Tension in the Middle East have mostly dominated sentiment since Friday. However, the US session saw a mild rebound in risk and equities shrug off concerns with the lack of any further escalation. Going into the session it was noted several yen pairs were at key levels of support, which suggested it could be a pivotal moment for risk, even if shortly lived. Whilst tensions can flare again at any moment, here are three yen pairs worth keeping an eye on from a technical standpoint.

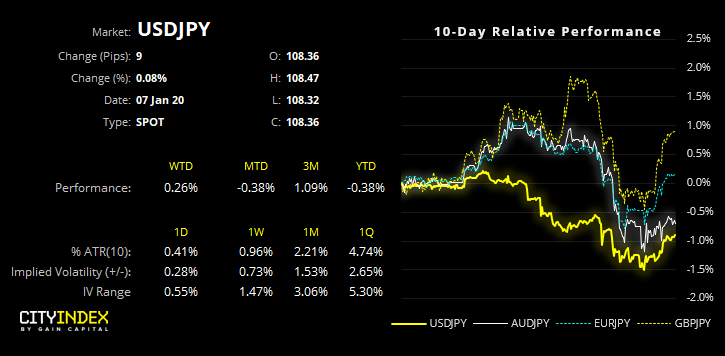

USD/JPY: It appears that USD/JPY has topped. Its failure to break above the 2nd December high sent a warning to the bull-camp before it rolled over late December. Whilst the initial sell-off remained within the bullish channel, the rise in tensions between US and Iran saw it break the bullish channel and 108.41 swing low, which warns of a change in trend.

EUR/JPY: Firmer PMI data saw the Euro trade broadly higher yesterday and EUR/USD break out of an inverted H&S pattern on the hourly chart. Along with improved risk appetite, EUR/JPY also produced a bullish 2-bar reversal pattern on the daily.

A bullish channel remains in play and yesterday’s bullish piercing pattern suggests a swing low is in place. However, prices are now trading just below the 200-day eMA, a level we’d prefer to see broken before assuming a reversal is underway.

AUD/JPY: Typically, we’d refer to AUD/JPY as the forex traders preferred barometer of risk. However, raging bush fires continue to wreak havoc across Australia at an unprecedented rate, which has seen lower growth forecasts at a time where it’s already a 50/50 as to whether RBA will cut rates. For this reason, AUD/JPY has not rebounded in the way it would have otherwise. This leaves it on a knives edge as to whether we’ll see a rebound, or whether it will keel over in due course.

A strong rebound would require general risk on (and tensions from Middle East recede) alongside bush fires coming under control. A strong signal for bears is to see fires rage on and Middle East tensions escalate further.