Investing.com’s stocks of the week

At a business luncheon on Friday, U.S. Federal Reserve (Fed) Chair Janet Yellen confirmed that if economic conditions continued to match the Fed’s expectations, the rate normalization process would not be as gradual as in 2015 and 2016, an opinion echoed by Fed Vice-Chair Stanley Fischer, who is usually one of the least eager Fed voting members to raise interest rates. As a result, the bond market has priced the likelihood of a rate hike on March 15 at 94%. These facts notwithstanding, the U.S. dollar took a breather on Friday, consolidating its gains from the week against most major currencies.

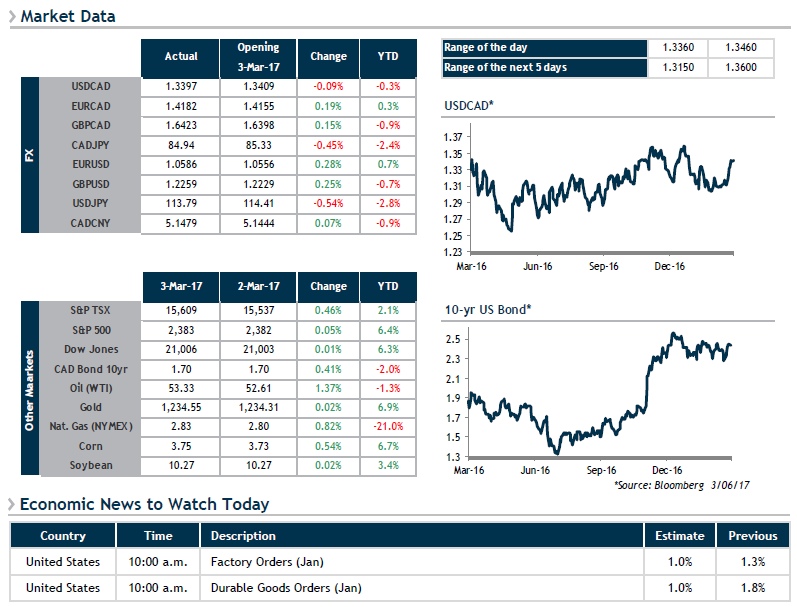

This morning, we’ll be keeping an eye on two U.S. indicators at 10:00 a.m.: Factory Orders and Durable Goods Orders for January. In both cases, economists expect a slight dip in the readings, bringing both to 1.0% growth. Despite this minor setback, it would be surprising to see any major stumble from the greenback as it continues to surge.