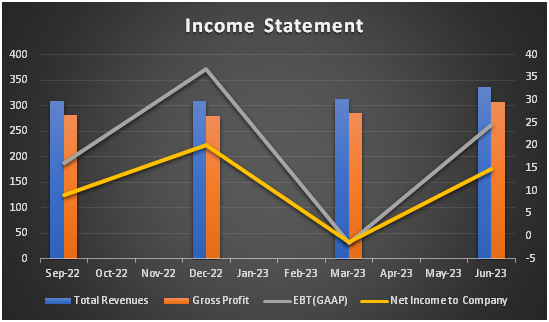

- Yelp beats Q2 forecasts with $0.66 normalized EPS (+$0.05 consensus), $0.21 GAAP EPS, and $337.13M revenue. Strong Q2 2023 performance showcases robust growth - 13% YoY revenue increase and 25% YoY increase in adjusted EBITDA.

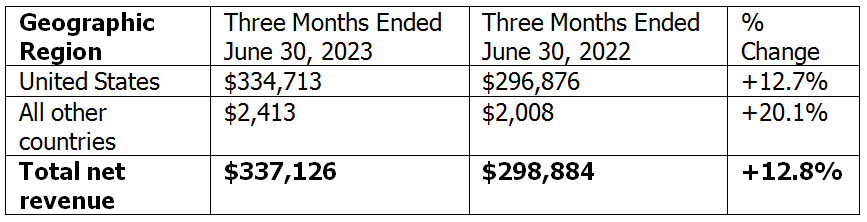

- Advertising revenue drives growth, while the services category sees strong YoY growth of 14.9%. International revenue expands by 20.1% YoY.

- Activist investor pressure from TCS Capital Management raises concerns, with calls for strategic alternatives and potential valuation increase. Rumors of a merger with Angi gain traction, while past rejections of acquisition offers add intrigue. AI threats loom, but Yelp's mobile app user base remains resilient.

Financial Highlights

In the second quarter of 2023, Yelp Inc. (NYSE:YELP) reported robust earnings growth and strategic progress. The company's net revenue reached a record $337 million, representing a 13% increase year-over-year (YoY). Adjusted EBITDA increased by 25% year-over-year to reach a new peak of $84 million. Successful advertising initiatives, robust growth in the Services category, and an emphasis on strategic product development drove these results.

Revenue Breakdown

According to Yelp's revenue breakdown analysis, the Services category was the primary growth driver in Q2 2023, with a robust YoY growth of 14.9%. Advertising revenue, which includes both Services and Restaurants, Retail and other revenue, accounted for 95.5% of total revenue and increased by 13.6% year-over-year. However, transaction revenue decreased by 14.2% year-over-year, indicating potential challenges or adjustments to this segment's business strategy. The company's international revenue grew by 20.1% year-over-year, indicating potential for further expansion.

In thousands

Strategic Advancements

Yelp's growth in the second quarter of 2023 was propelled by its strategic focus and innovations. The company's investments in product development and AI integration have accelerated the sector's growth. Additionally, the strategic initiatives of Yelp have resulted in successful advertising campaigns, particularly in the Self-serve and Multi-location channels, which accounted for a substantial portion of advertising revenue. Positive advertiser feedback reflects the organization's dedication to customer satisfaction and product excellence.

Capital Allocation and Share Repurchases

Including share repurchases, Yelp's prudent capital allocation strategy has contributed to the enhancement of shareholder value. The company repurchased approximately 1.6 million shares for $50 million in the second quarter. This disciplined approach to capital allocation, coupled with an emphasis on maintaining a considerable cash balance, strengthens the company's operational resiliency and readiness for potential acquisitions.

Outlook and Projections

The sustained advertiser demand and robust financial performance of Yelp have led to an increase in annual outlook expectations. The company anticipates annual net revenue between $1.32 billion and $1.33 billion and adjusted EBITDA between $310 million and $320 million. These projections indicate Yelp's positive growth trajectory and long-term growth prospects.

Potential Risks

Despite the company's strong performance and strategic progress, there are hazards and difficulties. Under pressure from TCS Capital Management, an activist investor with a 4% stake in Yelp (NYSE:YELP), the company appears to be at a crossroads. TCS Capital Management has overtly criticized Yelp's stock performance and recommended that strategic alternatives be investigated. There is a possibility that the company's valuation will increase to over $70 per share, a significant increase from its current status.

In this context, it is significant to note how & at what valuation platforms such as Angi trade. While rumors of a potential merger between Yelp and Angi gain momentum, implying potential revenue and cost synergies due to their parallel business structures, Yelp's past decisions add a layer of intrigue. The platform has previously rejected acquisition offers from industry giants such as Google (NASDAQ:GOOGL) and Groupon (NASDAQ:GRPN).

Moreover, threats such as AI's growing influence loom large, but Yelp remains resilient, as evidenced by its robust mobile app user base. A significant financial revelation is that approximately fifty percent of Yelp's current revenue is derived from stock-based compensation. However, strategic moves to reduce this to 8% by 2025 are possible.

Given this context, The Deal's disclosure that Yelp has hired JPMorgan Chase (NYSE:JPM) and Evercore IS as advisors becomes particularly significant. Yelp maintains its silence, refusing to remark on specifics and labeling them as "rumors." The underlying message, however, is their commitment to maximizing shareholder value. The ambiguity surrounding the precise role of these new advisers — whether it be protecting the company from activist pressure or guiding it towards a strategic overhaul — adds another element of intrigue to Yelp's evolving narrative.

Despite the possibility that these strategic changes could unlock additional value for shareholders, the outcome is uncertain. Historically, Yelp's management has been reluctant to sell, and advancements in artificial intelligence could potentially disrupt the platform.

Conclusion

Yelp Inc. exhibited robust growth and strategic advancements in the second quarter of 2023. The company's financial success has been aided by its focused approach to advertising, product development, and capital allocation.

However, prospective risks and uncertainties, such as activist investor pressure and technological disruptions, should be taken into account. Existing investors should hold to the position and traders should look out for opportunities to dive in on following this news closely as this can be something where arbitrage opportunities remain and in a bull case can take the stock to $60 with a downside risk of the stock turning back to $32-$34.

Disclosure: We don’t hold any position in the stock.