USD/JPY has edged higher in Monday trade. In the North American session, USD/JPY is trading at 113.38, up 0.18% on the day. In Japan, Household Spending declined 0.3%, well of the estimate of +0.7%. Preliminary Industrial Production declined 1.1%, better than the forecast of -1.5%. As expected, the Bank of Japan maintained interest rates at -0.10%. In the US, key indicators were sharp. CB Consumer Confidence jumped to 125.9. well above the forecast of 121.1 points. Chicago PMI improved to 66.2, its highest level since March 2011. On Wednesday, the US releases two key events – ADP Nonfarm Payrolls and ISM Manufacturing PMI. As well, the FOMC will release its monthly rate statement.

It was business as usual from the Bank of Japan, which released its rate statement earlier on Tuesday. The BoJ maintained its commitment to guide interest rates at -0.10% and 10-year bond yields around zero percent. Despite weak inflation and wage growth, there has not been much pressure on the BoJ to change policy, as the Japanese economy has performed well in 2017. GDP expanded at an annualized 2.5 percent in the second quarter, buoyed by solid numbers from the manufacturing and export sectors. Consumer spending has improved, and retail sales in September improved 2.3%, compared to 1.7% a month earlier. Retail sales have risen for 11 consecutive months, as consumers appear more confident in the economy and have opened their purse strings.

The focus is on the Federal Reserve, which releases a rate statement on Wednesday. The Fed is not expected to raise rates, so analysts will be combing through the rate statement, looking for clues about future rate moves. The markets have priced in a December rate hike at whopping 96%, and the markets are focusing on what the Fed has planned for 2018. This will depend, of course, on the new head of the Fed, who will take over from Janet Yellen in February. The two front-runners, John Taylor and Jerome Powell, have very different stances on monetary policy, which has created some suspense ahead of President Trump’s nomination. Trump is expected to choose the new head before departing for Asia at the end of the week. Powell is expected to continue Yellen’s incremental approach to raising rates, while Taylor is a proponent of much higher rates, as underscored in his “Taylor Rule”, which calls for higher rates when inflation is high or the labor market is at full capacity.

USD/JPY Fundamentals

Monday (October 30)

- 19:30 Japanese Household Spending. Estimate +0.7%. Actual -0.3%

- 19:30 Japanese Unemployment Rate. Estimate 2.8%. Actual 2.8%

- 19:50 Japanese Preliminary Industrial Production. Estimate -1.5%. Actual -1.1%

- 23:05 BoJ Outlook Report

- 23:05 BoJ Policy Rate. Estimate -0.10%. Actual -0.10%

- Tentative – BoJ Monetary Policy Statement

Tuesday (October 31)

- 1:00 BoJ Core CPI. Estimate 0.5%. Actual 0.5%

- 1:00 Japanese Housing Starts. Estimate -3.0%. Actual -2.9%

- 2:30 BoJ Press Conference

- 8:30 US Employment Cost Index. Estimate 0.7%. Actual 0.7%

- 9:00 US S&P/CS Composite-20 HPI. Estimate 5.8%. Actual 5.9%

- 9:45 US Chicago PMI. Estimate 60.2. Actual 66.2

- 10:00 US CB Consumer Confidence. Estimate 121.1. Actual 125.9

Wednesday (November 1)

- 8:15 US ADP Nonfarm Employment Change. Estimate 191K

- 10:00 US ISM Manufacturing PMI. Estimate 59.4

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

*All release times are GMT

*Key events are in bold

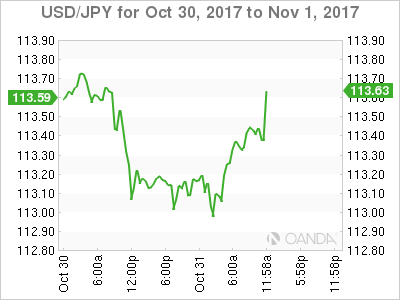

USD/JPY for Tuesday, October 31, 2017

USD/JPY October 31 at 11:30 EDT

Open: 113.18 High: 113.53 Low: 112.96 Close: 113.38

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 110.30 | 111.53 | 112.57 | 113.55 | 114.49 | 115.50 |

USD/JPY showed little movement in the Asian session. The pair edged higher in the European session and is showing little movement in North American trade

- 112.57 is providing support

- 113.55 is under pressure in resistance

Current range: 112.57 to 113.55

Further levels in both directions:

- Below: 112.57, 110.94 and 110.10

- Above: 113.55, 114.49, 115.50 and 116.54

OANDA’s Open Positions Ratios

USD/JPY ratio is unchanged in the Tuesday session. Currently, short positions have a majority (57%), indicative of trader bias towards USD/JPY reversing directions and moving downwards.