Investing.com’s stocks of the week

Following the admission by the Bank of England that we may be in for a rate hike sooner than expected, potentially in 2015, the pound came in for a quick test, with much weaker than expected retail sales data coming yesterday. The October reading was -0.7% month on month compared with the previous reading of +0.7% and expectation around 0%. Essentially this news was quickly discounted, as the retail number is known to be volatile and affected by seasonal factors, in this case with mild weather was seen as the culprit.

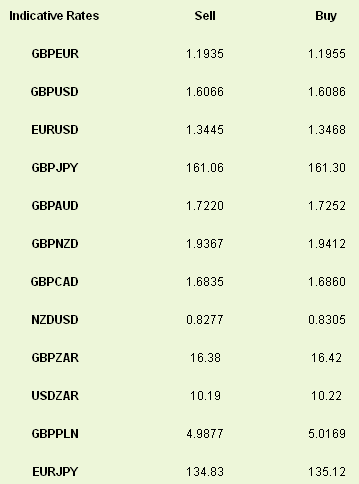

Sterling strength remains well justified in the medium term due to the improving UK growth picture and a ‘less dovish’ Bank of England stance. Even so, it seems unlikely at the moment that there will be sufficient news to trigger a break of the last month’s ranges in GBP/USD or GBP/EUR, with 1.6260 a significant level in GBP/USD and 1.20 in GBP/EUR.

The main event from yesterday was the testimony by the Fed’s chairwoman elect, Janet Yellen, though her dovish tendencies were already well signposted from comments on Wednesday evening. One of the implicit objectives of the major central banks is to dampen volatility in exchange rates and capital markets. In releasing her prepared remarks the market capably adjusted for her dovish tone with a S&P 500 nudge to record highs, while the dollar slipped the to its farthest point since it bottomed last month.

In her testimony, Yellen maintained the accommodative language we have come to expect from the FOMC overall. Her insistence that support should not be removed too early as it would threaten the economic recovery does little to displace the market’s assumption that we will see the start of QE tapering in March. At the same time it does keep the door wide open to speculation.

In a relatively light week for US data, today’s releases will provide further insight into how economic activity fared in October during the shutdown and more widely, will lead expectations for Q4 GDP. The strong October employment report and the acceleration in the ISM surveys suggest that the impact of the shutdown on the US may not have been as great as initially feared. Today’s October industrial production report will provide the first output reading for the month. Following September’s robust 0.6% rise, we are looking for industrial activity to have stagnated last month, reflecting a fall in utilities output that will be somewhat offset by a rise in manufacturing output.

In terms of the outlook for the rest of the quarter, the Empire State manufacturing survey for November is forecast to have recovered back to its pre-October level. Last month, the headline index dropped markedly to 1.5 from 6.3. However, new orders remained elevated last month and suggest that expectations of future output should remain buoyant with expectations of a reading today around 5.

Top event risk for the Eurozone yesterday was the first readings of 3Q GDP data. The Eurozone grew 0.1 percent through the quarter slightly below expectations of 0.2%. From the core, Germany cooled while France and Italy contracted by 0.1 percent. The periphery continued to show improvement, but both Cyprus and Greece were still deep in recession. Overall, this is kind of soft data that a dovish leaning market will interpret as evidence that further unconventional monetary measures could be on the cards from the ECB. Indeed, short-term market rates are at a 5-month low. Yet, we should also keep an eye on the discussion of rescue programs as some are soon to exit and others are grumbling.

The only data out of Europe today is Consumer Price Inflation, expected at 0.7% year on year, with the likelihood that we will continue to see a lack of inflation pressures which will continue to fan the flames of further ECB action.