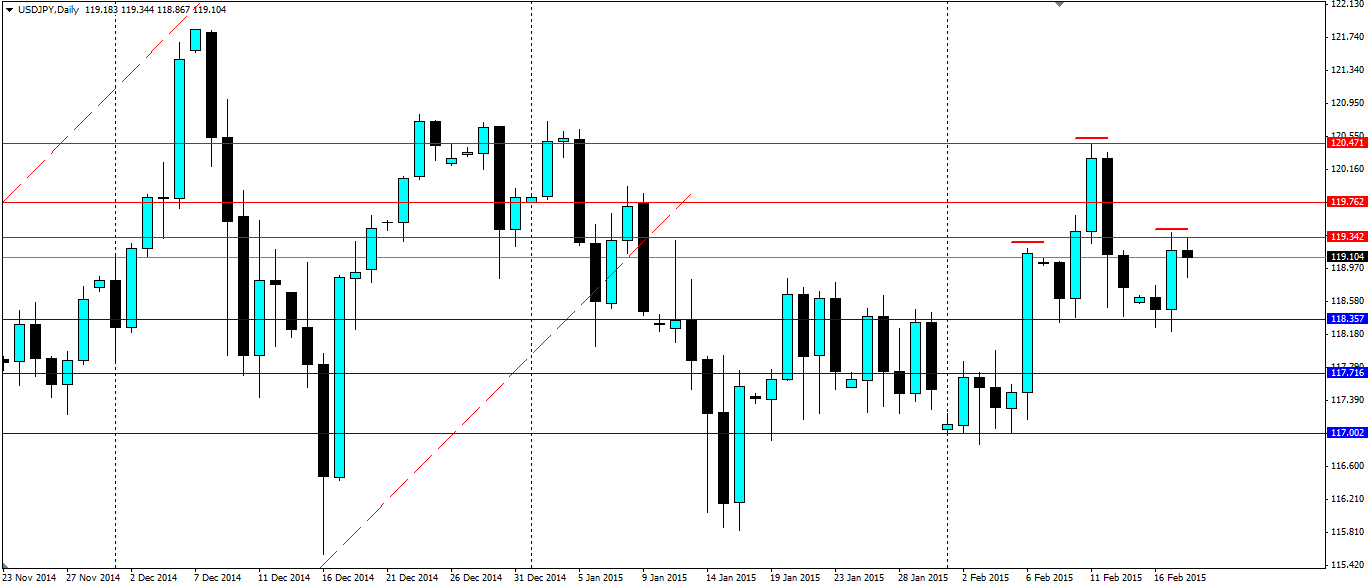

If you have been following the yen recently you will probably have noticed the ranging pattern it has been following. You may have also noticed the head and shoulders pattern that is likely to signal a move towards the lower end of the range.

The yen has formed a rather wide range over the last three months or so with highs that are getting lower. The yen now looks to trend back towards the lower end of the range and the potential formation of a head and shoulders pattern could be a trigger for the market to make a move.

The pattern has not fully formed yet and there is always the possibility of an event that will completely negate this technical set up. But the early bird, as they say, catches the worm and in this case the worm is a healthy 200 pips.

The USD/JPY pair will need to break through the neck line at 118.357 for this setup to be confirmed as a head and shoulders pattern, but the risk/reward ratio of taking an entry at the formation of the second shoulder makes it a worthwhile bet. A stop loss can be set just above the high of the second shoulder which gives us a decent RR.

The overall structure is 210 pips wide which as a rule of thumb would give us a target 210 pips under the neck line at 116.257. This is a level we have seen twice in the past 3 months, but the support at 117.002 looks to be rather solid and is a logical target for this movement.

Further support will be found at the neckline at 118.357 and 117.716 on the way down to 117.002. If we see a breakout upwards through the resistance at 119.342, look for further resistance at 119.762 and the ‘head’ of the structure at 120.471.