European indices are expected to open a little higher on Wednesday despite another negative lead from the US and Asia overnight and as both macro and domestic issues continue to weigh. Futures remain volatile though ahead of the open so another move into the red would not come as a surprise.

There appears to be a long list of reasons to be a market bear right now – be it global growth fears, China’s slowdown, the health of Europe’s banks, to name just a few – but the case for bulls is becoming increasingly difficult.

To make matters worse, fears around the Europe’s already fragile banking sector are growing on the back of increasing non-performing loans related to the oil rout and negative interest rates squeezing profits. Not only could this once again raise solvency concerns, meaning banks need to raise additional capital, it could create another big obstacle to the eurozone recovery.

With many central banks already in uncharted territory when it comes to monetary stimulus, we have to wonder how much more they can actually do. Should another crisis develop on the back of this, the toolkit is suddenly looking quite empty. This was at least part of the rationale in many people’s minds for the Fed to pursue higher rates at the end of last year. If the economy was in a position to take it and inflation was expected to return to target, the Fed should begin the tightening cycle and end this long period of ultra-loose monetary policy. Should another crisis follow, it will then have some traditional stimulus measures at its disposal.

The problem that the Fed now faces is that global conditions have deteriorated since December and it now must decide whether it will continue to raise rates, even as other central banks loosen monetary policy further, or delay its previous target of four more hikes this year. I still think we’ll see a couple of hikes this year but given how the start of the year has gone, four is extremely unlikely.

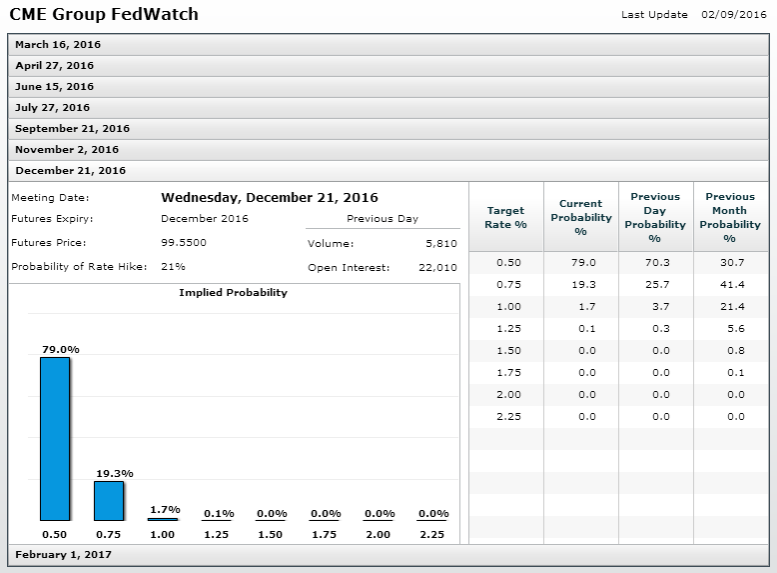

It will be up to Fed Chair Janet Yellen, in her testimony in front of the House Financial Services Committee today, to shed further light on how this year’s events have altered the central banks’ expectations, if at all. Given that the markets are now pricing out any chance of a rate hike this year – 79% chance that interest rates will still be at 0.5% in December according to Fed Funds futures – Yellen’s comments are going to be monitored extremely closely and markets could be very sensitive to them.