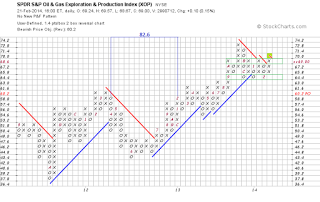

The underlying strength in the Energy sector, as well as the Exploration & Production industry, has caught my attention recently. The Oil & Gas Exploration & Production ETF (XOP) after hitting its all-time high in October 2013 retraced to the major support level at 64. Over the last three months the XOP has been consolidating within a rectangle pattern (light blue) just above the major support. The rising trendline from the bottom in October 2011 provided the additional support and the price reached to the upper limits of the consolidation pattern. Note that XOP started to outperform the Energy Sector ETF (XLE).

The intermediate horizon P&F chart shows that a breakout from the 64-69 congestion area would trigger a buy signal (lime box) at 70 and establish a new horizontal count with the potential target at 81.2. It would be in close proximity to the horizontal count target from the bottom of 2012 at 82.6. Keep in mind that the 82 level is an intermediate-term target and may be months away. I would keep my eye on the recent highs at 73 first.

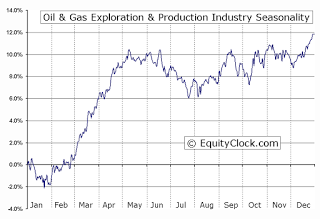

The seasonality chart, courtesy of equityclock.com, shows that the Exploration & Production industry enters the most favorable period in March-April. We might expect the upside breakout from the three-month consolidation on the XOP chart.