The fourth-quarter earnings season is picking up pace, with 16.1% of the energy companies — representing 14.9% of the S&P 500’s total market capitalization — having already reported results.

Per the latest Earnings Trends, total earnings for these firms increased 140.1% on 39.2% growth in revenues, both on a year-over-year basis. Most importantly, the releases of energy companies so far have shown a beat for both the top and the bottom line.

ExxonMobil (NYSE:XOM) , the largest publicly traded energy firm, and smaller rival Chevron (NYSE:CVX) have yet to report their numbers this earnings season. Let’s take a look at which of these oil majors has an edge over the other ahead of their Q4 release on Feb 2.

Before delving deeper into numbers, let's discuss the oil and natural gas pricing scenario during the October-to-December quarter since commodity prices determine the fate of energy players to a great extent.

Q4 Oil & Gas Prices Encouraging

West Texas Intermediate (WTI) crude increased almost 20% in the fourth quarter of 2017, per The U.S. Energy Information Administration (EIA). Through most of November and the entire month of December, the commodity traded above the $55-per-barrel psychological mark. The extension of the production cut deal by OPEC players supported the rally.

On Nov 30, 2017, OPEC members met non-OPEC players to decide on an extension of the crude production cut accord, first signed in late 2016, beyond the first quarter of 2018. More than 20 oil producers, including leading exporters like Russia and Saudi Arabia, attended the meeting. As expected by most analysts, all crude exporters decided to extend the deal through 2018-end. Saudi Arabia, Russia and their allies have pledged to put 1.8 million barrels a day of crude oil out of the market through the end of this year.

Like oil, natural gas price reflected a gain of 25.5% through fourth-quarter 2017.

XOM vs. CVX

We have assessed these oil companies on four parameters.

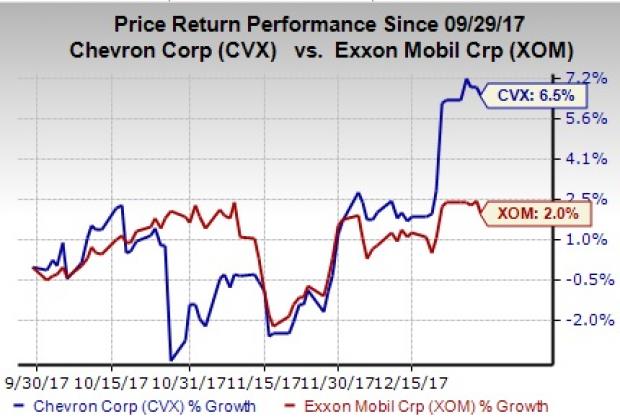

Price Performance

During the fourth quarter of 2017, Chevron clearly outpaced ExxonMobil in terms of price performance. Chevron rallied 6.5% compared with ExxonMobil’s 2%.

ESP and Earnings History

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising in their upcoming earnings announcement. It shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Our research shows that for stocks with the combination of a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP, the chance of a positive earnings surprise is as high as 70%.

Chevron is likely to beat earnings in the quarter to be reported. This is because the stock has an Earnings ESP of +0.31% and a Zacks Rank #3. However, the picture is different for ExxonMobil with an Earnings ESP of 0.00%.

The snapshot for earnings surprise history seems comparable as both Chevron and ExxonMobil managed to surpass the Zacks Consensus Estimate in three of the last four quarters.

Projected Earnings Growth

We expect year-over-year 2017 earnings growth of a massive 335% for Chevron, significantly higher than 56.5% for ExxonMobil.

The picture is quite similar for the fourth quarter of 2017. We project 486.4% earnings growth for Chevron, way higher than ExxonMobil’s 19% for the quarter.

Upstream Performance

Through 2017, oil and gas plays in the United States have witnessed a higher number of drillers. Data provided by Houston-based oilfield services player Baker Hughes, a GE company (NYSE:BHGE) , clearly showed an increase from 665 to 929 in rig count during the aforesaid period.

Upstream operations in the United States have been lucrative, with Chevron having an advantage over ExxonMobil. Investors should know that both the integrated energy players generate a chunk of their earnings from upstream operations.

For Chevron, the Zacks Consensus Estimate for fourth-quarter 2017 earnings from the U.S. stands at $154 million, against a loss of $26 million in the third quarter. The estimate also stands higher than the year-ago quarter’s $121 million. (See more on Why Chevron Could See Its Upstream Earnings Rise in Q4).

We expect ExxonMobil to see a loss from U.S. business even though its likely to be narrower than the prior quarter. For upstream operations in the domestic region, the Zacks Consensus Estimate for after-tax loss is pegged at $114 million, significantly narrower than 238 million and $2.3 billion reported in the preceding and year-ago quarter, respectively. (See more on Can Upstream Operations Fuel ExxonMobil's Q4 Earnings?)

Bottom Line

Chevron is poised for a better fourth quarter, as the company clearly scores higher than ExxonMobil in all the four parameters.

Our model also backs Chevron when it comes to earnings projections for 2018. We expect Chevron to witness earnings growth of 42.2% in 2018, higher than ExxonMobil’s 26.7%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Baker Hughes Incorporated (BHGE): Free Stock Analysis Report

Original post

Zacks Investment Research