Key Takeaways

- XRP is trading within a tight range that is getting narrower.

- A spike in buy orders around the current price levels could see the price of XRP rise more than 60%.

- However, greater selling pressure from "whale" investors is a reason to be concerned about XRP's long-term value.

XRP appears to be forming a massive bullish pattern, even as the rest of the market remains stagnant.

XRP Sits on the Verge of a Breakout

XRP has developed a bull flag within the daily chart. The 200% upswing that took the XRP token to nearly $0.80 in late November formed the flagpole, while the on-going consolidation period is creating the flag of this continuation pattern.

A spike in buying pressure could result in a breakout in the same direction of the previous trend. Indeed, the bull flag pattern forecasts a 66% jump upon the breakout point, which could take the coin beyond the $1.00 psychological barrier.

This target is determined by measuring the flagpole’s height and adding that distance to the flag’s upper boundary.

Top Analyst Comments on XRP

One of the most prominent analysts in the industry believes that XRP could rise to $1.00. Peter Brandt, a 40 year trading veteran, supports the thesis that the coin is forming a bull flag on the daily chart.

The technical analyst sees the $0.68 resistance as a crucial hurdle that will determine whether the international settlements token will aim for $1.00. Brandt writes that “the correction in XRP has taken the form of a classic symmetrical triangle. A close above .6810 would complete this pattern.”

He adds that “XRP also has an unmet target of .9487 from the log scale completion of an H&S bottom on the weekly graph.”

Whales Are Offloading Their Tokens

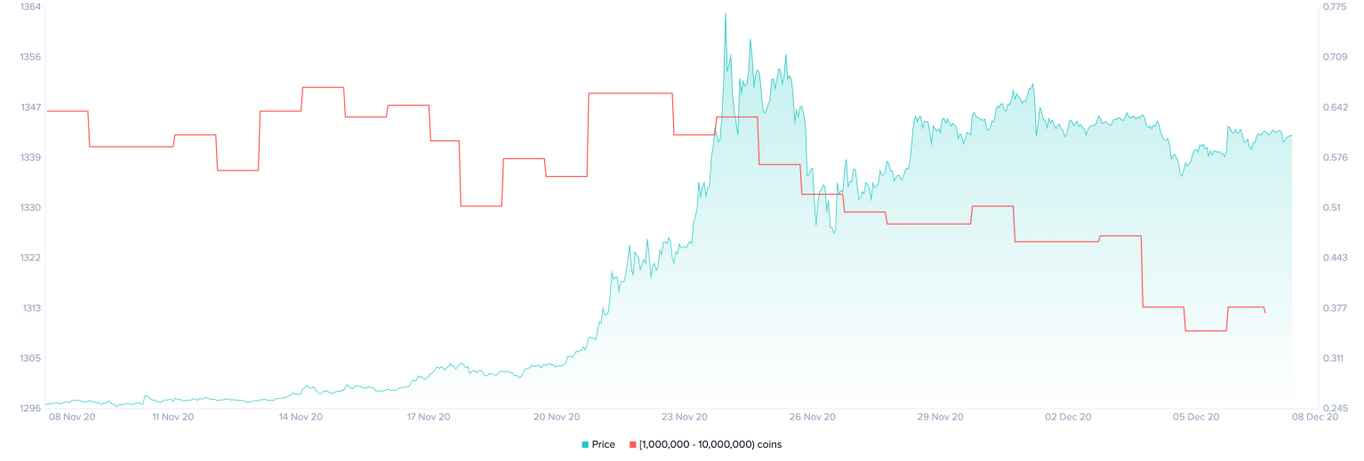

Technicals suggest that prices are poised for further gains. However, “whale” investors with millions of dollars in XRP have been significantly decreasing their positions over the past few weeks.

Santiment’s holder distribution chart shows that since Nov. 22, the number of addresses holding 1 million to 10 million XRP plummeted. Roughly 37 whales left the network or redistributed their tokens, representing a 2.7% drop over a short period.

Given the increase in downward pressure, it is imperative to pay close attention to the underlying support at $0.57. A daily candlestick close below this price hurdle will jeopardize the bullish outlook and lead to further losses for holders.

On its way down, XRP may find support around $0.40.