When fear strikes in Asia, markets know where to turn, and in nearly all cases, an Asian crisis leads to the buying of the Yen. Japan’s economy is seen as one of the safest in the world, even though it has one of the largest debt to Gross Domestic Product (GDP) ratios as well.

The fear as of late has been China’s current economic position, as its banks start to feel the stress over heavy lending and a lack of liquidity as they are not able to pull capital out of overseas markets to help shore up their positions. In the past, the government has always come to the party to help out lenders in an effort to stimulate the economy. However, after a decade of investment and lending, the economy is starting to feel the pinch as it slows down.

This has been heightened in a series of reports recently on major Chinese regions which has so far led to many speculating that the government will allow a few banks to collapse, as they are deeply affected as of late. Either way, the shadow-banking sector is in trouble as of late, as capital constraints have led to a pinch and serious market concerns.

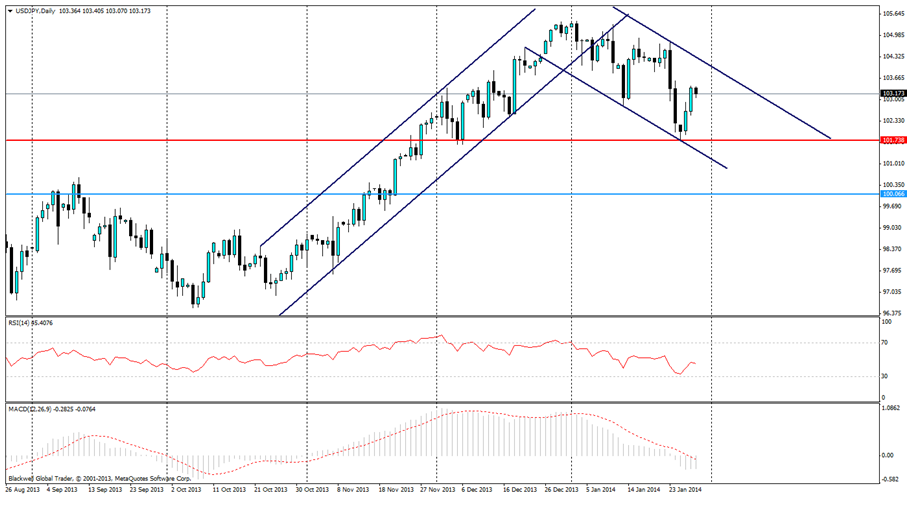

This positive effect for the Yen has led to a downward bearish channel, as investors pour into the safe haven. This is supported by the strong economic position of the Japanese economy, but most of all, the relative safety against the USD, as many worry that a hiccup in China will have a large effect on the US economy.

Relatively speaking though, the USD is doing strongly against the Yen, and with the effects of tapering, we should see it climb higher. But this is only half the consensus as people also factored in further stimulus efforts from the Bank of Japan (BoJ). However, after the recent strong performance of the Japanese economy, it looks likely that they will hold this off for now.

With the current economic situation, opportunities are certainly there to trade within the current channel, especially if you are looking at bearish options. My main watch though, would be for the 100 mark, which is expected to be a very solid level of support; based on historical trading patterns with the USD/JPY cross.

The Nikkei, which generally correlates the USD/JPY cross, has lately been a bit more hectic and the correlation that has been apparent for some time might be weakening slightly. I hint slightly as the Nikkei can and does have the power to quickly follow in line with the Yen at any given time as a lot of Japanese companies are big on exporting.

Overall, the USD/JPY cross is certainly one to watch and the bearish down trend is clear for all to see. With the trouble in China brooding and ever increasing, certainly it looks likely that we will see more ground gained back by the Yen. Furthermore, I would treat the current channel lines as dynamic resistance and support when trading the pair as if anything, these will be the key points for further movement up and down.