The Swell conference, which is hosted by Ripple and is its biggest conference of the year, will be held on Nov 7-9 in Singapore. It aims to bring in influential voices in the financial services, technology, and payments industry in order to discuss the current global payments industry. Will it have an effect on the XRP price?

MoneyGram has previously reached a partnership with Ripple in order to improve its liquidity management and operational efficiency. Additionally, the CEO of Moneygram is set to share insights from this experience and the future of the transfer payments industry at the Swell conference — further increasing the importance of this partnership.

Additionally, since the history of the previous price movement has been interesting before the conference, now is a good time to look at the current XRP price movement.

While the XRP price decreased significantly against Bitcoin (BTC) during the October 25 increase, the technical outlook does not seem bearish. If XRP weathers the storm and holds support above 3000 satoshis, it is likely to make a higher high.

However, cryptocurrency trader @thecryptocactus stated that the XRP/BTC pair has significantly more downside potential after its breakdown from the support line.

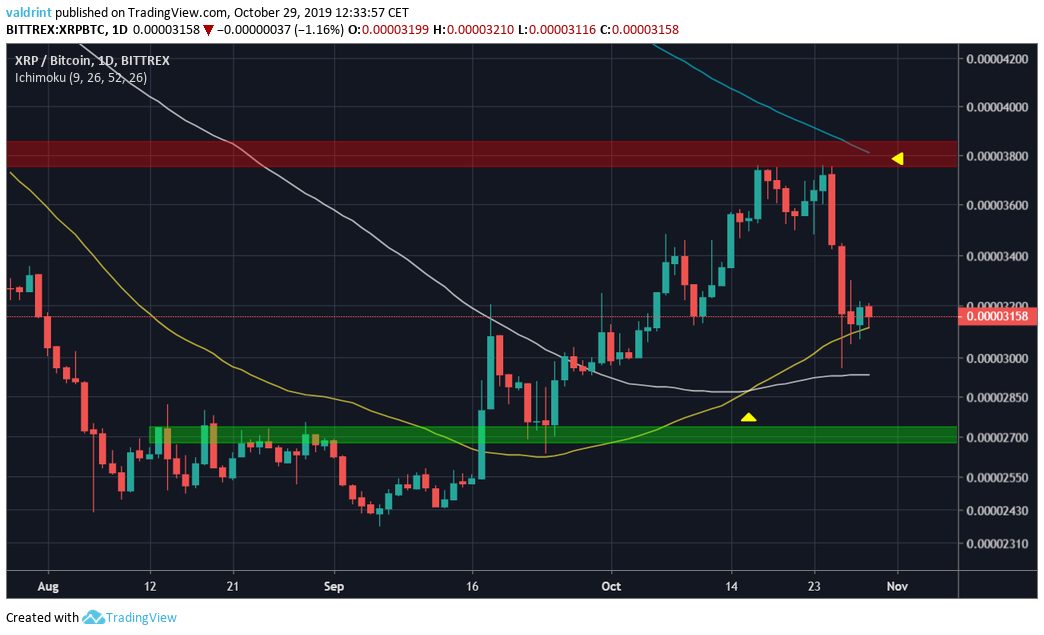

XRP Price: Double Top

The XRP price created a double top once it reached the resistance area at 3800 satoshis. The double top is a bearish pattern and it caused the price to immediately break down below the support area.

After the breakdown, the XRP price reached the minor support area at 3000 satoshis — created by the highs of September 18.

Moving Averages

Looking at the moving averages (MA), we can see that the 200-day moving average was a catalyst in the double top rejection — coinciding with the 3800 satoshis resistance area.

What is interesting is that after the decrease, the XRP price has reacted favorably to the 50- and 100-day MAs. They have previously made a bullish cross, possibly suggesting that further increases are in store.

If the MA support fails, the next support area is found at 2700 satoshis.

Long-Term

The long-term outlook seems bullish since the XRP price reached a significant support area and created a bullish divergence before beginning the current move.

Also, a bullish cross in the MACD suggests future increases.