Forex News and Events

FOMC meeting: more dovish than expected

Yesterday, the Federal Open Market Committee maintained the federal funds rate’s target range between 0 and 0.25%. Most market participants suggested that the statement and the press conference point toward a lift-off later in 2015. However, most FOMC participants lowered their projections for the federal fund rates for 2015, 2016 and 2017, the dots-plot showed. Janet Yellen, Fed chairwoman, declared that the Committee wants to see further improvements in the labour market and to feel reasonably confident that inflation will reach the 2% target over the medium term before starting to increase the federal funds rate. The Committee maintained its Core PCE inflation projection to between 1.3% and 1.4% for 2015, but increased its forecast for 2016 to between 1.6% and 1.09%. On the unemployment front, the members increased their projections to between 5.2% and 5.3% in 2015 from between 5% and 5.2% at the March meeting. The Fed also lowered its GDP growth forecast to between 1.8% and 2%, compared to between 2.3% and 2.7% in March.

Considering all the revisions above and the overall dovish tone of the press conference, we believe that a September rate hike is not guaranteed yet, as the Fed maintained that any change of the monetary policy will remain data dependent, saying that “the Committee will determine the timing of the initial increase in the federal funds rate on a meeting-by-meeting basis, depending on its assessment of incoming economic information and its implications for the economic outlook.” It is clear that policy makers want to see further improvements in the economy before starting to raise rates, as it could derail the recovery. And we have to admit that as the conditions are not fulfilled yet, the next few months will be crucial.

Norges Bank cut deposit rate

As broadly expected, the Norges Bank cut the deposit rate by 25bps to 1% as the country is facing weaker growth, sluggish economic outlook and below target inflation level (May CPI at 2.1%y/y and target at 2.5%). The Bank also left the door wide open for further monetary policy easing. We therefore can expect another rate cut later this year, most probably after the summer. USD/NOK jumped from 7.60 to 7.70, with 7.75 as the next target.

SNB keeps rates on hold

The SNB met today to decide about the target band of the 3-Month Libor as well as the SNB sight deposit rate, and as expected, the SNB kept its rate on hold. The SNB decided to maintain the status quo, as we assume that the central bank does not have all the necessary room to weaken the Swiss franc.

Three years ago, in order to compete against the strengthening of its currency, the SNB had no other choice to peg it against the euro as a break-up fear of the Eurozone was growing. Right now, as those uncertainties resurface again, the SNB is forced to make its currency less attractive. This is the curse of being a safe haven currency.

In addition, the Swiss franc is still overvalued, even though the Swiss economy contracted over the first quarter and inflation pressures remain weak. Domestic demand is pressured as consumers look up at additional values across borders.

The EUR/CHF pair remained in its range between 1.0400 and 1.0500. The pair is set to gain downside pressures as Greek deals are not settled yet, and therefore, this increases volatility on the markets. We target the support at 1.0235.

EUR/GBP - Pushing Toward the Support at 0.7146

The Risk Today

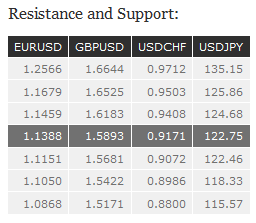

EUR/USD EUR/USD is increasing toward the resistance at 1.1386 (10/06/2015 high). Stronger resistance is given at 1.1459 (15/05/2015 high). Hourly support can be found at 1.1151 (12/06/2015 low). The technical structure suggests an upside momentum. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD GBP/USD is gaining strong upside momentum as resistances at 1.5700 and 1.5815 have been broken. Hourly support is given at 1.54220 (11/06/2015 low). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY USD/JPY is now declining toward the hourly support at 122.46 (10/06/2015 low). We expect the pair to test this support. We remain bullish for the pair as we stay largely above the 200- dma. However, the pair is gaining bearish momentum on the short term. Key resistance lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF USD/CHF is now decreasing toward the support at 0.9072 (10/06/2015 low). Hourly resistance can be found at 0.9408 (11/06/2015 high). Stronger resistance can be found at 0.9573 (29/05/2015 high). In the short-term, the pair is setting lower highs, and therefore we remain bearish over the next few weeks. In the long-term, there is no sign to suggest the end of the current downtrend after failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).