A quick look at the yen ahead of the weekend and Monday’s national holidays in both Japan and China to see which of the yen pairs we follow have performed the strongest this week as positive market sentiment continues to hold despite trade tariff tensions, a variety of geopolitical issues, and for us here in the UK, the shambles that is the Brexit negotiations. And all this against the 10 year anniversary of Lehman’s collapse and the start of the greatest financial crisis since the Great Depression.

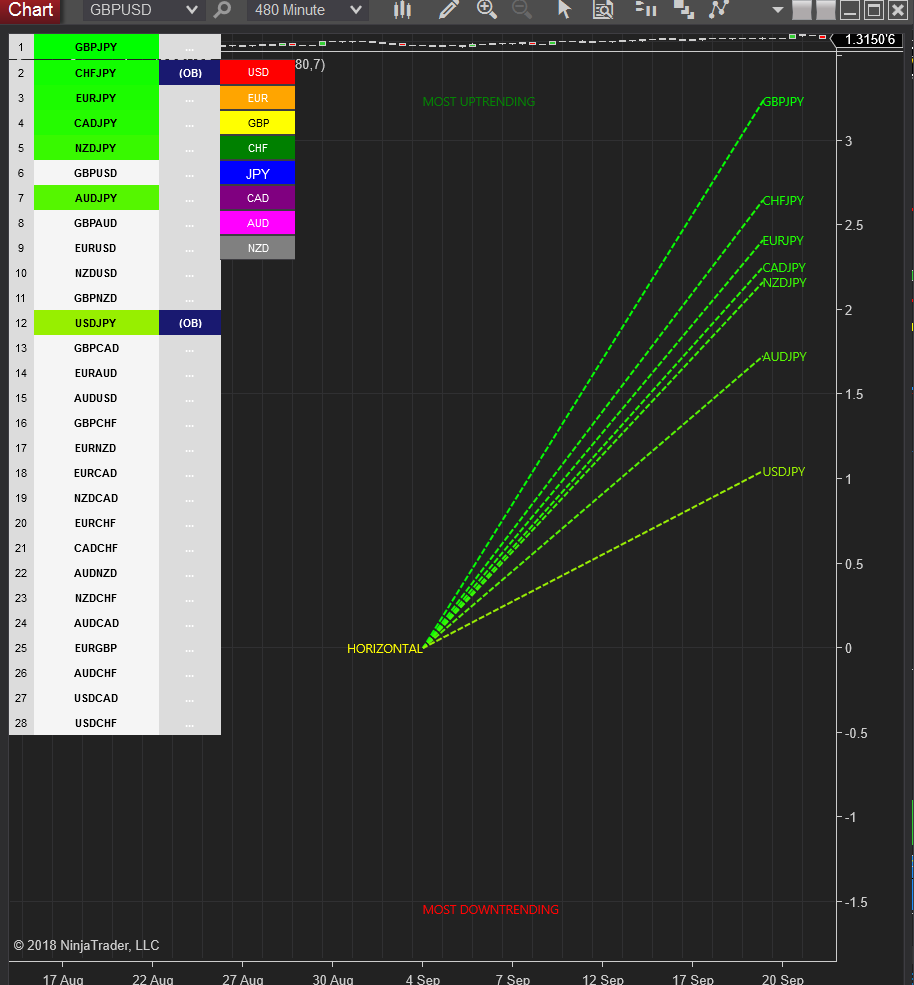

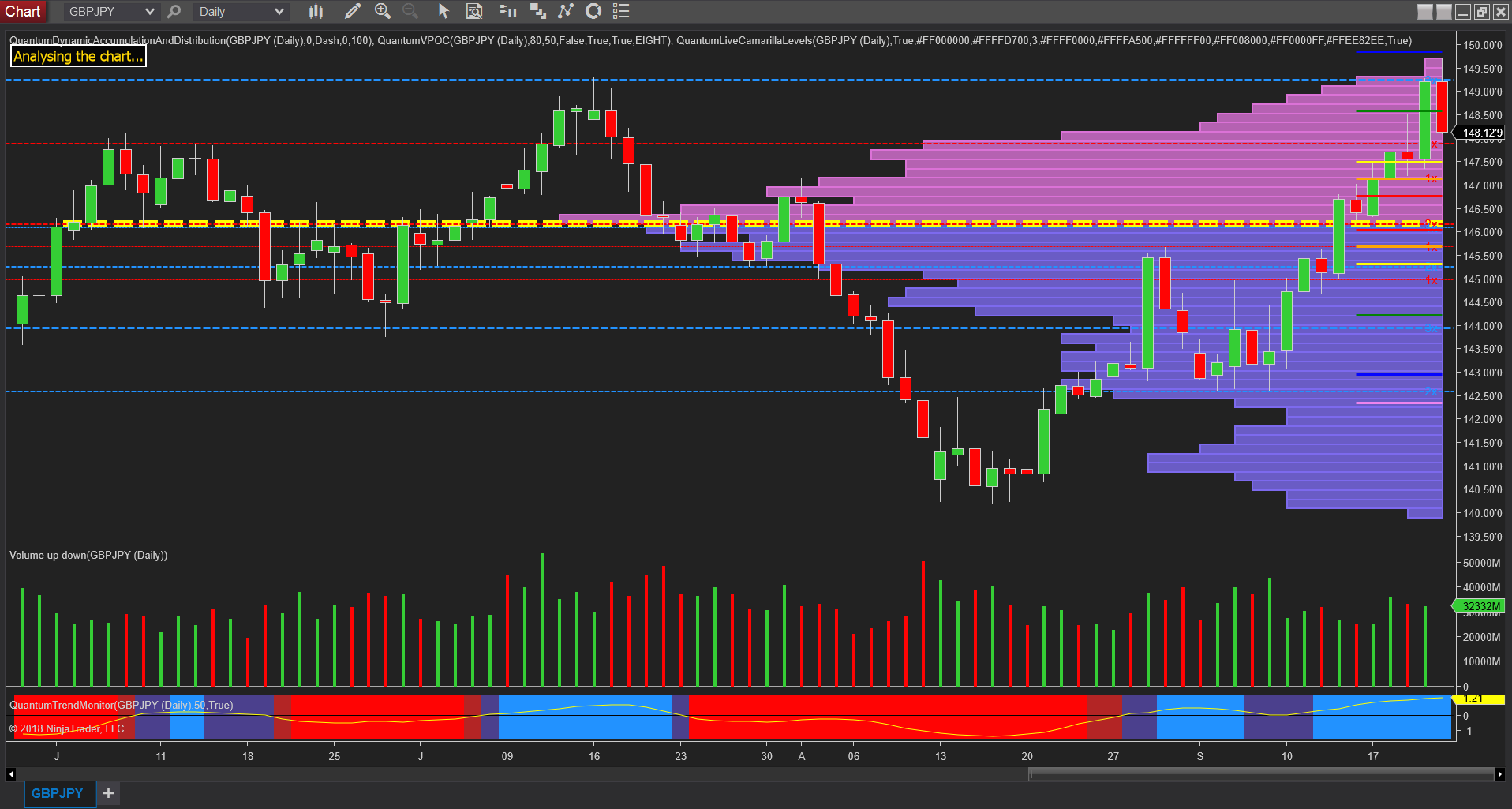

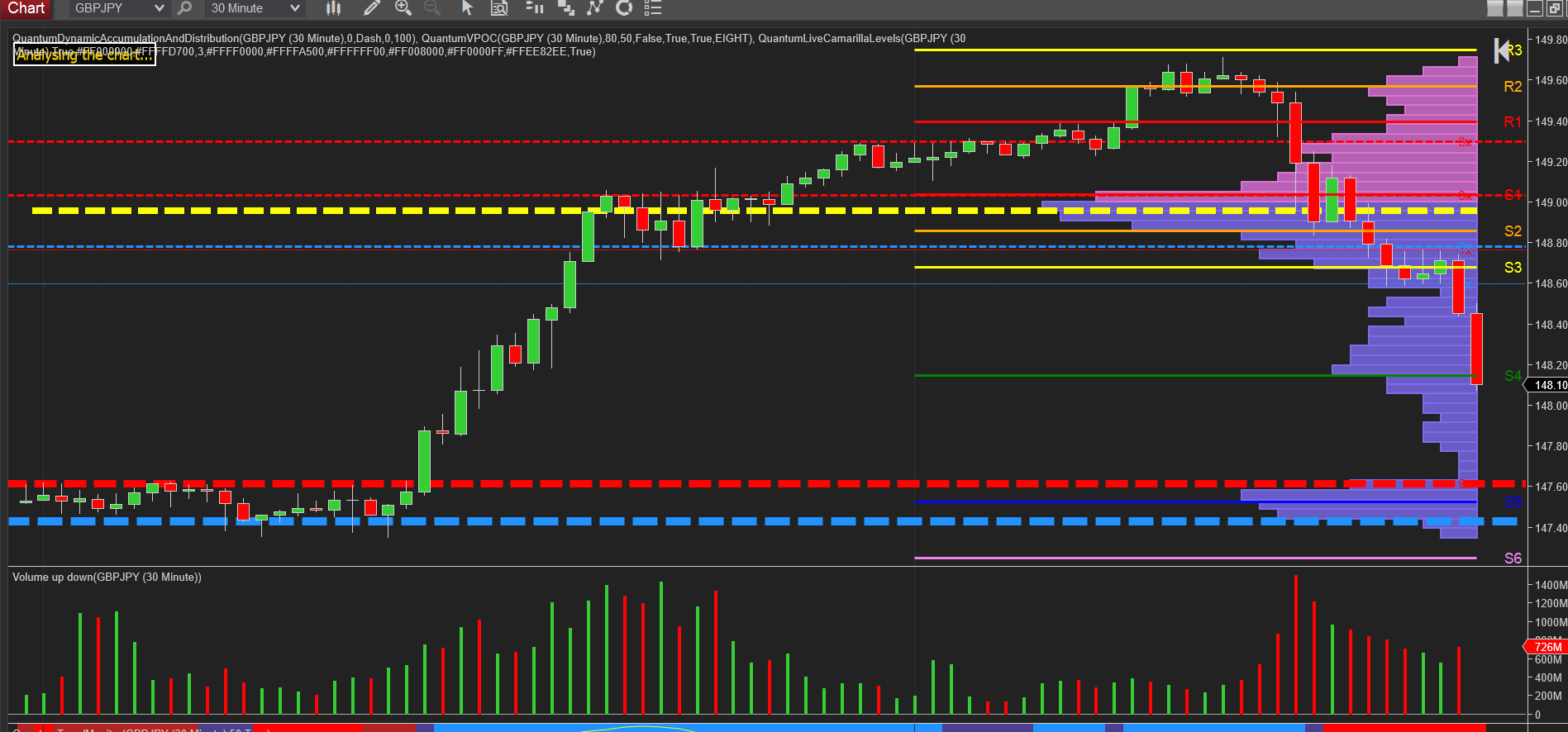

And of the pairs we track, it is perhaps ironic that it is the gbp/jpy that has outperformed its sister pairs, as highlighted by our Quantum Currency Array indicator where the 8 hr chart clearly shows the ranking of the pairs. GBP/JPY has so far been the most bullish but the failure to take out the key 150 level (and Brexit) has resulted in today’s correction back to the 148 region as we wait for NY to open and see if the indices and stocks can continue their strong rally higher.

To the downside for GBP/JPY 148 is the line in the sand and a break here would take the pair back to some strong support at 147.60.

For the other pairs the most laggard has been USD/JPY where the range for the pair is relatively narrow with 112.50 to the downside and 112.80 to the upside, and again sentiment in this afternoon’s US session will dictate direction.

For some of the other pairs here are levels to watch for:

CAD/JPY – 87.10 has proved to be springboard for a move higher following better than expected Canadian core retail sales and first price objective for the pair is 87.45 and thereafter 87.77. And of course with this pair we need to key a close eye on oil and Donald’s latest spat with OPEC.

For EUR/JPY there is strong resistance at 132.80 and and only minor support at 132.40.

AUD/JPY has strong support at 81.50 and resistance at 82.35.