulus. The effect is a seesawing of prices into what is the current range between 117.20 and 118.80.

Further adding to the ranging pressure is the contrast in data and expectations. Last week the Bank of Japan reduced their expectations for inflation for the year to April 2016 from 1.7% to 1.0%. This contrasts with the CSPI y/y released earlier today which did not fall as the market had expected, rather it remained steady at 3.6%.

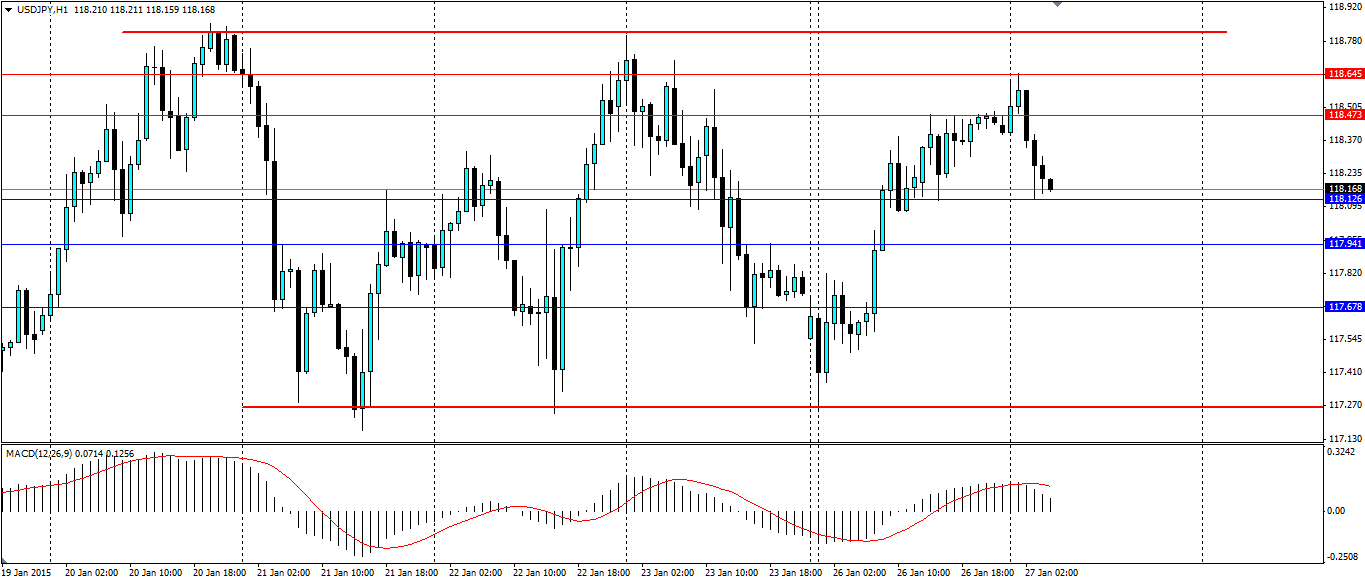

Already we have seen the USD/JPY pair look to turn back towards the lower end of the range, despite not reaching the previous highs. This suggests the market was anticipating it and the pair will likely fall to the bottom of the channel. Indeed the MACD indicator looks to be forming a bearish wave.

Source: Blackwell Trader

Look for the price to find support at 118.126, 117.941 and 117.678 on its way towards the bottom of the channel. If we see the current support hold and a movement towards the top of the channel, look for resistance at 118.473, 118.645 and of course the top of the channel at 118.80.