The yen was extremely active towards the end of last week and at the open of this week as the shine begins to wear off the US dollar. Long positions in the USD/JPY pair are being wound up which caused a sharp fall, triggering stop losses along the way. The turmoil in China and on the US stock markets is spurring demand for the safety of the yen, despite some disappointing economic data out of Japan.

The yen smashed through several levels of support as the market dumped long US dollar positions, triggering a stop loss squeeze. The belief that the Fed will not have the data to support a rate rise in September is beginning to take hold. This, combined with the 5%+ swings on the Chinese stock market, a 3% fall in US stocks, and a sharp 7% fall in Middle East stocks on Sunday, sent investors scrambling for the yen's safety.

The data was not entirely favourable for the yen, with the manufacturing PMI at 51.9, missing forecasts of 52.1. JPY all industries activity came in at 0.3%, vs 0.4% exp and the GDP price index took a sharp dive from 3.4% to 1.6%.

The week (and weeks) ahead will be dominated by the market anticipating the Fed's move, right up until the September 17 meeting. Keep an eye on US Core Durable Goods and Consumer Sentiment figures, with any signs of weakness in the US likely to benefit the yen further. Inflation figures will be keenly watched for Japan this week and could trigger another round of stimulus from the BoJ if they come in any weaker than expected.

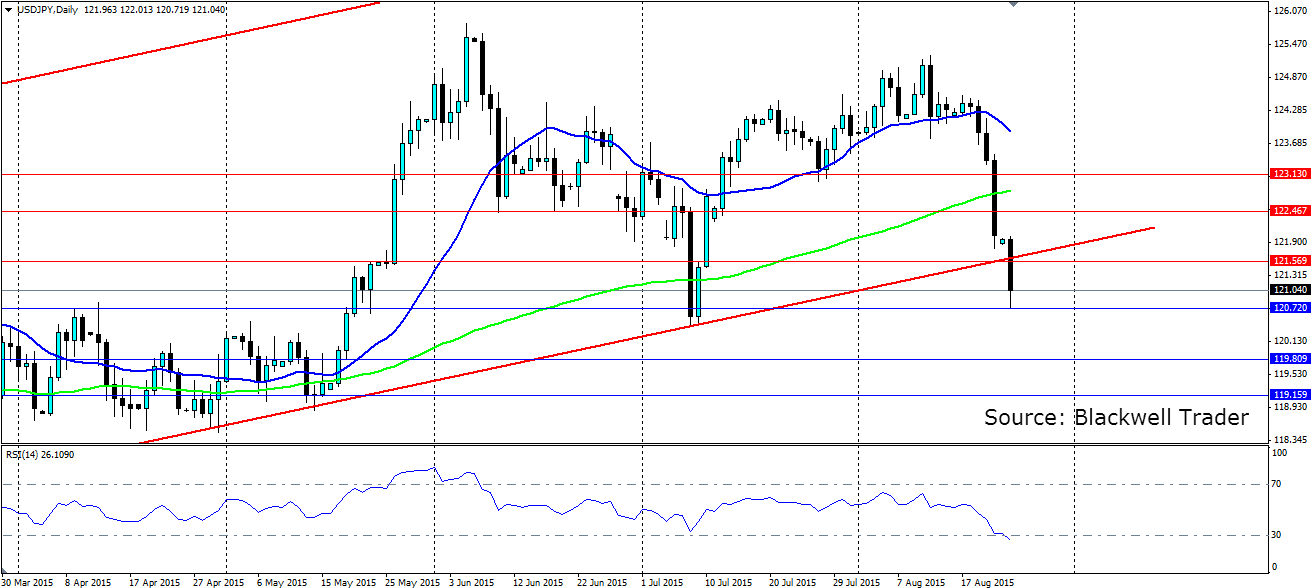

Technicals show the pair smashing through support including the bullish channel after the sharp fall at the end of last week extended into this week. The pair has found support that has acted as a swing point earlier this year and could lead to consolidation, especially as traders look to take profits. The RSI is has shifted into oversold territory on the daily chart, which indicates a consolidation could be on the cards.

We may also see the trend line act as dynamic resistance before another leg lower, as tends to be the case in bearish breakouts. Look for resistance to be found at 121.56, 122.46 and 123.13 while support is found at 120.72, 119.80 and 119.15.