The yen consolidated after finding support early last week. The continued sell off in US and Chinese equities ensured the yen remained strong, ending the week with a brief push into a new 5 month low. It will not take much to spook the market into another wave of yen buying, so watch for potentially more strength.

The recent movements in the yen have all been about risk and the market's aversion to it. Last week opened up with some relative strength in US equities which led to an exit on the safe haven yen bets. That saw the USD/JPY pair retrace somewhat but by the end of the week the yen had briefly extended the 5 month low out as the rout in US equities continued.

The financial markets are a jittery place at the moment and the poor US economic data is not helping to calm the nerves. US core retail sales were poor at -0.1%, to go with a disappointing unemployment claims figure at 284k vs 275k exp. The Atlanta Fed downgraded their Q4 GDP estimate to 0.6% which added icing to the cake. It will not take much to spook the markets into a large sell off, so watch for further yen strength.

Watch for US inflation this week, along with the regular unemployment claims as any poor results may affect the Fed's outlook on interest rates. There is some minor JPY economic data due out, but the risk sentiment will be what drives the pair.

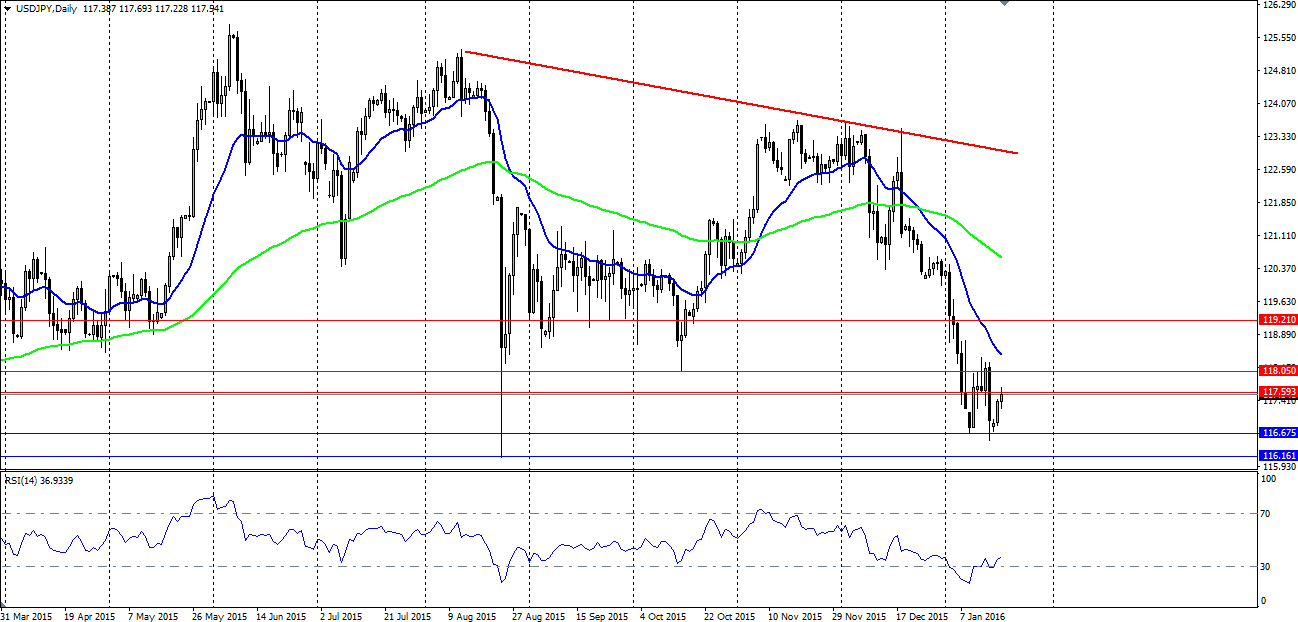

Looking at technicals, it appears the yen may have found some support. RSI has nudged out of oversold which could lead to further selling, but the pair is in an area that has seen swings in the past. If the minor high at 118.05 is breached, then look for the upside to be extended. Look for support at 116.67, 116.16 and 115.48 with resistance at 117.59, 118.05 and 119.21.