The Japanese yen has improved slightly, as USD/JPY was trading in the low-102 range in Friday’s European session. Key US releases, notably Unemployment Claims, looked weak on Thursday. In Japan, Core Machinery Orders looked very sharp, posting its best showing since January 2012. Today’s highlight is UoM Consumer Sentiment. There are no Japanese releases on Friday.

The US released a string of releases on Thursday, but for the most part, the news was not encouraging. Core CPI posted a weak gain of 0.1%, missing the forecast of a 0.2% gain. Unemployment Claims had looked impressive in recent readings, but the key indicator slumped, as new claims jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. The markets had expected a gain of 2.5 points. Housing Starts fell sharply, from 1.04 million to 0.85 million. This was well below the estimate of 0.98 million. There was some positive news, as Building Permits, which rose to 1.02 million, beating the estimate of 0.94 million. The disappointing numbers will again bring into question the health of the US economy, which has not been able to churn out continuous positive releases.

In Japan, there was more good news, as Core Machinery Orders sparkled. The important manufacturing indicator jumped from 7.5% to 14.2%, blowing away the estimate of 3.1%. This release comes on the heels of a solid GDP release, which hit a four-month high as it gained 0.9%. The improvement in Japanese numbers is encouraging, and there is a growing feeling in the market that “Abeonomics” is starting to bear fruit. However, the proof in the pudding will be Japanese inflation numbers, which for the most part continue to point to deflation, the sworn enemy of the government and the Bank of Japan.

The dollar has enjoyed some broad strength against the major currencies of late, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, said that the Fed could begin reducing its quantitative easing program this summer and wind up bond buying late in 2013. As QE is dollar-negative, any further statements from the Fed about QE will likely have an impact on the movement of EUR/USD.

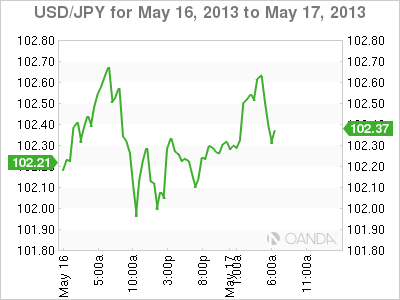

USD/JPY May 17 at 10:35 GMT

USD/JPY 102.33 H: 102.63 L: 102.11 USD/JPY Technical" title="USD/JPY Technical" width="400" height="104">

USD/JPY Technical" title="USD/JPY Technical" width="400" height="104">

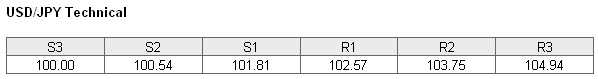

USD/JPY has edged lower in Friday trading. The pair is facing resistance at 102.57. This is a weak line, and could break if the dollar rebounds. This is followed by a strong line of resistance at 103.75. On the downside, the pair is receiving support at 101.81. This is followed by a support level at 100.54, which is protecting the 100 level.

- Current range: 101.81 to 102.57

- Below: 101.81, 100.54, 100 and 99.57

- Above: 102.57, 103.75, 104.94, 105.87 and 106.55

USD/JPY is showing activity after a lull on Thursday. Currently, there is movement towards short positions. This is consistent with what we are seeing from the pair, as the yen has posted some modest gains against the dollar. The ratio is slowing a slight majority of open positions in favor of short positions, indicating that trader sentiment is biased towards the yen recovering after the recent strong rally by the dollar.

USD/JPY continues to trade at multi-year highs, as it trades in the low-102 range. The pair did not show much reaction to weak US releases on Thursday. The US will release key consumer confidence data later today, and this market-mover could affect the pair if the reading is not in line with market expectations.

USD/JPY Fundamentals

- 13:55 US Preliminary UoM Consumer Sentiment. Estimate 77.9 points.

- 13:55 US Preliminary UoM Inflation Expectations.

- 14:00 US CB Leading Index. Estimate 0.3%.