The Brent Oil price has proven to be volatile over the past 10 days. After rising to above 70 USD/b in late January, which is 55% higher than the recent low of 45 USD/b set in June last year, the Brent oil price fell back to around 63 USD/b last week. Despite the recent drop, we have decided to make an upward revision to our forecast for Brent crude oil in 2018 to 60-65 USD/b (average) from 55-60 USD/b previously. Our forecast is based on a combination of a regression model, the oil futures curve, and consensus forecasts. Within our regression model we have revised higher our estimate of the average break-even oil price for US Shale oil producers from 58 USD/b to 63 USD/b. At the same time, the futures curve and consensus forecasts have both increased.

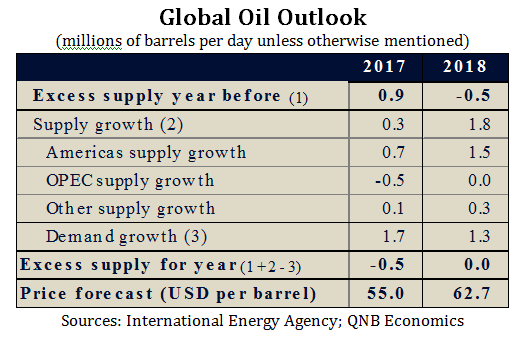

The underlying driver of the rally in oil prices in the second half of last year was a rebalancing in the global oil market. The global market, which had been oversupplied by 0.9m b/d in 2016, switched to being under-supplied by 0.5m b/d in 2017. Supply was held back by OPEC’s initial production cut to counter increases in US production. Additionally, oil demand was higher than expected on the back of strong global economic growth and as a response to lower prices.

Going forward, we expect the market to change direction again as higher prices bring US shale and other non-OPEC producers back into the market, offsetting continued strong demand growth. We expect the market to move from being under-supplied in 2017 to balanced in 2018.

Non-OPEC production is expected to increase by1.7m b/d in 2018, as producers take advantage of higher prices, with total US production (shale and non-shale) contributing 1.35m b/d of this total. With oil prices recently rising above the US shale break-even price, estimated to be 63 USD/b in 2018, US shale producers are likely to have already locked into forward prices around this oil price level and have already begun to ramp up production this year. Additionally higher production is expected from Brazil and Canada.

OPEC and its partners are expected to maintain strong compliance with the production freeze agreed last year, which aims to keep 1.8m b/d off the market until December 2018. Among OPEC producers, production in Venezuela continues to fall due to unplanned outages, but this is expected to be offset by higher production from some OPEC producers that are not bound by the agreement (Libya and Nigeria).

Turning to demand, despite recent upward revisions to global GDP growth, including in emerging markets, the International Energy Agency (IEA) projects demand growth upto moderate at 1.3m b/d from 1.7m b/d in 2017 as higher prices temper consumption. We believe risks to this oil demand forecast are skewed to the upside as emerging market demand for oil tends to be less price elastic and global growth forecasts continue to be revised up.

Global Oil Outlook

(millions of barrels per day unless otherwise mentioned)

Sources: International Energy Agency; QNB Economics

The bottom line is that the market price dynamics will depend on OPEC and its major partners’ ability to sustain a high compliance rate once again in 2018. Assuming a repeat ofthe same level of compliance as 2017,the global oil market should be balanced in 2018 and oil inventories should decline to their five year average by the third quarter according to our own internal projections. Based on our modelled historical relationship between the supply and demand balance and prices, this results in an average price forecast between 60-65 USD/b in 2018.

Looking further out, we expect oil prices to be range bound around the 60 USD/b mark. On the one hand, OPEC would have a strong incentive to extend the current production cuts beyond 2018 if prices threaten to break significantly lower due to excess supply. This would help to rebalance the market and support prices. On the other hand, if prices rise significantly above the US shale “break-even” price, these producers are likely to respond by increasing US shale production more aggressively thus capping the topside in oil prices.