It's already been a roller-coaster week for the SPDR S&P Retail (NYSE:XRT). The exchange-traded fund (ETF) rallied on Tuesday on news that the Trump administration will delay tariffs on some Chinese goods, including several clothing and apparel items. Today, however, XRT shares are back in the red, following a grim earnings showing for Macy’s Inc (NYSE:M) and concerns about the global economy. And with a handful of additional retailers set to report earnings this week -- including sector stalwart Walmart Inc (NYSE:WMT) tomorrow -- XRT options are flying off the shelves today.

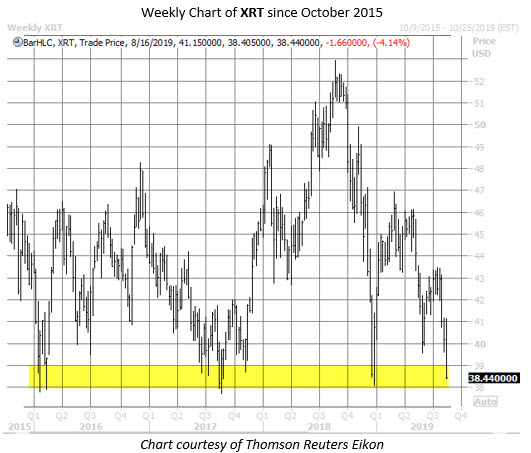

At last check, the retail fund is down 4.1% to trade at $38.44, pacing for its lowest close since the Dec. 24 lows. In fact, from a longer-term standpoint, the $38-$39 region has been a foothold for XRT since early 2016, and a move south of $37.80 would put the ETF in territory not charted since mid-2013.

It looks like some options traders today are betting on a breach of long-term support. The fund has seen more than 39,000 put options change hands so far -- six times the average intraday put volume. For comparison, just over 2,300 XRT call options have traded today.

The September 37 and 40 puts are most popular. Digging deeper, it seems one trader may be rolling down a bearish position, selling to close 4,300 now in-the-money September 40 puts to purchase an equal number of September 37 puts. The newly bought puts will move into the money if XRT shares move south of $37 by the time the options expire on Friday, Sept. 20.

However, today's appetite for bearish bets is par for the course for the retail fund. Over the past two weeks, traders on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open nearly three XRT puts for every call.

Aside from various commodity-related ETFs, XRT has racked up one of the steepest year-over-year losses of all the funds that we track, down more than 25% in this time frame. However, more than half of the analysts following the sector maintain "buy" or better opinions -- fairly unchanged from a year ago, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Should the sector extend its 2019 slide, a flood of analyst downgrades could drag XRT even lower.