Investing.com’s stocks of the week

The Japanese yen declined broadly this week and stays soft in Asian session today. Nikkei also extended recent up trend and hit new seven years high. The move was triggered by news that Prime Minister Shinzo Abe might postpone the planned sales tax hike in October 2015, by as long as a year and a half. And Abe could call a general election this December to take the issue to voters. He might make a decision after getting the Q3 GDP data due next Monday, which could reflect the continuation of impact of the sales tax hike earlier this year. The delay of the next tax hike is seen as generally stock positive. Meanwhile, this could most likely deteriorate the already bad fiscal health of Japan and raised doubts on whether the government can achieve fiscal balance outside debt payments by 2020. This, it's also yen negative.

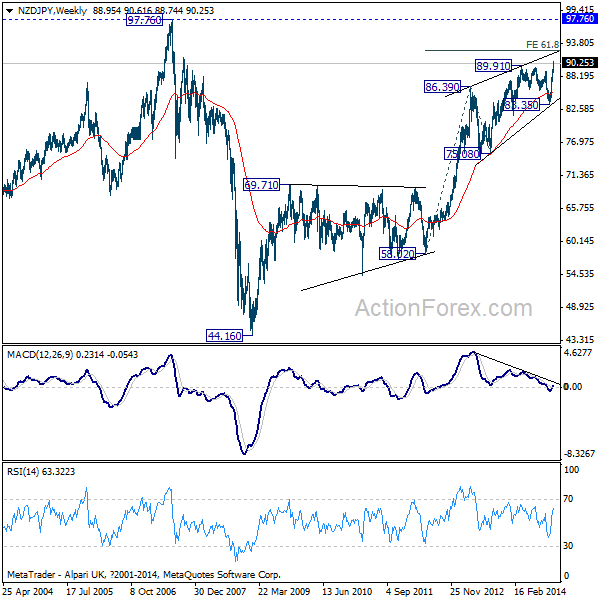

USD/JPY took the lead by taking out last week's high and reached as high as 116.10 so far. EUR/JPY and GBP/JPY also followed by breaching 144.21 and 184.31 respectively. NZD/JPY also surged through 89.91 resistance and reached new seven year high at 90.61. The long term up trend from 44.16 has resumed. Further rally would be see to trend line resistance around 92, and probably further to 61.8% projection of 58.02 to 86.39 from 75.08 at 92.61. However, note that upside momentum is rather weak for the moment with bearish divergence condition in weekly MACD. We'd be cautious on strong resistance between 92.61 and 97.76 record high to bring medium term trend reversal.

In US, Boston Fed President Eric Rosengren urged people to be "until we get the economic outcomes we want" before raising the interest rates. He said he won't tie the timing of the first hike to a "calendar day" but the "economic outcomes". Meanwhile, he said the Fed move is to prepare markets for an eventual hike by telegraphing the move in the statements. On the other hand, Philadelphia Fed President Charles Plosser said that there are "many indicators that tell us interest rates are too low." And, "given the unemployment rate, and even given low inflation, we are below where we would normally be," and "this is something we should be cognisant of."

On the data front, Australia wage cost index rose 0.6% qoq in Q3, Westpac consumer confidence rose 1.9% in November. Japan tertiary industry index rose 1.0% mom in September while Money stock M2 rose 3.2% yoy in October. The main focus is in UK today as BoE will release quarterly inflation report. Also, UK employment data will be featured. Eurozone will release industrial production while US will release wholesale inventories.